Bitcoin buyers on Coinbase tend to go on to experiment with altcoins, and BTC could be acting as a gateway drug.

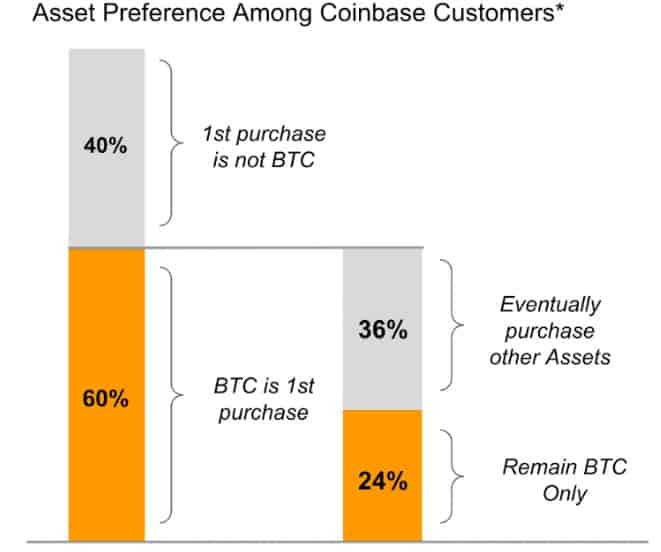

That’s according to new research by Coinbase, which showed that among customers with at least five purchases, those who bought Bitcoin first were more likely to spread out into the altcoin market too.

The blog post made clear Bitcoin’s sustained dominance among Coinbase customers, but also noted a growing interest in alternative assets. The post notes:

“The data bears this out. Among customers with at least 5 purchases, 60% start with Bitcoin but just 24% stick exclusively to Bitcoin. In total, over 75% eventually buy other assets.”

Bitcoin Traders Chase Altcoin Gains

Coinbase speculates why this would be the case, noting a psychological yearning for a return to the heights of 2017’s bull market. The post states:

“This could be for a variety of reasons, but one is largely psychological. As people feel good about their initial crypto investments (into Bitcoin), they branch out to find other possible categorical winners (as evident in the 2017 bull run).”

Coinbase also notes that purchases of altcoins tend to follow large volatility swings, and reference the 2020 surges of Chainlink and Tezos as examples. The report also says that traders tend to move back over to Bitcoin during bear market swings.

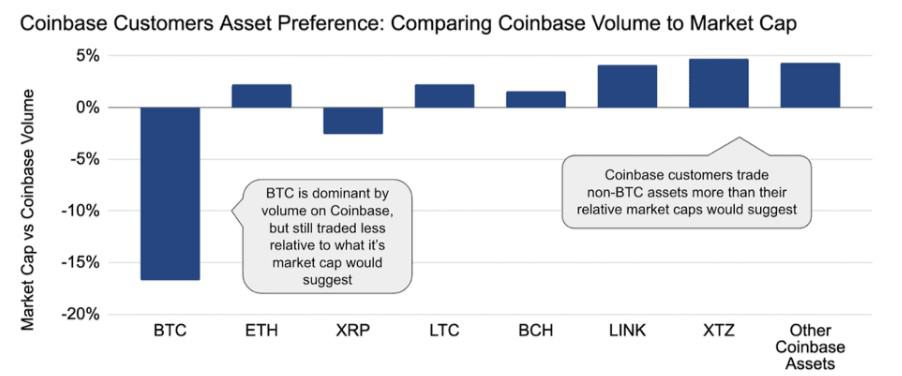

Remarkably, the data shows that Bitcoin is traded at a level lower than its market cap would suggest. Meanwhile, altcoins are traded on average ~3% higher than expected.

“On average, Coinbase customers trade non-BTC assets at a ~3% higher rate than their relative market caps would suggest.”

Blue-Chip Asset?

Coinbase affirms Bitcoin’s current goal of becoming “digital gold,” and says other assets will, “provide differentiated services,” and that, “It will be important for the industry to build support for these other assets as well.”

The article declares Bitcoin’s status as cryptocurrency’s blue-chip asset has remained unchanged, and that it flies the flag for the space as a whole. according to the report, Bitcoin’s proclivity to turn people onto other assets makes it, “top of the funnel for broader crypto growth.”

Before the advent of stable coins and large-scale exchanges, Bitcoin had always been a gateway into the broader cryptocurrency market. In fact, it was the gateway.

As well as being a funnel for growth, Bitcoin could also be a garden. Coinbase ended its analysis of Bitcoin’s role among altcoins by adding:

“Bitcoin is king, and likely to remain king for a long time. But it is also paving the way for a thousand flowers to bloom.”

The post Bitcoin is a Gateway Drug to Altcoins, According to Coinbase appeared first on CryptoPotato.

The post appeared first on CryptoPotato