Despite speculations that miners may abandon ship following the 2020 Bitcoin halving, the network’s security has been primarily increasing, and the hash rate reached a new ATH days ago.

In response, the network increased the mining difficulty earlier today by almost 10%, reaching a fresh all-time high as well.

Bitcoin’s 10% Difficulty Enhancement

Upon creating the Bitcoin network, Satoshi Nakamoto introduced a self-sustaining feature that allows it to make significant adjustments depending on related events. Referred to as a difficulty adjustment, it enables the network to enhance or reduce the mining difficulty, making it harder or easier for miners to complete their work and get rewarded.

A valuable example came following the mid-March price plunges prompted by the COVID-19 crisis, when some miners had to shut down operations as the low prices made it unprofitable for them. Without any outside interference, the network reduced the difficulty by more than 10% to keep miners incentivized.

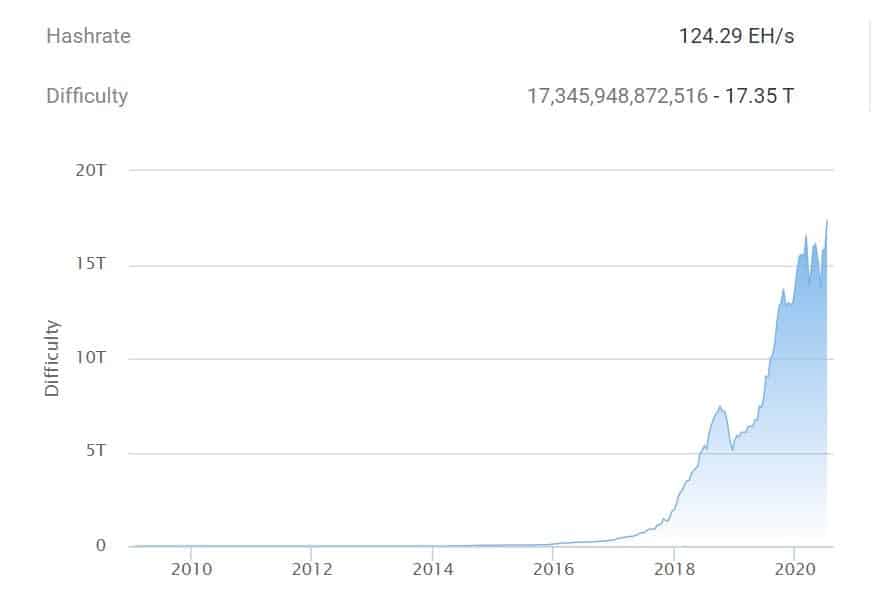

The ultimate goal of difficulty adjustments being to keep the average time between blocks steady as the network’s hash power changes, Bitcoin went through the exact opposite adjustment just hours ago. At block number 639,072, the primary cryptocurrency enhanced the difficulty levels by 9.89% – one of the most significant changes ever.

Adding another massive increase of 14.95% on June 16th, Bitcoin’s difficulty level is now at a new all-time high of 17.35 T, according to btc.com. Moreover, the next difficulty adjustment scheduled to occur in two weeks is set to increase it by 9.76%, which would push it above 19 T.

Bitcoin’s Hash Rate ATH

These adjustments take place every 2016 blocks (approximately every two weeks.) Whether they reduce or enhance the difficulty depends on the current state of Bitcoin’s hash rate.

Typically, when the hash rate is higher, it means that miners are putting more and more computational work to sustain the network, making it more robust.

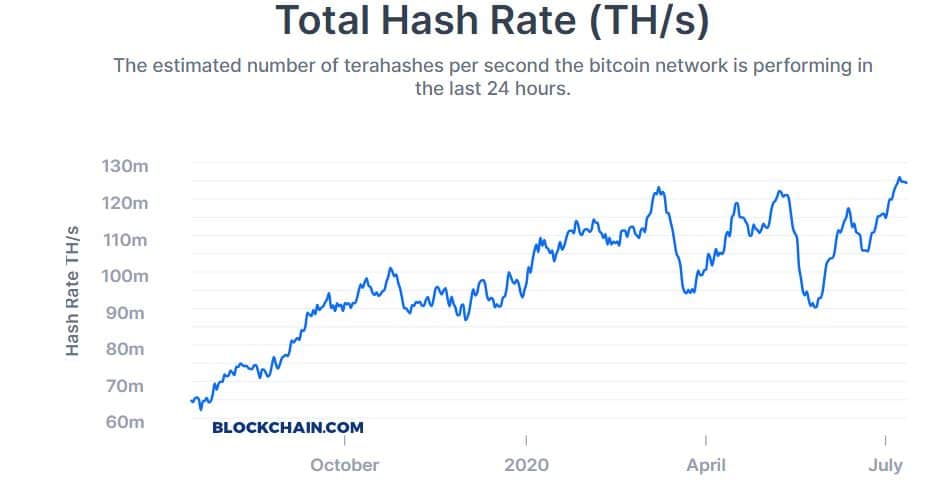

Since miners receive rewards for their work, which gets slashed in half after each halving, speculations began after the 2020 May halving that they could capitulate, leaving the network less secure and more susceptible to security challenges. Interestingly, that’s precisely what occurred days after the event, as the hash rate plunged by over 30%.

However, the situation reversed shortly after, and the metric started regaining positions rapidly. The continuous increase led to a new all-time high registered on July 8th as the 7-day Average indicated 126 million TH/s.

Bitcoin’s Bullish Fundamentals

Bitcoin’s rising hash rate, and consequently, the increasing difficulty adjustments are strong indicators that miners have not abandoned ship after their rewards declined, despite some estimations asserting that BTC’s price has to hover around $15,000 to remain profitable. Just the opposite, the network continues to improve its security and is more robust than ever.

Although the asset price has been somewhat stagnant recently, while lots of altcoins have surged, a recent report noted that Bitcoin had confirmed a buy signal, suggesting a future increase.

The analysis was based on the Bitcoin hash ribbon – a combination of moving averages of BTC’s hash rate, which identify market bottoms and miner capitulation. Ultimately, it could provide excellent buy opportunities. According to digital asset manager Charles Edward, the BTC hash ribbons have just confirmed a buy signal, hinting that the next “great bull run begins.”

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato