Yet another battleground for Bitcoin and gold. In 2019, while the yellow metal saw a consistent rise, reaching a 6-year high, its luster, in the face of Bitcoin’s massive rise, on the fundamental and the technical side, was overshadowed. The markets paint a different picture of how the larger public looks at the cryptocurrency and the commodity.

The previous year saw contrasting movements and similar claims between the two stores of value. For both, the year saw distinct halves.

Bitcoin, began at $3,400, saw a consistent rise to $13,800 till the halfway point, then tettered off, dropping below $7,000 and ending the year slightly above. Gold was sluggish till May, and then began inching up little-by-little reaching $1,550 in September, before closing 2019 at $1,520.

From the outside-looking-in, gold and Bitcoin were seen as mediums of capital flight. From Venezuela to Hong Kong, political uncertainties fuelled the demand for digital and tangible gold, leading to a spike in price.

Even as the year began with yet another safe haven claim boosting the two markets, it’s interesting to note that the annual gold demand dropped in 2019.

According to the recent report by toe World Gold Council, the demand for the yellow metal dropped to 4,355.7 tonnes, a meager 1 percent drop, but notable nonetheless owing to the surrounding effect of world markets and Bitcoin.

The drop in consumer demand for gold was mirrored by an increase in the inflows into ETFs, showing that the commodity is being traded, rather than stored. The report read,

“Huge rise in ETF inflows almost equalled the sharp drop in consumer demand in 2019.”

Bitcoin, however, tells a different story.

Based on data from Glassnode, the number of active addresses for Bitcoin saw a YTD increase of 14 percent to over 640,000 addresses, recorded on December 31, 2019. Furthermore, the addresses that have non-zero balance has increased by 26.2 percent through 2019, reaching over 28 million addresses. New addresses created in 2019 increased by 24.89 percent reaching over 330,000 addresses.

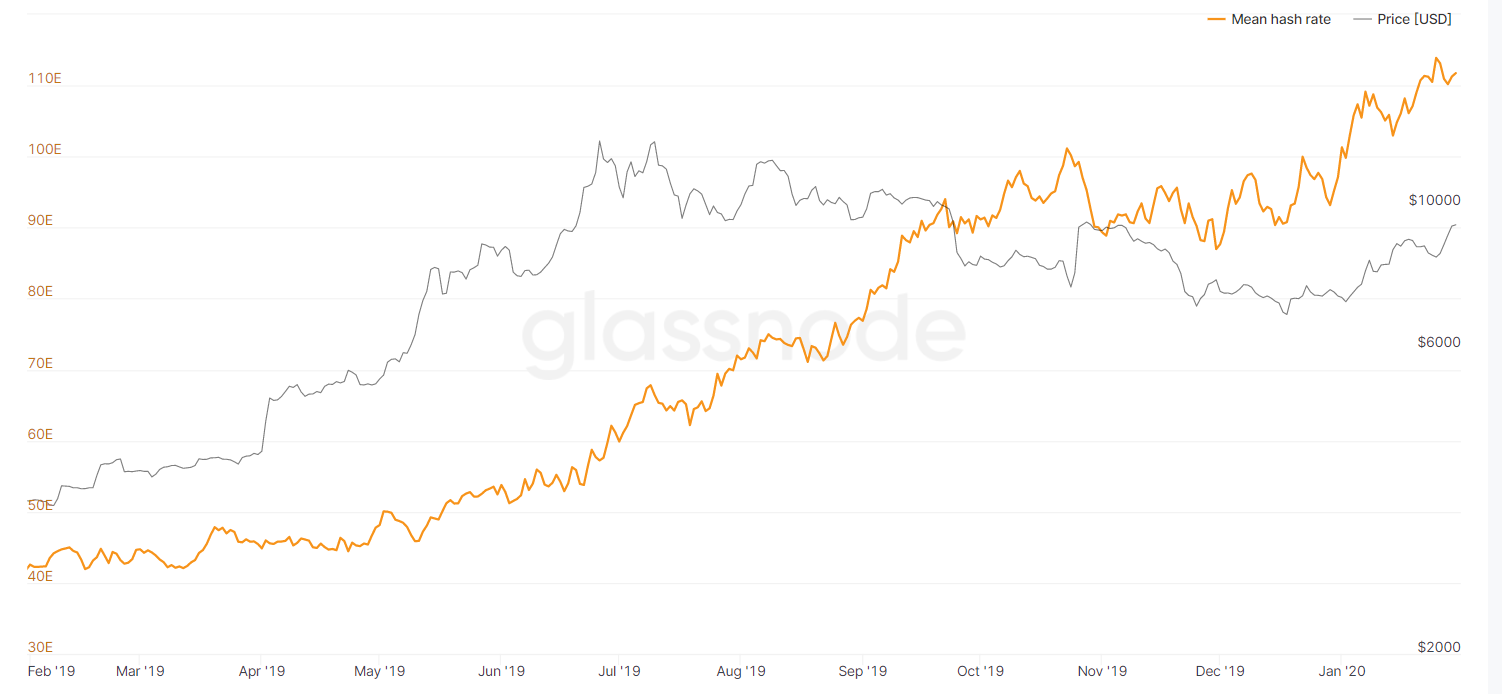

While this shows the uninitiated and active accumulation of Bitcoin, on the supply side, Bitcoin has seen an increase. The hashrate for the cryptocurrency was on a consistent incline through the year, as seen in the chart below,

The post appeared first on AMBCrypto