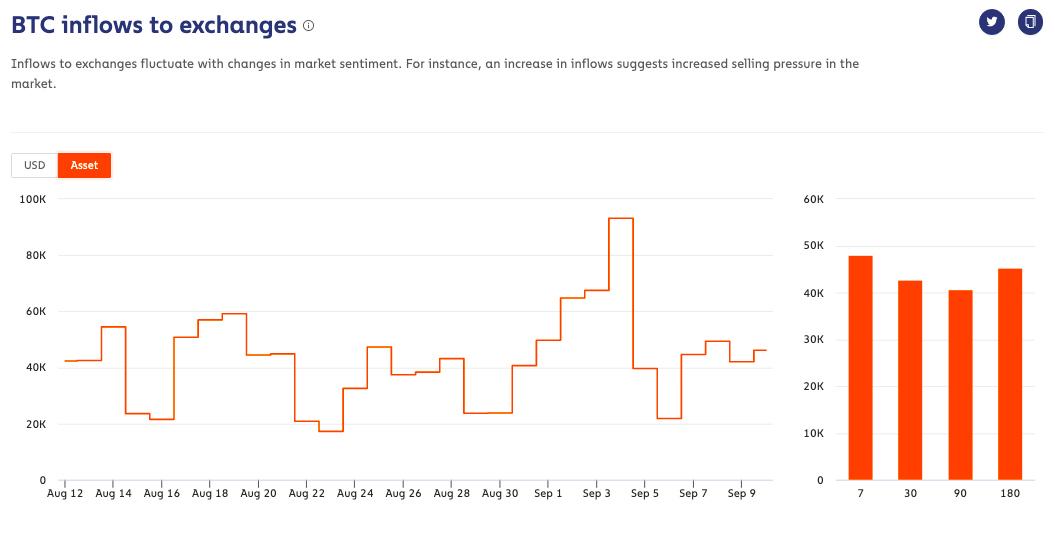

Bitcoin’s price has dropped by 11% from $11,736 to $10,390 – all in a matter of just 10 days. In fact, some argue that the price may plummet even further with rising liquidity on the horizon. However, there are bigger concerns to take care of, such as the question of how this liquidity will be absorbed. Looking at BTC inflows is a good place to start, with data suggesting that the same has risen by 117% from 1 September up to the time of writing.

Source: Chainalysis

Bitcoin inflows were at their peak at $1.3B on 4 September, with the same down to $636M, at press time. Bitcoin inflows over the last 24-hours were around 46.15k BTC, well above the 90-day average. The increase in inflows to exchanges has affected BTC in more ways than just a drop in price. In fact, the steady inflows suggest that the price may sustain itself above the $10,000-level for the next few weeks now.

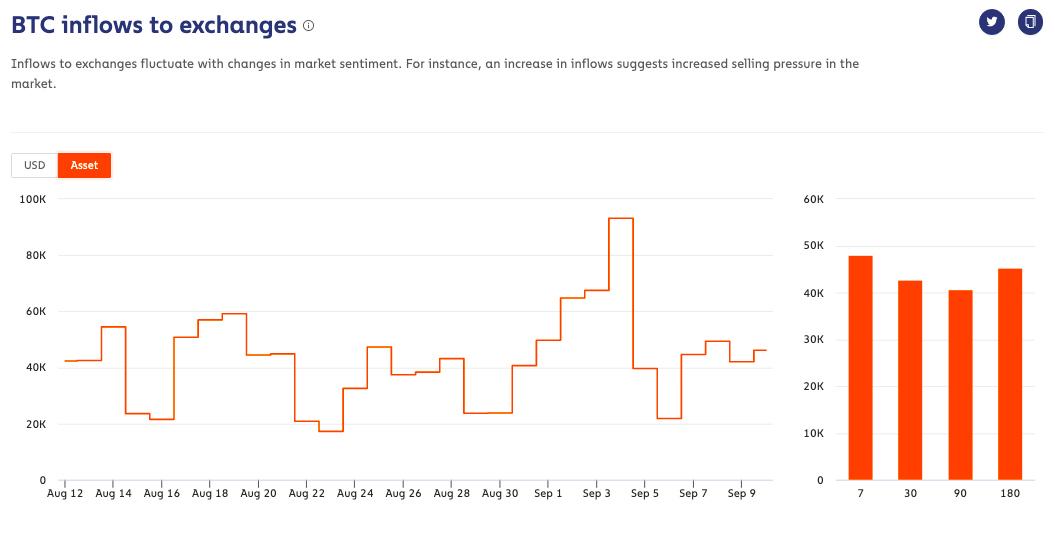

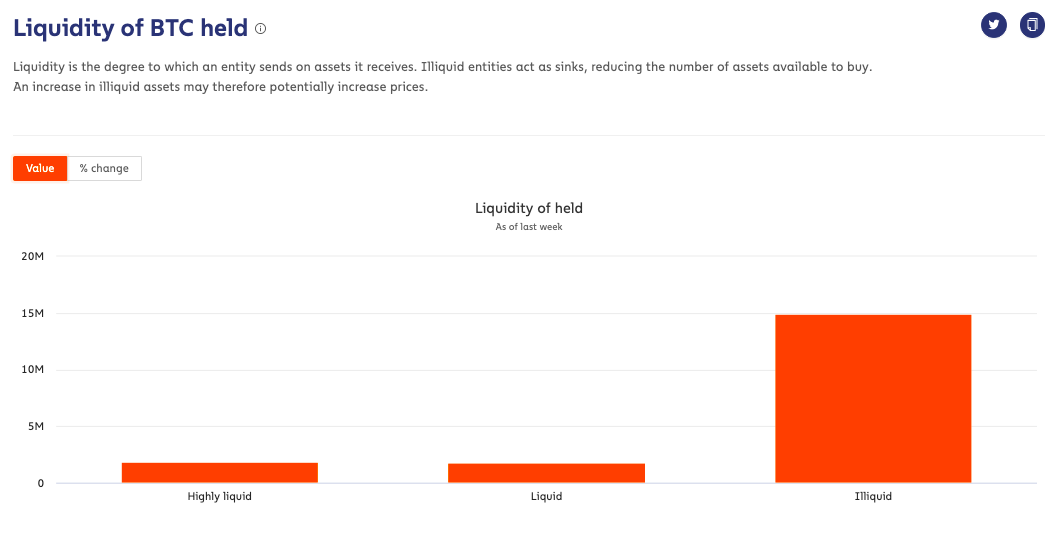

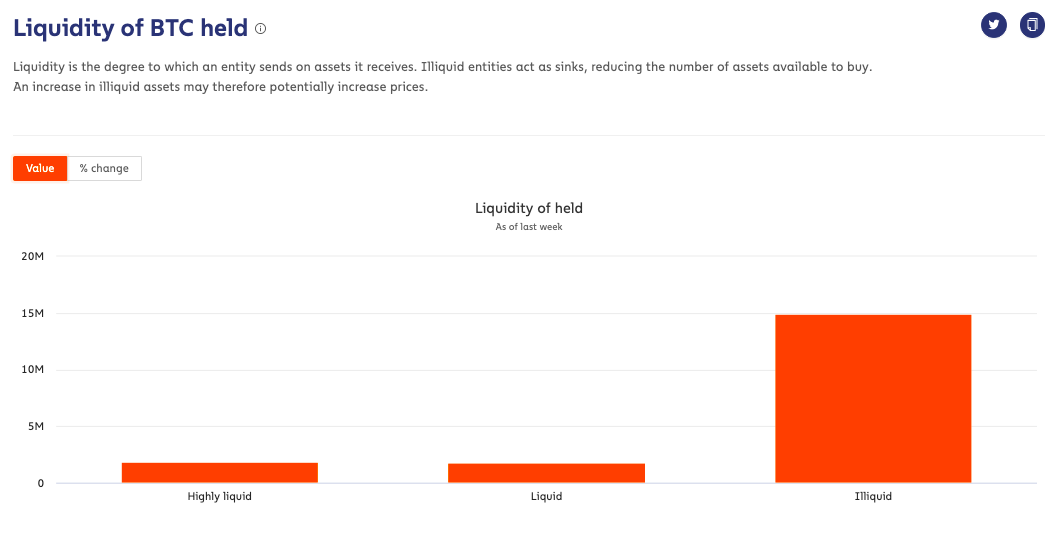

At the same time, illiquid BTC has fallen by 30.8k BTC, on average, over the past four weeks. This is the largest fall observed over a two-month period, based on data from Chainalysis.

Source: Chainalysis

An increase in liquidity is absorbed by new buyers and institutional players, conventionally. However, other factors like traders burnt from the SushiSwap incident may fuel a more sustained demand on spot exchanges.

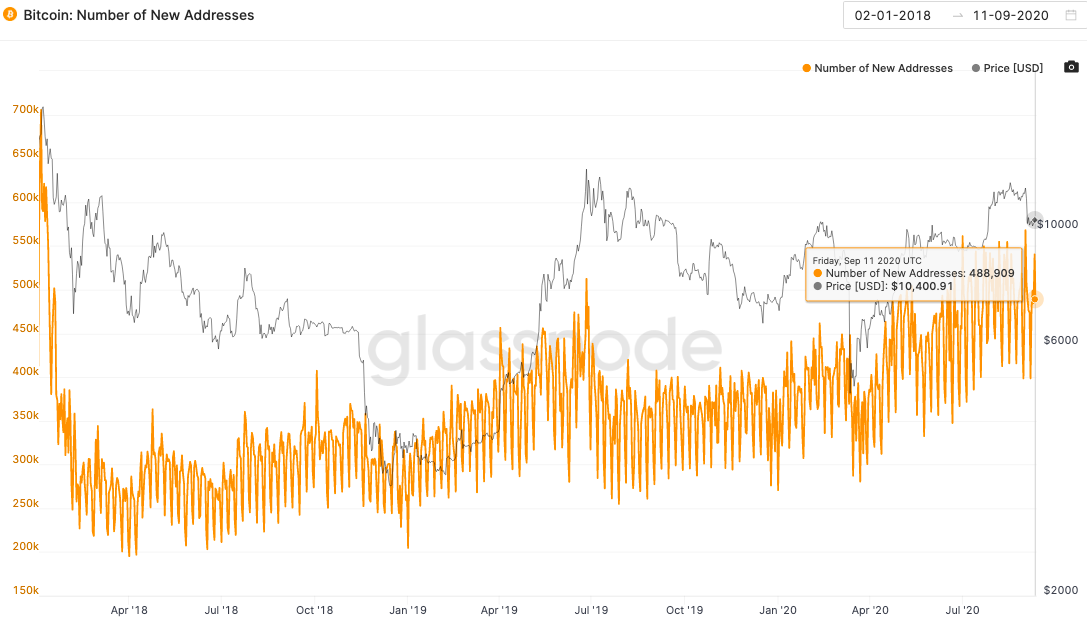

The SushiSwap incident contributed to DeFi’s market cap plummeting by nearly 50%. The incident wiped out millions from DeFi and the market, at press time, was recovering from its losses. However, complete recovery may not be on the cards yet as some analysts say the DeFi bubble may be about to burst.

In fact, immediately after the incident was reported, the price of 90% of the top DeFi tokens dropped. Following the recent sell-offs in DeFi, wary traders may create new demand for Bitcoin on spot markets, in hope of a continuing price rally.

Source: Defipulse

Further, the Total Value Locked in DeFi has dropped by over 10% in 10 days. If the figures for Total Value locked drop further, traders may replace lost value from DeFi by adding BTC to their portfolios.

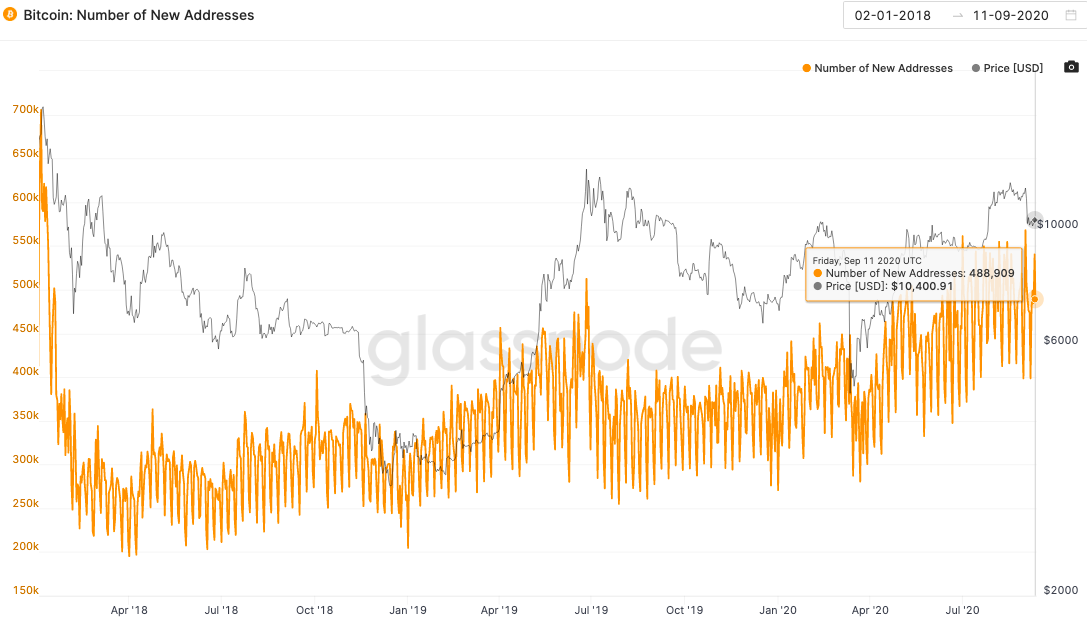

This can be evidenced by the fact that wew buyers are getting added to the Bitcoin Network at a rate of nearly 6% every 10 days.

Source: Glassnode

With a plummeting DeFi market cap, this number may rise even further.

In addition to the loss of interest in DeFi, traders are being lured towards BTC through new offerings on derivatives exchanges. Derivatives product offerings never fail to gain popularity as the inherent risk is lower, when compared to trading in the asset. An increase in Open Interest and volume on derivatives exchanges boosts the entire ecosystem and generates parallel demand for Bitcoin on spot exchanges as well.

Between Huobi’s Bitcoin Options and and Brave’s decentralized derivatives exchange, there are several new offerings for derivatives traders and this may push investor interest to rise.

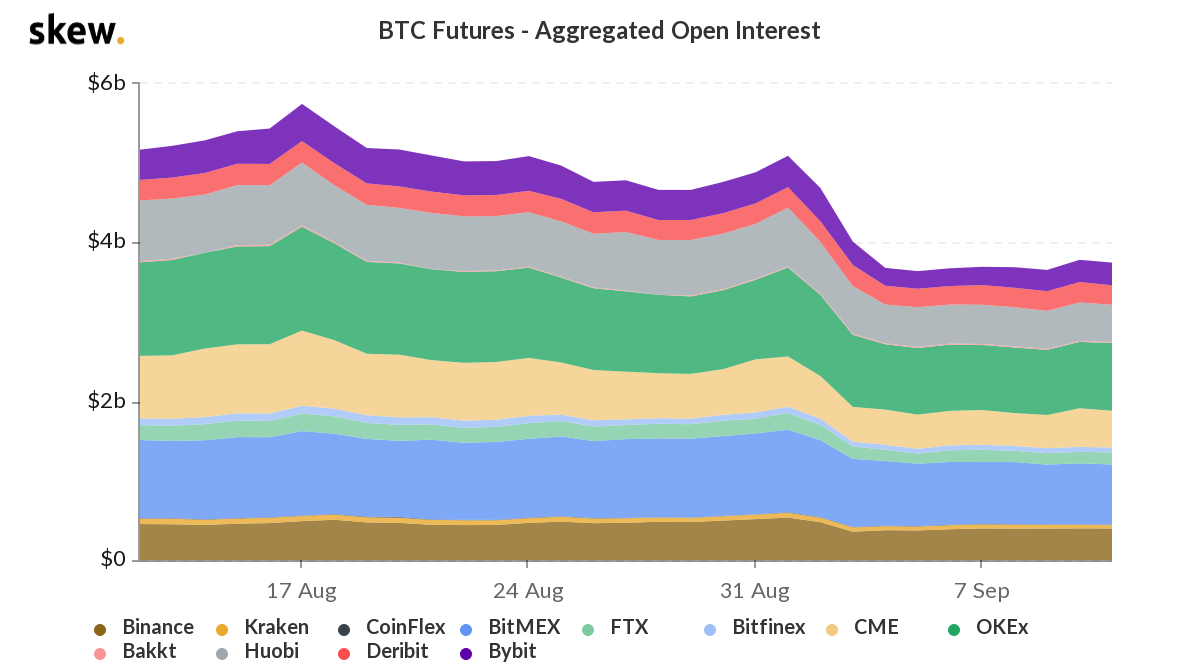

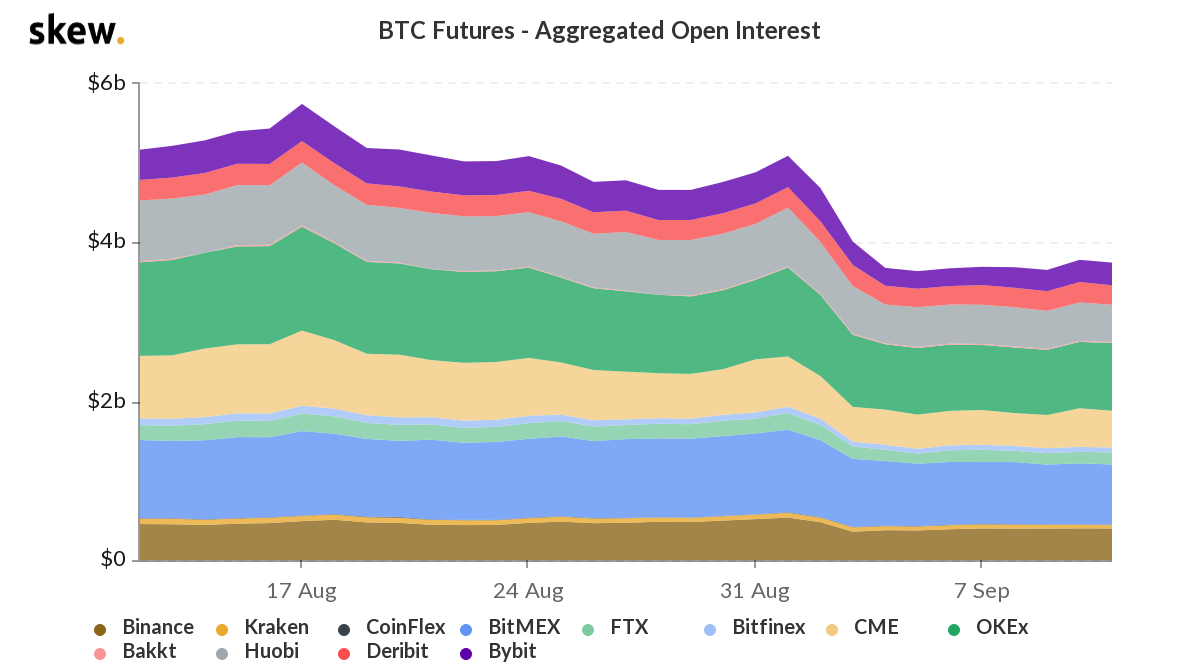

Source: Skew

Finally, Aggregated Open Interest on derivatives exchanges also hit $5.7 Billion on 17 August, and it may climb even higher with new product offerings. At the same time, this demand may shift to spot exchanges and absorb increasing liquidity.

Increasing Bitcoin inflows may not affect price in the long run. However, factors like the falling craze in DeFi and a boost in trader’s interest on derivatives exchanges may provide a much-needed boost to demand for Bitcoin on spot exchanges. Ergo, the price rally, once revived, will possibly sustain itself until the end of 2020.

The post appeared first on AMBCrypto