This week was nothing short of exciting in the cryptocurrency markets. Bitcoin definitely woke up from its slumber and made a few aggressive moves upwards. Altcoins felt the pain as most of them decreased in value as the king of crypto took its toll.

In seven short days, Bitcoin went from around $9,600 to $11,400, charting gains upwards of just shy of 20%. Earlier on Monday, the cryptocurrency catalyzed its performance, jumping from $9,800 to $11,200. After that, it consolidated for a few days, and just today, it painted fresh 2020 highs at around $11,400.

While all of this was happening, altcoins took somewhat of a beating. The total share of Bitcoin relative to that of the entire market increased to about 62.6%, which is 1.5% more than last week. In other words, altcoins have been losing grounds.

This, of course, isn’t true for every altcoin. Ethereum plays by its own rules as the cryptocurrency gained upwards of 20% to its Dollar value during the week. And, our weekly report wouldn’t be complete without mentioning YFI – the second-most expensive token on the market right now.

And while large-cap cryptocurrencies might not be having the time of their life, small and unknown projects are popping daily on Uniswap, bringing the notorious 2017-like vibe to the DeFi market.

In any case, the total value locked in DeFi protocols is at $4 billion, with Maker once again reclaiming the leading position with $1.21 billion and 30.4% market dominance.

It’s interesting to see where the market will take from here. It’s clear that Ethereum is finally capitalizing on the ongoing DeFi craze, but is it sustainable?

Market Data

Market Cap: $335B | 24H Vol: 85B | BTC Dominance: 62.5%

BTC: $11,360 (+2.17%) | ETH: $345,67 (+2.76%) | XRP: $0.254(+2.94%)

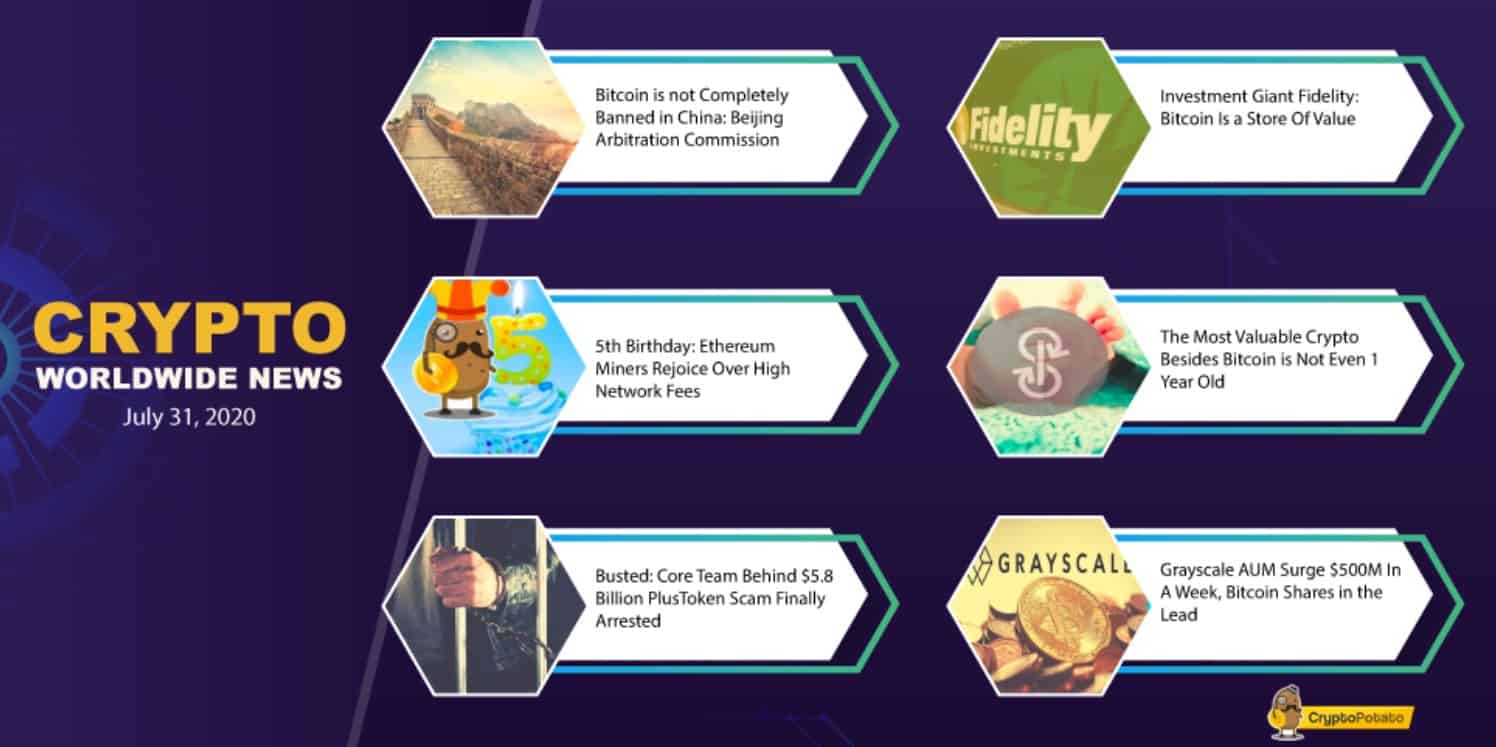

Grayscale AUM Surge $500M In A Week, Bitcoin Shares in the Lead. Grayscale Investments, who operate the largest cryptocurrency hedge fund, attracted over $500 million worth of assets under management in less than a week, following the latest surges in Bitcoin’s price. Notably, shares for BTC are in the lead.

The Most Valuable Crypto Besides Bitcoin is Not Even 1 Year Old. Launched less than two weeks ago, YFI has become the second-most expensive cryptocurrency on the market. As of July 25th, it was up more than 35,000% thanks to the yield farming craze catalyzed in the DeFi field.

Investment Giant Fidelity: Bitcoin Is a Store Of Value. Fidelity Digital Assets, the cryptocurrency arm of one of the world’s largest asset managers – Fidelity Investments, has published a report acknowledging Bitcoin as an “aspirational store of value.” This comes in times of economic uncertainty as the coronavirus continues to pose a threat.

Busted: Core Team Behind $5.8 Billion PlusToken Scam Finally Arrested. After pulling off one of the biggest cryptocurrency scams ever, the core team behind PlusToken has finally been arrested by the police in China. 27 individuals were caught and detained as part of the fraudulent scheme that attracted over $5.8 billion reportedly.

5th Birthday: Ethereum Miners Rejoice Over High Network Fees. Ethereum saw its 5th birthday this month. On that day, it not only surged in price but also tapped a few other important on-chain metric highs. Its hash rate has been growing steadily, meaning the network is becoming more secure.

Bitcoin is not Completely Banned in China: Beijing Arbitration Commission. According to a recent report, Bitcoin is not completely banned in China. The Beijing Arbitration Commission pointed out that while it can’t be used as a currency, it represents a “virtual commodity.”

Charts

This week we have a chart analysis of Bitcoin, Ethereum, Ripple, Chainlink, and VeChain – click here for the full price analysis.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato