Despite briefly dipping to $10,660, Bitcoin has slightly increased in value since yesterday and trades above $10,800. At the same time, Ethereum has spiked by about 2% to above $360, while more volatility is evident from lower and mid-cap altcoins.

Bitcoin To Above $10,800

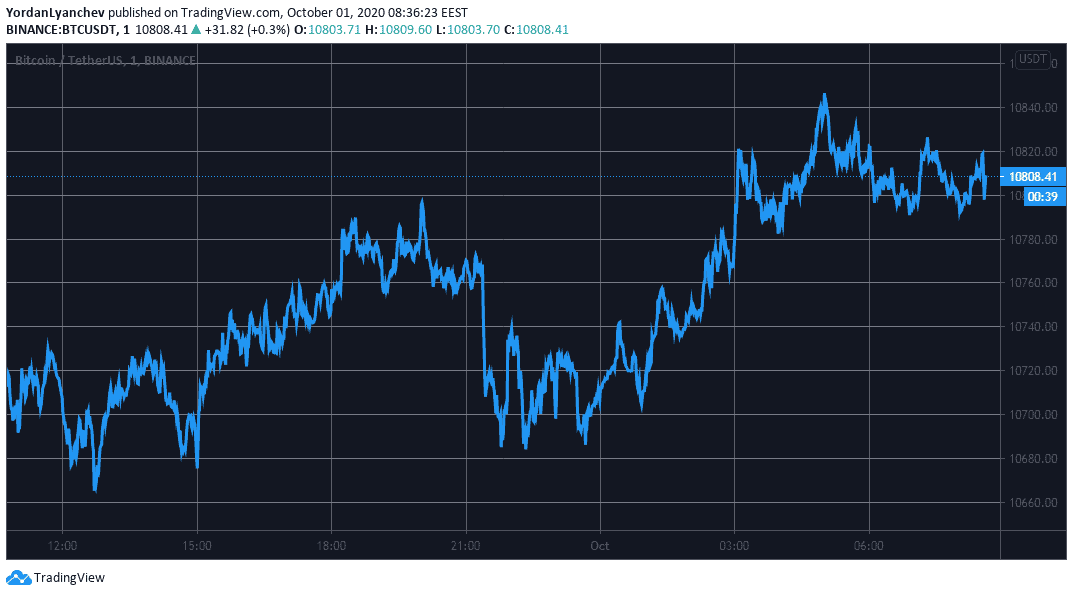

After an unsuccessful attempt to conquer $10,800 yesterday, Bitcoin headed south and bottomed at about $10,660. However, the bulls intercepted the brief price dip and didn’t allow further declines.

Just the opposite, BTC started accelerating again and reached its intraday high of $10,850 (on Binance). Although the asset has decreased slightly, it’s still about 1% up on a 24-hour scale, and it hovers around $10,800.

From a technical standpoint, Bitcoin has to overcome the first resistance at $10,840 before heading towards the psychological level at $11,000. Alternatively, the primary cryptocurrency could rely on $10,680, and $10,570 as support in case of a price breakdown.

Bitcoin’s increase seems to be a correlation with the US stock market. The S&P 500, the Nasdaq Composite, and the Dow Jones Industrial Average all closed yesterday’s trading session with about 1% gains.

However, gold demonstrated untypically high volatility. The precious metal spiked from $1,880 to $1,900, dropped back down and repeated the move once again in a matter of hours. On a 24-hour scale, though, gold has decreased by about 0.5%.

Ethereum Rises Above $360, Cardano Back To Top 10

Ethereum has finally increased above $360 after a near 2% jump. Ripple and Bitcoin Cash marked minor gains and are situated approximately at the same levels as yesterday – $0.241 and $228, respectively.

The most impressive performer from the top ten is Cardano. By increasing with 5% to over $0,10, ADA has actually surpassed Crypto.com Coin for the coveted 10th spot.

Monero is the only top 20 coin that has surged by a double-digit percentage. XMR has jumped by 12% and trades at $110. On a weekly scale, Monero is up by 25%.

Further double-digit price increases come from lower and mid-cap altcoins. DigiByte leads by a 16% surge, Maker (13%), Zcash (11%), Swipe (11%), DFI.Money (11%), Algorand (10.5%), and Zilliqa (10%) follow.

On the other hand, The Midas Touch Gold has lost the most value since yesterday – 15%. THETA (-7%), Hyperion (-6.5%), Energy Web Token (-5.5%), and Uniswap (-4.5%) follow.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato