With the start of April, Bitcoin is entering its best performing quarter of the year. History shows in five out of the last six Q2s, the primary digital asset has been well in the green.

This year’s Q2 marked a 10% increase in a few days as well, and the community wonders if another positive price development is to come.

Historic BTC Q2 Data

The popular cryptocurrency monitoring resource, Skew, recently examined Bitcoin’s quarterly returns since 2014.

As the graph above clearly outlines, Q2 (April-May-June) has provided the most periods with positive returns. In fact, out of the past six already completed quarters, only in 2018, Bitcoin was worth a bit less at the end of Q2 than at the start of it.

Aside from Q2 2015, when BTC increased by 7.72%, all other cases have recorded double and even triple-digit returns. Last year was particularly beneficial for Bitcoin investors, as its price skyrocketed by over 160% in three months.

It’s also worth noting, though, that the most significant quarterly gains of 226% occurred during Q4 in 2017. What later became recognized as the parabolic price increase, Bitcoin reached its all-time high of approximately $20,000.

Q2 2020 To Follow?

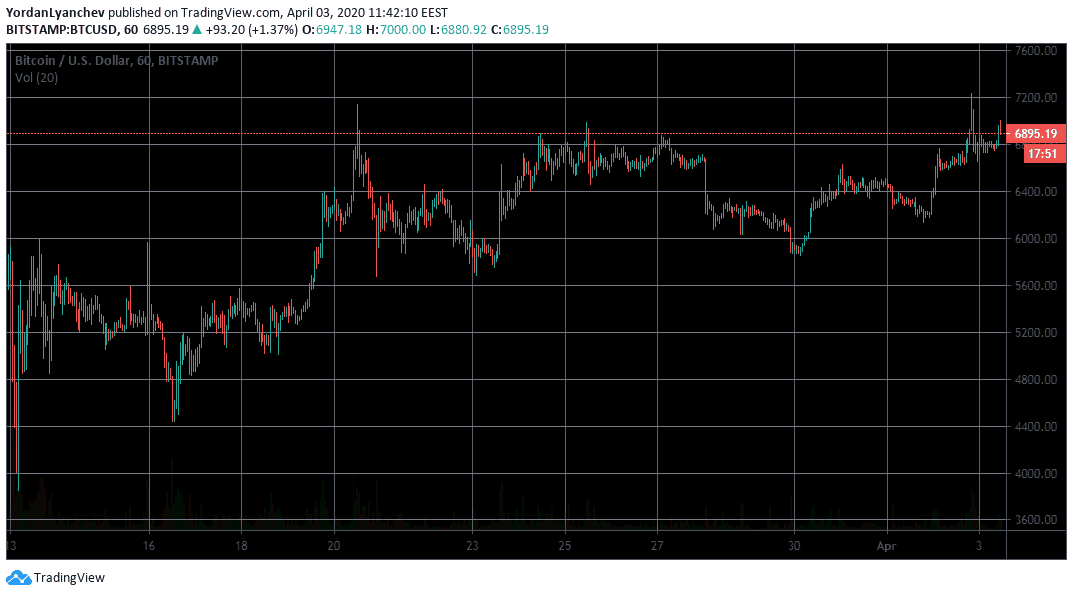

History is no valid indicator of future price performance. This is especially true in the eminently volatile cryptocurrency world. The community, however, speculates that another bullish run might be around the corner. It has been only three days since the start of 2020’s Q2, but the leading digital asset by market cap is already in the green with approximately 10%.

This quarter will also see one of the most important Bitcoin events. In just over a month, the BTC Halving is scheduled to take place. It will cut in half the block rewards miners receive, which could ultimately result in fewer bitcoins reaching the market.

Basic economy principles dictate that once an asset’s supply decreases, while the demand remains the same or increases, its price should, in theory, rise.

So far, two Halvings have taken place, and after each, Bitcoin’s price has skyrocketed.

Nevertheless, Q2 just started, and it’s too early to make decisive conclusions. However, it will be quite compelling to follow if BTC will continue its positive quarterly run.

The post Bitcoin Loves Q2: With 66% Average ROI, Only Once Since 2014 Q2 Ended Red appeared first on CryptoPotato.

The post appeared first on CryptoPotato