Bitcoin has been treading higher every day and was priced at $10,700, at the time of writing. While most of the market is still hesitant due to choppy market moves, there is an upside to this.

The overall market sentiment has shifted recently from being fearful to one of neutrality, after a small Bitcoin surge. This shows that users are getting acclimated to the market moves, while also hinting at a reversal in sentiment to greedy aka bullish.

Below are several charts that explain why Bitcoin is bullish in the short-to-medium term scenario.

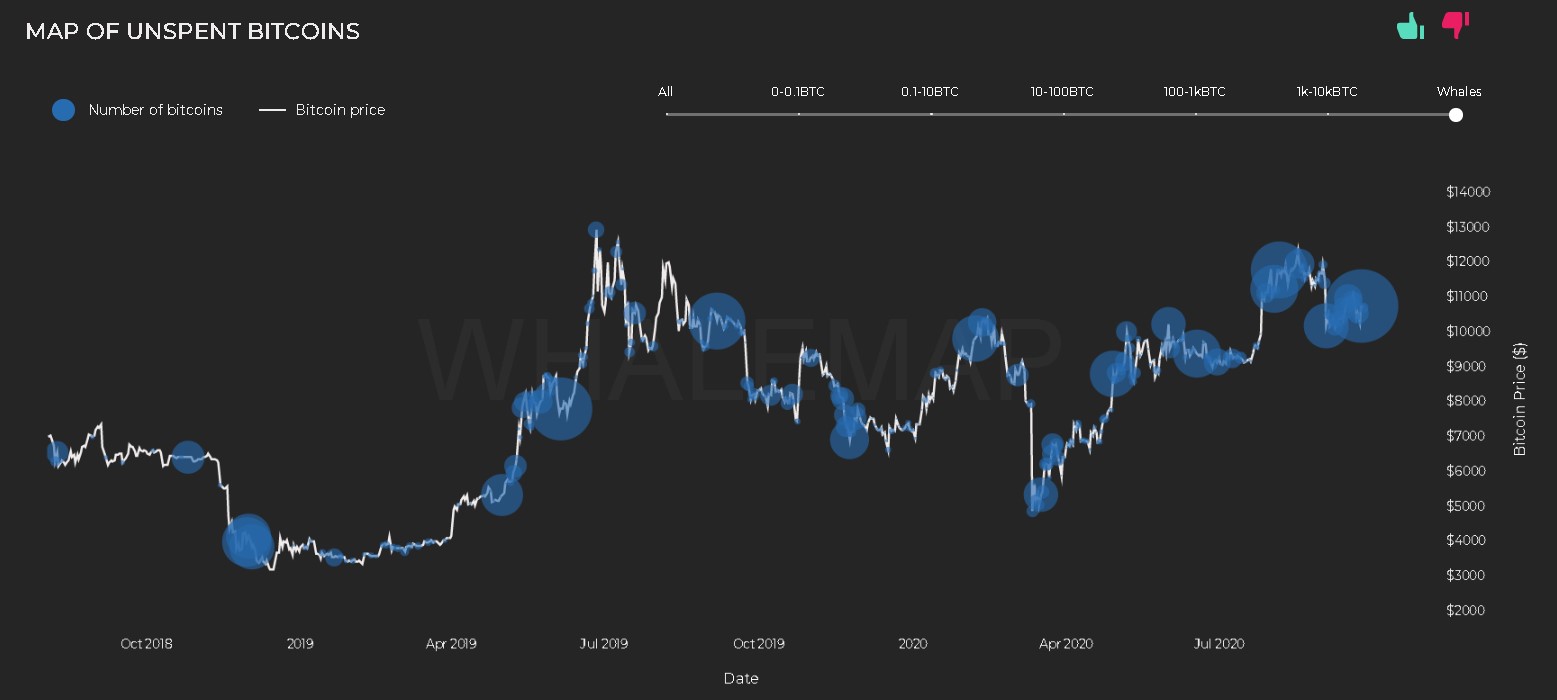

Unspent Transactions

Source: Whalemap

This chart shows bubbles that indicate where unspent Bitcoins were accumulated by whales. From the above, it is clear that there has been a lot of activity since 1 September. It should be noted here that the largest bubble formed on the charts indicates massive accumulation by whales.

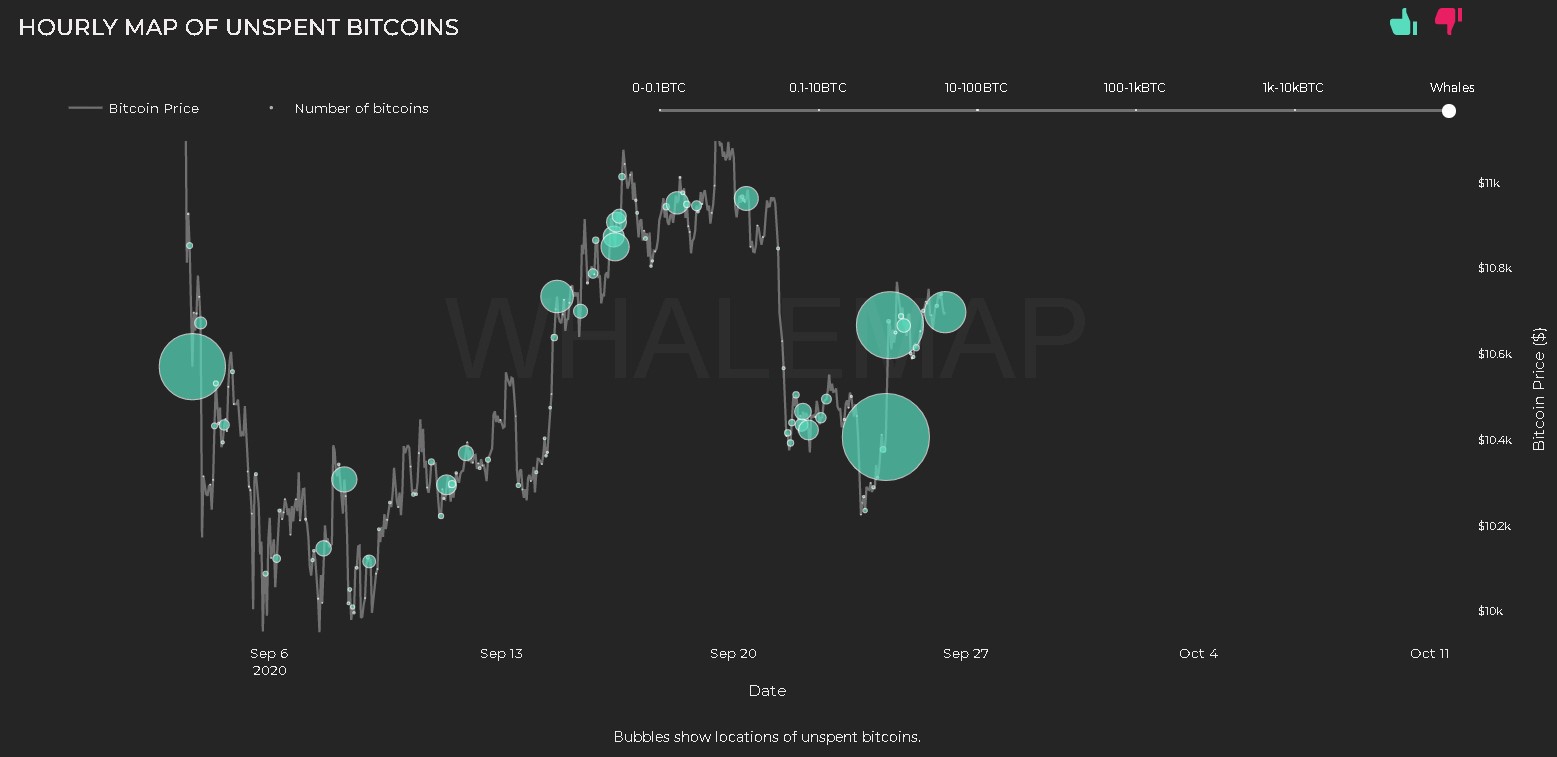

Source: Whalemap

To be precise, on 25 September, 96.1k BTC at $10,400 and 25, 57k BTC at $10,600 were accumulated. Furthermore, 21.5k BTC was also accumulated, as of today, at $10,700. Since these accumulations, the price has surged by $300 to $400, with more possibly on their way.

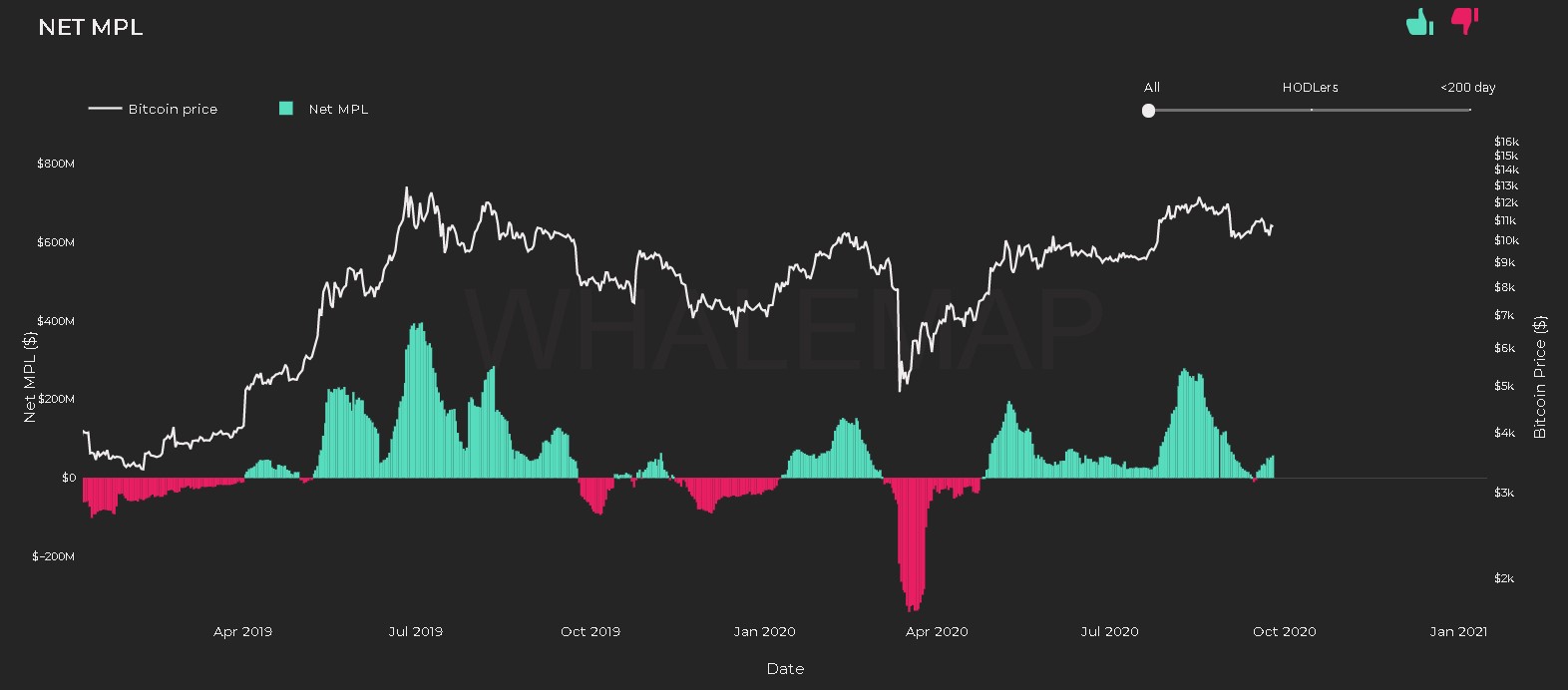

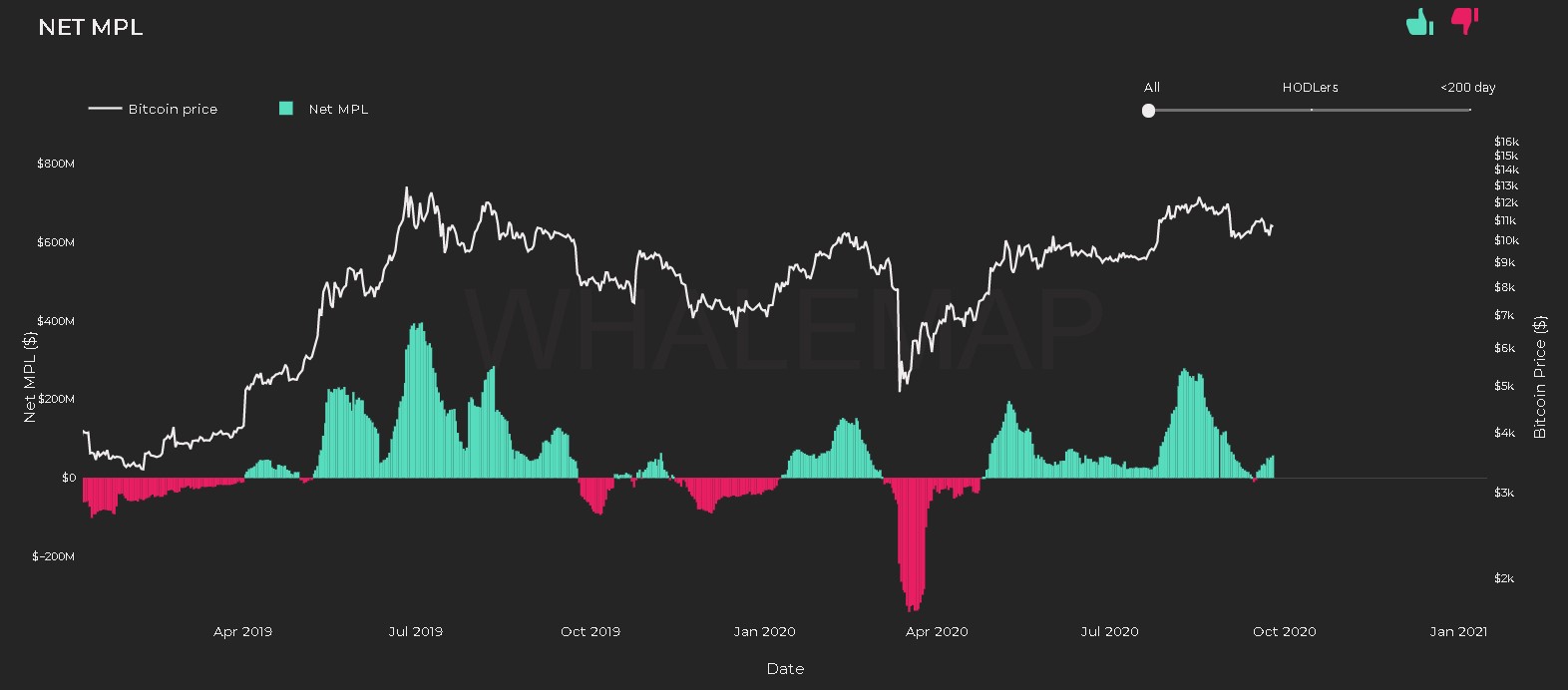

Net Moving Profit and Loss [NMPL]

Source: Whalemap

The attached chart shows net moving profits or losses on Bitcoin on a daily basis. Moving profits and losses on a daily basis indicate if people are cashing out profits or panic selling to take a loss. Large red areas signify a large portion of on-chain movement being at a loss. Since we just exited the red area, a lot of people are in profit and these red areas act as places where momentum builds up for a price to appreciate.

Change in Holdings

Source: Whalemap

Since September, the amount of Bitcoin sold seems to be at $11,780, which means it is a local top. Similarly, the local bottom seems to be at $10,500, a level where a large amount of accumulation has taken place.

Hence, judging by other metrics, it can be concluded that we can expect Bitcoin to easily move up to $11,780, a level where it will face resistance, and perhaps even sell-off.

The post appeared first on AMBCrypto