The latest data from on-chain analytics firm, Glassnode shows that the dollar value of transactions on the Bitcoin blockchain has been steadily increasing. Also, crypto research firm Messari has dispelled misconceptions regarding the failure of public blockchains like Bitcoin and Ethereum as payment channels.

Median BTC Transfer Volume up 100 Percent Since 2020 Beginning

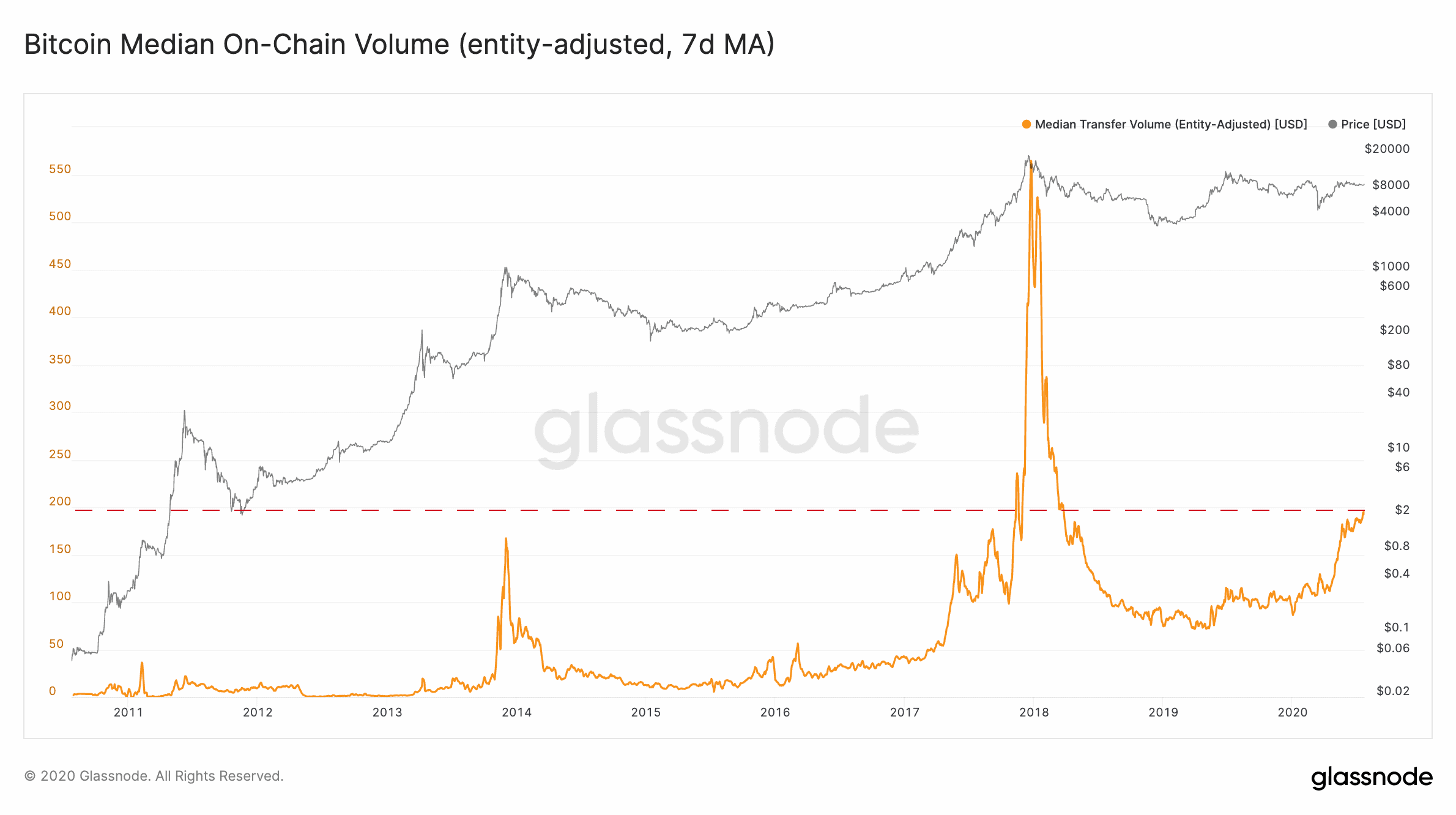

As per a tweet on Glassnode’s official handle, the median Bitcoin transfer is standing at around $195. This marks a 100 percent appreciation from the previous number since the beginning of the year.

The last spike in median BTC transfers happened between November 2017 and March 2018.

But what does median Bitcoin transfer volume mean anyway? As per the description on Glassnode’s website:

The median estimated amount of coins (USD Value) moved between different entities, i.e. excluding volume transferred within addresses of the same entity. Entities are defined as a cluster of addresses that are controlled by the same network entity and are estimated through advanced heuristics and Glassnode’s proprietary clustering algorithms.

This shows that, overall, Bitcoin as a ‘Peer-to-Peer Electronic Cash System’ as per Satoshi’s original design, is finally fulfilling its objective. And if the above falls short of demonstrating the same, there’s something else.

Bitcoin & Ethereum About to Clock $1.3 Trillion in Transfers This Year

People have blasted public blockchains, especially Bitcoin and Ethereum for their ‘stunted value transferring abilities’. Well, numbers from the latest report by crypto research firm Messari say otherwise.

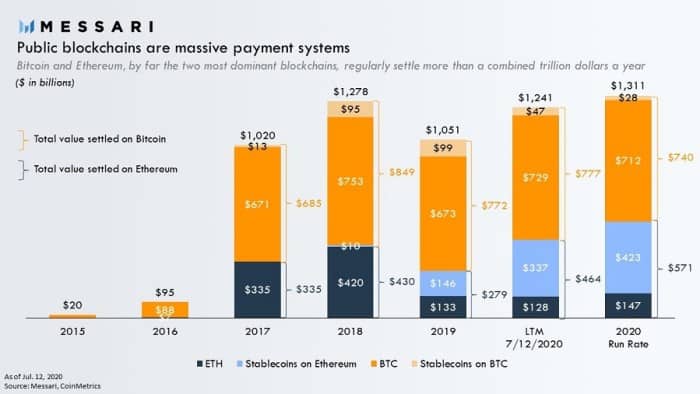

According to an article posted yesterday by Messari researcher Ryan Watkins, Bitcoin and Ethereum are on pace to settle a combined $1.3 trillion in transactions in 2020.

BTC transfers take up the majority in the ‘transfer pie’, as per the chart. Bitcoin and BTC-based stable coins account for $740 billion worth of transactions. And this is not the story this year.

Every year since 2017, Bitcoin transactions have been ranging in the $670 to $750 billion zone. Also, BTC, ETH, ETH-based stable coins have continually registered over $1 trillion in annual transactional volume.

Public Blockchains Have a ‘Purpose’

Pointing out misconceptions about public blockchains, Watkins says that the claims are unfounded. People ‘prematurely’ compare them to companies like VISA. But it is much more appropriate to equate them with large settlement systems like Fedwire.

Public blockchains have a purpose, according to Watkins, and that purpose is to clear transactions immediately without them being refuted, reversed, or double-spent.

He goes on to add that public blockchains need to absolutely guarantee payments between transacting parties. Therefore ‘strong settlement assurances’ are a necessity.

This is the necessity that Satoshi implied when he first released the Bitcoin whitepaper in 2008.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato