Most of the cryptocurrency market is finally taking a breather after a few consecutive days of price drops. Bitcoin sits just shy of $10,500, but some large-cap altcoins like Ethereum are still displaying issues.

Bitcoin Hovers Around $10,500

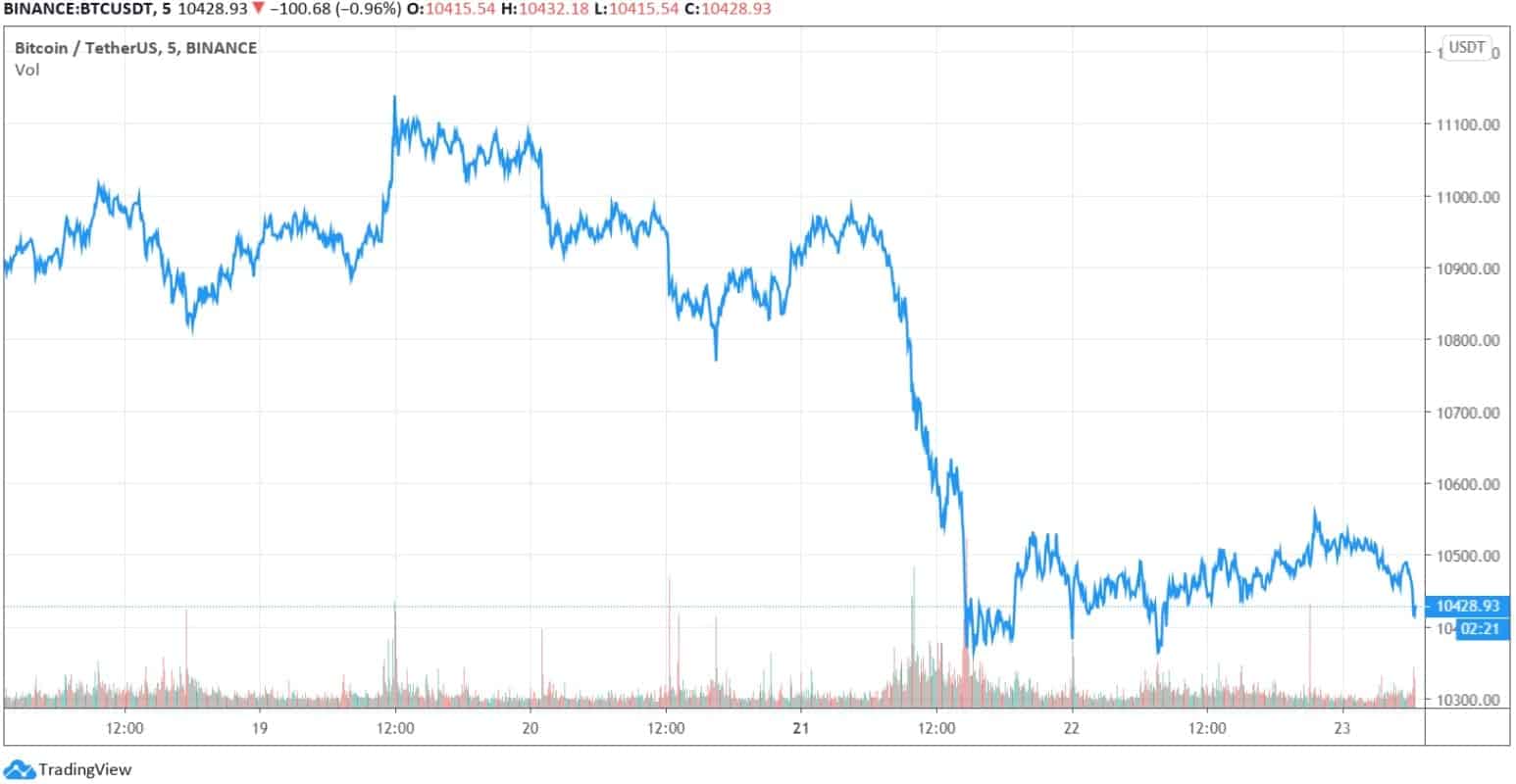

In the past couple of days, Bitcoin went from a top of $11,150 to a bottom of below $10,300. The primary cryptocurrency correlated with the price performances of other financial markets. Gold and equities plummeted similarly following rising COVID-19 confirmed cases in Europe.

Since yesterday, though, the asset has displayed minor recovery signs. The free-fall stopped, and BTC even headed towards $10,600. However, the bears didn’t allow any further price increases and drove the price down to its current level – around $10,450.

In case Bitcoin continues recovering, it needs to overcome the first resistance at $10,580, followed by $10,700, and $10,840, before having a chance to face $11,000.

Alternatively, the support levels that could assist if it drops lower are $10,300, $10,200, and $10,000.

On a 24-hour scale, the correlation between gold and Bitcoin seems interrupted. While BTC has stopped declining, gold is back under $1,900 per ounce. However, this could suggest further adverse price developments for BTC. As reported recently, BTC tends to follow the precious metal as the 60-day correlation between the two reached a new all-time high.

Large-Cap Alts Struggle With Recovery

As it generally happens, the billions of dollars that evaporated from the crypto market cap in the last few days harmed altcoins the most. Ethereum went from challenging $400 to about $330. Despite increasing slightly to $338 since the bottom, ETH is still in the red on a 24-hour scale.

Bitcoin Cash has increased by 0.5%. Thus, BCH has extended its lead over Polkadot for the 5th position as DOT has dropped by 2.7%.

Chainlink has lost the most substantial chunk of value from the top 10 (-8.5%). LINK is down below $8.5, and Crypto.com Coin, which has stayed relatively flat since yesterday, has taken over the 8th spot.

Ultra (21%), HedgeTrade (15%), OMG Network (14%), Celsius (10%), and Synthetix Network (10%) have recovered the most value in the past 24 hours.

After launching its mainnet, getting listed on several exchanges, and exploding in price in days, Avalanche has retraced today by 60%. Orchid has also declined by 15%, followed by Loopring (-9%), Blockstack (-8%), and Ren (-8%).

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato