It is a well-known fact now, that the Bitcoin blockchain is considerably processing fewer transactions than it’s ‘Ethereum’ counterpart. And this decline in transaction processing has significantly reduced the revenue of miners as well. How much? Well, on-chain analysis firm Glassnode points to numbers that are at a 5-month low.

Bitcoin Miner Revenue Touches 5-Month Low

As per the latest update from Glassnode, miner earnings on the largest cryptocurrency network dropped drastically to a 5-month low figure of 30 BTC/day.

#Bitcoin $BTC Miner Revenue (1d MA) just reached a 5-month low of 29.956 BTC

Previous 5-month low of 31.348 BTC was observed on 26 May 2020

View metric:https://t.co/doB3A2e0hh pic.twitter.com/EQVVpZ1p2N

— glassnode alerts (@glassnodealerts) October 19, 2020

This declining trend in bitcoin miner revenue clearly portrays the disinterest amongst traders and investors to conduct transactions on the BTC network. Since they have dropped, miners don’t have much to process. And why is that? Well, for starters, ultra-low volatility levels, even after BTC remaining above $10,000 for quite a long time.

Although there were some exciting price actions at the beginning of the year. And around mid-2020 (when BTC flew above $12k), the BTCUSD realized volatility has touched 33 percent in the last 1-Month, and 27 percent in the last 10 days, according to skew’s analysis below.

It’s a first to see bitcoin >$10k with realized volatility this low pic.twitter.com/r0Vm3NP8JF

— skew (@skewdotcom) October 19, 2020

Folks don’t want to trade with their bitcoin holdings. Instead, they are moving to other avenues to put their BTC to much more ‘constructive’ use.

Wrapped BTC Soaring Like As If There’s No Tomorrow

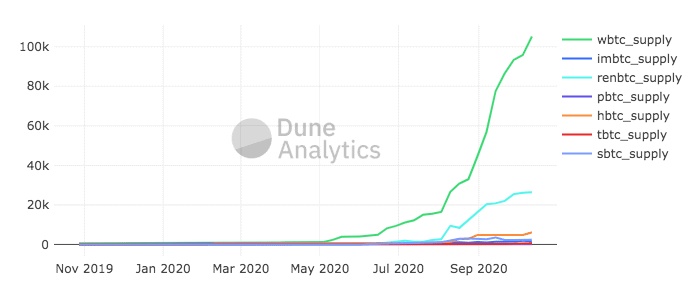

Multiple data sources suggest that bitcoin holders are tokenizing their BTC stash en-masse, in order to leverage the DeFi boom to reap ‘instant profits’. According to Dune Analytics, the total supply of Wrapped Bitcoin (wBTC) on Ethereum surpassed 100,000.

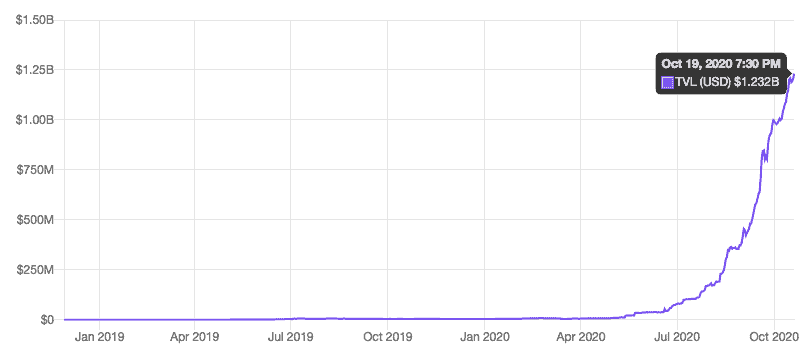

This has led the total USD value locked in wrappedBTC to rally way past $1 billion throughout October, and it’s still steadily increasing with the current numbers approaching the $1.25 billion number.

It is the third most popular avenue only preceded by Uniswap and Maker. IntotheBlock that uses machine learning to arrive at significant blockchain data points, notes that wrappedBTC has experienced explosive growth throughout 2020. This can actually be seen from the chart above.

More ‘100+ BTC Owners’ Have Now Entered The Ecosystem

As mentioned above, people are not trading bitcoins. Either they are tokenizing them on Ethereum or they are buying more. The latest data set from Glassnode shows that the number of BTC addresses holding 100+ coins has been on the rise, and has reached a ‘6-month high’.

#Bitcoin $BTC Number of Addresses Holding 100+ coins just reached a 6-month high of 16,159

Previous 6-month high of 16,158 was observed on 08 June 2020

View metric:https://t.co/ceqO9LHIvs pic.twitter.com/tyo8RtHAVU

— glassnode alerts (@glassnodealerts) October 19, 2020

This explains why bitcoin miner fees have dropped to a ‘5-month low’ and also is a pretty bullish indicator as far as future market outlook is concerned.

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited offer).

The post appeared first on CryptoPotato