Bitcoin skeptic Peter Schiff has done it again: The notorious gold bug, famous for being the owner of the only Bitcoin wallet capable of forgetting passwords, claimed that this time —unlike his other failed predictions— Bitcoin is genuinely about to die .

Shortly before the price correction on Oct. 20, 2020, the investor went on Twitter to unload his thoughts on the famous cryptocurrency, declaring it to be the worst bubble he’d ever seen. Schiff explained that the “level of conviction buyers have in their trade” is so high that it beats famous dark episodes in the history of finance like the dot-com bubble or the 2006 real estate crisis.

If you measure the size of asset bubbles based on the level of conviction buyers have in their trade, the #Bitcoin bubble is the biggest I’ve seen. Bitcoin hodlers are more confident they’re right and sure they can’t lose than were dotcom or house buyers during those bubbles.

— Peter Schiff (@PeterSchiff) October 28, 2020

The Peter Schiff Effect and The Stubborn Bitcoin Market

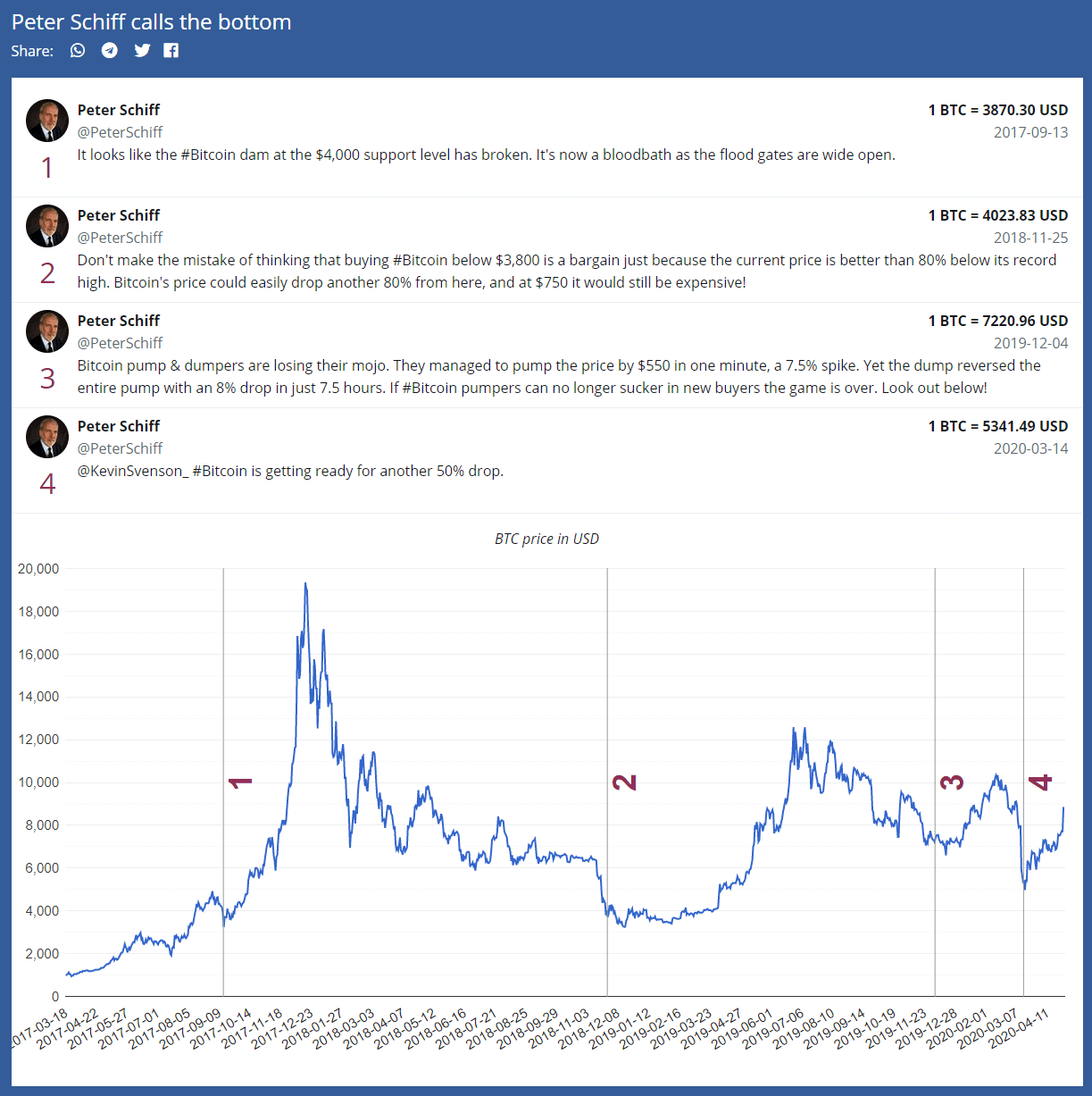

We can’t say how Schiff was able to measure the level of conviction of the generality of Bitcoin traders; however, based on past experiences, we can say that when Peter Schiff has a high level of conviction that Bitcoin is going to crash… Bitcoin tends to go up.

An image shared by the Redditor Blockchaincenter_de shows the evolution of Schiff’s tweets. The well-known investor has become a kind of meme within the crypto community for being a contrarian price indicator for Bitcoin.

One of the latest comments about Bitcoin by Peter Schiff explained that the token would soon crash to sub $10,000 levels. He invited his audience to discuss how hard the fall would be. His tweet gave luck to Bitcoin, because the token has not fallen below the $10,000 mark again and currently holds the record for the longest time above said price line.

Two of the last three times #Bitcoin rose above $10,000 in Oct. of 2019 and in Feb. of 2020 it soon fell by 38% and 63% respectively. The last time Bitcoin rose above $10,000 was in May, and it only fell by 15%. It’s above $10,000 again today. How big will the next drop be?

— Peter Schiff (@PeterSchiff) July 27, 2020

Will a Golden Needle Pop The Bitcoin Bubble?

Schiff, who became famous for predicting the 2008 financial crisis —which, by the way, seems to be one of the reasons why Satoshi created Bitcoin— explains that Bitcoin’s performance, rising in price very quickly and falling with the same force, is a characteristic of a bubble and not of a young product consolidating its market.

Schiff claims that Bitcoin has no intrinsic value and Gold outperforms it because of the multiple uses the metal has beyond pure speculation and storage of value. He also said Bitcoin would not increase its price due to inflation even though gold would certainly appeciate in price.

The well-known investor and CEO of Schiff Gold LLC is also the man behind Europacific Capital, a bank based in Puerto Rico focused on providing services to high profile customers in need of security and confidentiality. His bank is currently the target of one of the most extensive tax fraud investigations in United States history.

If only he just used Bitcoin or another crypto-currency for his operations…

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited offer).

The post appeared first on CryptoPotato