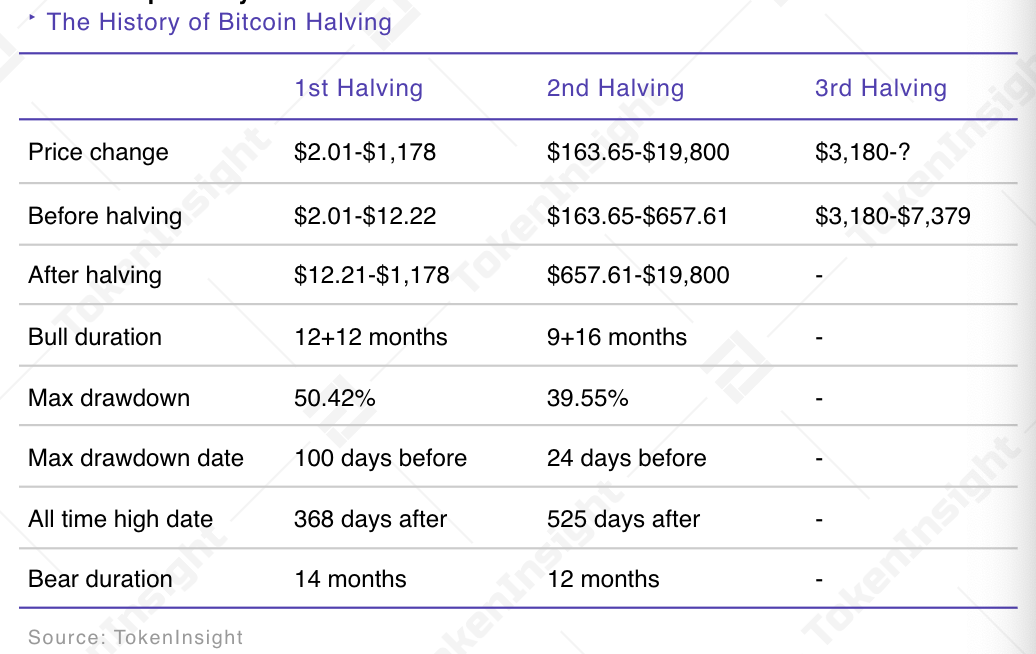

Bitcoin [BTC] has always been the topic of discussion when anyone talks about cryptocurrencies. It has gained a relevant position in the tech and financial sector, even though many are still skeptical about investing in Bitcoin. 2020 may turn out to be an important year for Bitcoin due to its third halving event, an event which will decrease the digital asset’s inflation rate to almost 1.7%.

This reduction in the inflation rate will be “lower than the 4.8% – 6.2% [Gold] and 5% [M1] issue rate,” stated a report by TokenInsight. According to the aforementioned research report,

“After halving, if Bitcoin is to maintain the $7,000 price level, the required daily capital inflow will be reduced by $6.3 million, equivalent to a nearly $200 million monthly reduction.”

The annual supply of Bitcoin will be reduced to 1.7%, lower than any other type of asset class. However, the report, unlike some in the market, claimed that Bitcoin halving is “not priced in,” despite the fact that the market is aware of the upcoming event. However, the factor that will support the rise of Bitcoin’s price will be new investors, and not the existing capital in the market.

Source: TokenInsight

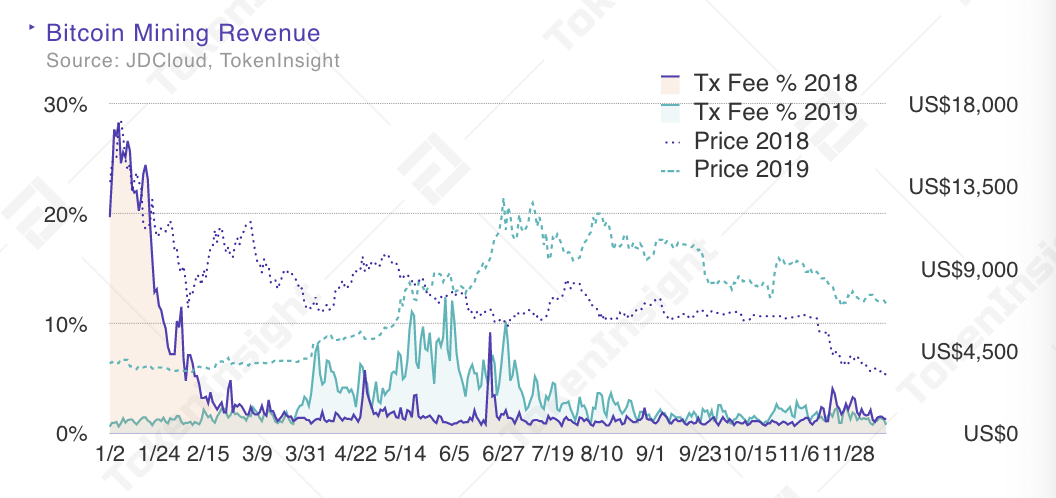

Even wallet addresses cannot be related directly to growing adoption as the number of addresses grew steadily over the last year, along with compliant channels. As for mining, the overall cost is expected to rise post-halving, a development that might weed out lower-end mining hardware, following which the miners might jump to an active ASICs second-hand market. This might result in competition among ASIC manufacturers. Additionally, the profits earned by the mining farm via electricity bill will also reduce.

The transaction fees have dropped drastically from $280 million to $160 million YoY, which is a 67% decrease.

Source: TokenInsight

According to the report, miner’s revenue was largely dependant on Coinbase rewards as the total income from transaction fees only accounted for 3.07% of the total mining revenue in 2019. This was an enormous fall of 40.7%, compared to 5.07% of the revenue generated from transaction fees. Satoshi Nakamoto had once stated that when the reward gets too small, the transaction fee will contribute to the compensation for nodes.

The post appeared first on AMBCrypto