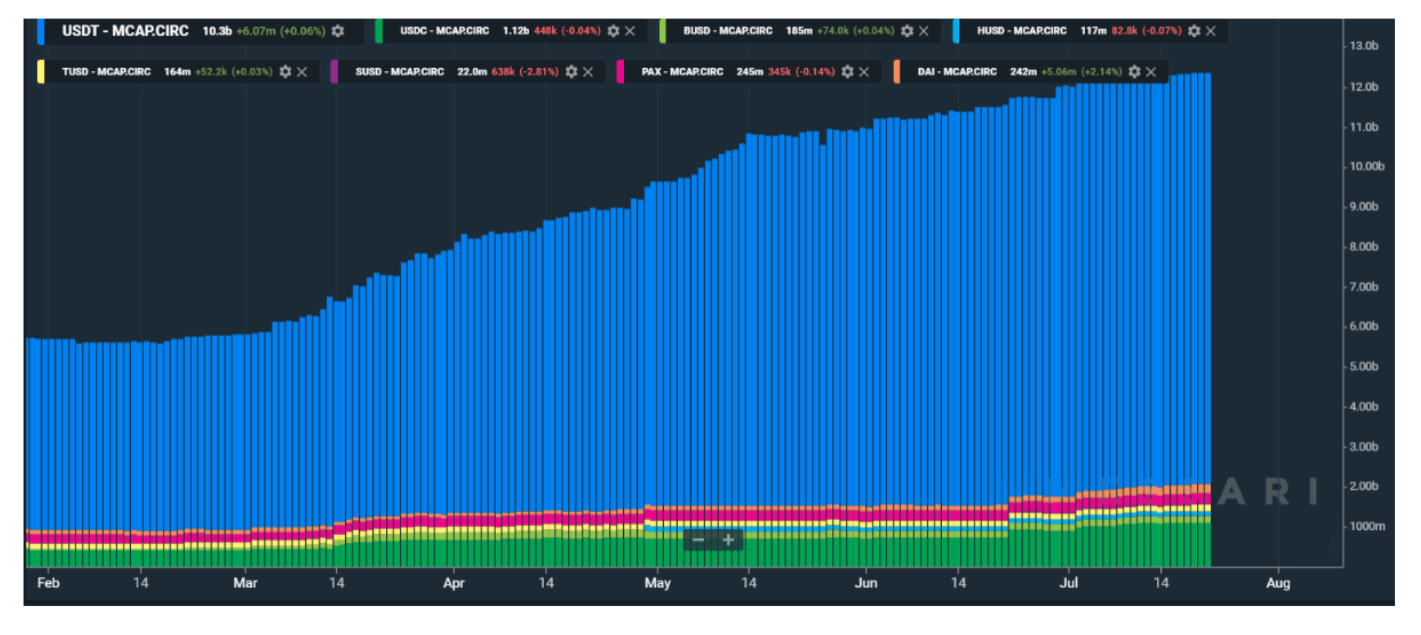

The story of stablecoins has been extraordinary in 2020. After the collapse in March 2020, the rate at which Tether has exploded in terms of issuance and market cap has led many to believe that U.S dollar-pegged centralized digital assets will have a major say in Bitcoin‘s future.

Now, when it comes to stable assets, users have had to opt for one of the two functionality. Either the asset will be scalable or it will be decentralized. Now even though, the concept of digital assets with Bitcoin embraces the idea of decentralization, many are overwhelmingly choosing higher levels of scalability.

According to a recent post by Messari, from the existing supply of $12 billion stablecoins, only 2 percent have remained non-custodial, validating the fact that users rather prefer a centralized dollar-pegged token than its trustless counterparts. The post added,

“When the price of a centralized stablecoin like Tether moves above $1.00, traders can quickly deposit dollars, receive stablecoins, and sell them at a slight profit. Simple arbitrage restores the peg back to $1.00. “

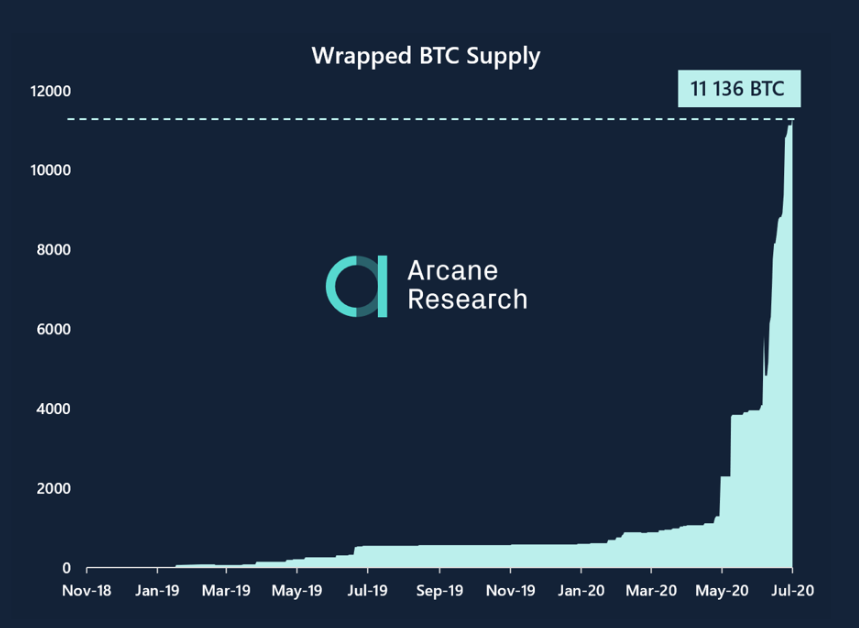

Talking about centralized stablecoins such as Tether, the popularity of tokenized Bitcoins is rapidly increasing, as BTC held on Ethereum is backed by BTC reserves held by a third party. The evolution of Wrapped Bitcoins or WBTC is the perfect example.

Data suggested that since the beginning of 2020, WBTC locked has gone from being under 2000 BTC to a whopping 11,136. That is 85 percent of the total Bitcoin held of Ethereum, worth close to $130 million. Now, in comparison to the total market cap, it is definitely a small amount, but it is beginning a marketplace for third-party held Bitcoins.

It is clear as day that users are currently easing to the idea of having a “trusted entity” like BitGo holding on to their underlying Bitcoins locked in WBTC.

So, what will be the end game for “Scalable Bitcoins”?

Messari’s Jack Purdy believed that WBTC will go on to become “tether of BTC on Ethereum” and expects its exponential growth and market dominance.

On the other hand with tokenized Bitcoins creating an array of options to bridge Bitcoin’s properties with other protocols, the major trade-off remains the centralization and more complexity than when using the Bitcoin blockchain itself as the settlement layer.

The post appeared first on AMBCrypto