Today is the first day of August, and this means that a few hours ago, the monthly candle of July closed.

A surprising fact is that only once in its history, Bitcoin had recorded a monthly close higher than yesterday’s – and that was during December 2017 – the peak of the bubble.

After two months of dull price action, while Bitcoin was mostly traded at around $9200, there came the breakout. And what a breakout it was.

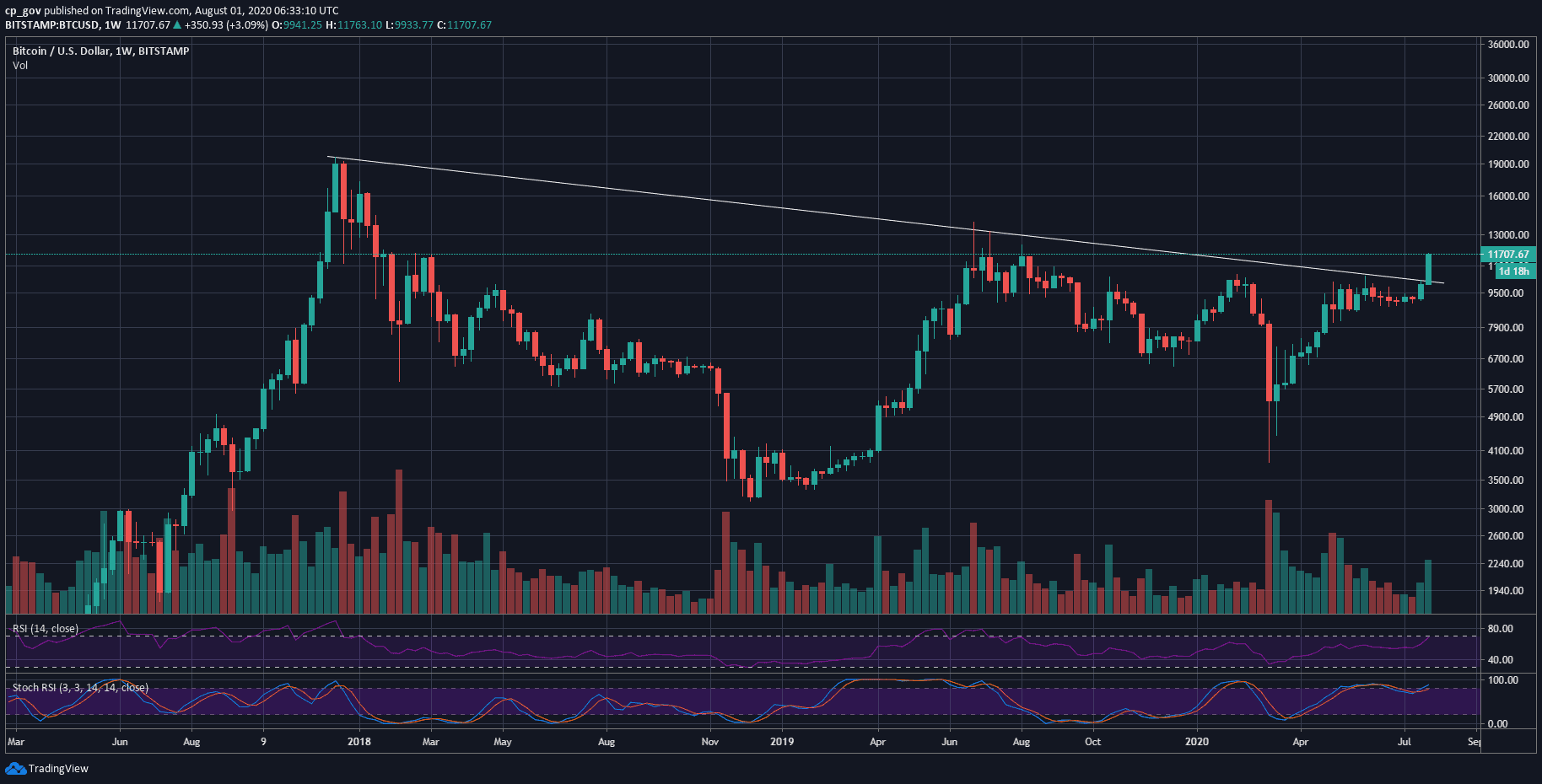

Looking at the following weekly chart, we can clearly see that the current bullish move started upon breaking $9200, and most importantly, was breaking above the descending trend-line. Yes, the line that begun forming during December 2017 – Bitcoin’s all-time high near $20,000.

There are still two days to this impressive weekly candle; however, as of now, it is hard to believe that the candle will close below the weekly line (around $10,200).

The state of Bitcoin is now parabolic. Remember the past two times Bitcoin entered such mode: November 2017 and June 2019. In a matter of 3-4, Bitcoin doubled and tripled its value. So, things can get happen fast this time as well.

However, keep in mind that when possible price corrections come – it will hurt. Also, the indicators are overextended. The daily RSI is at its highest level since June 2019.

Bitcoin’s Next Price Targets

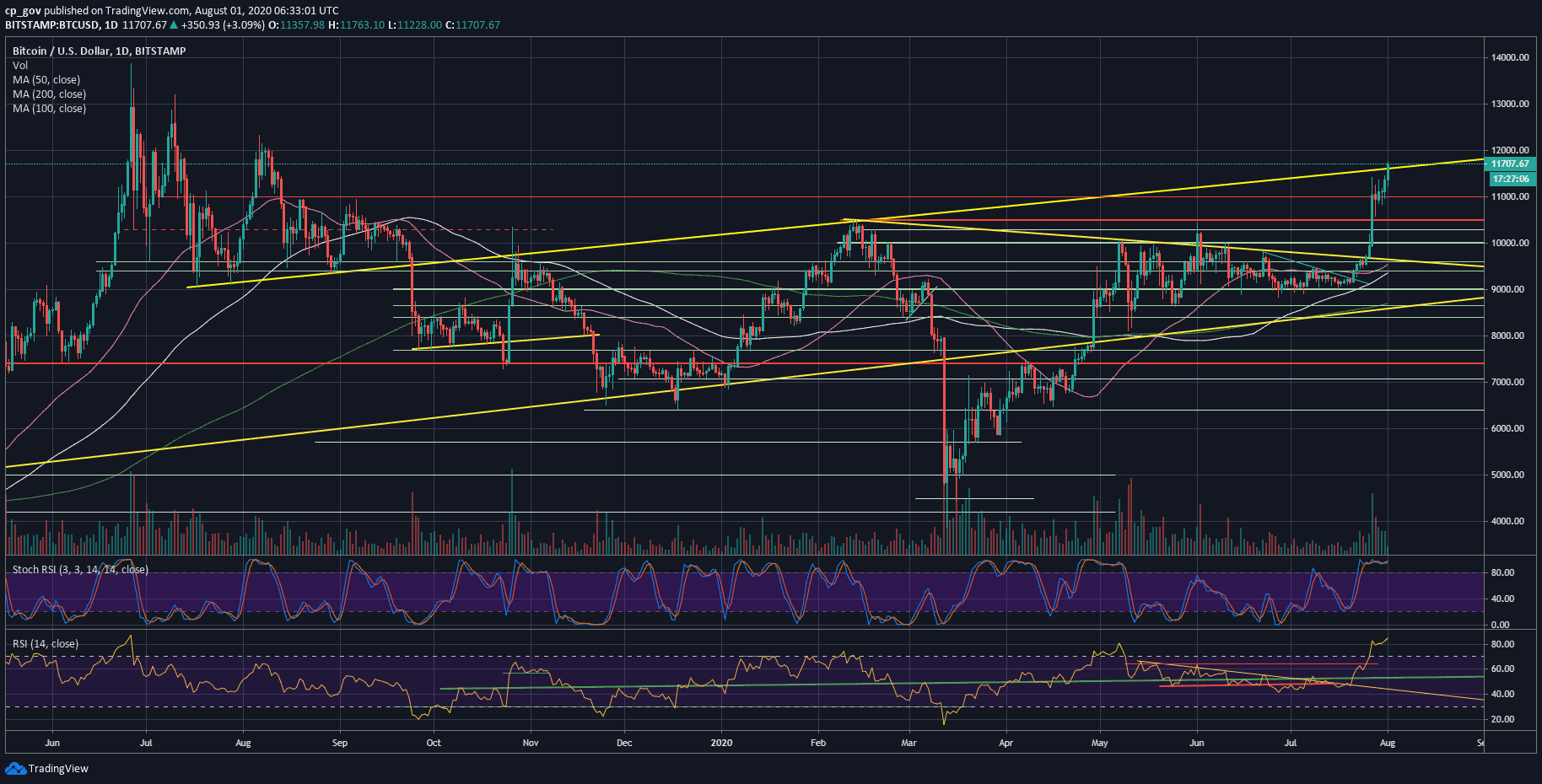

Looking at the following daily chart, we can see Bitcoin currently surpassing a critical ascending trend-line together with the horizontal resistance at $11,600.

A daily close above it will fuel the continuation of this move towards $11,800 (resistance from March 2018) and the psychological level of $12,000.

Further above lies $12,300, which was the highest level reached in August 2019 exactly a year ago. The latter is followed by the $12,500 resistance.

In case of a correction, the latest resistance levels will likely serve as support. The first level from below is $11,600, followed by $11,400 (prior high). Further below lies $11,00 and $10,800.

Total Market Cap: $345 billion

Bitcoin Market Cap: $215 billion

BTC Dominance Index: 62.5%

*Data by CoinGecko

BTC/USD BitStamp 1-Day Chart

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato