Bitcoin started its 2019 journey being valued at around $3k. With time, however, the BTC market reflected strong bullish momentum that carried the coin to its yearly peak at $13k. However, this wave of bulls receded once the bears approached the market. The coin that was once speculated to surpass $20k fell and was valued at $7,311.62, at press time. Despite the rise and fall in price, however, BTC has managed to garner over 80% in returns to its investors, outperforming all indexes, as per a report by Arcane Research.

Source: Coinstats

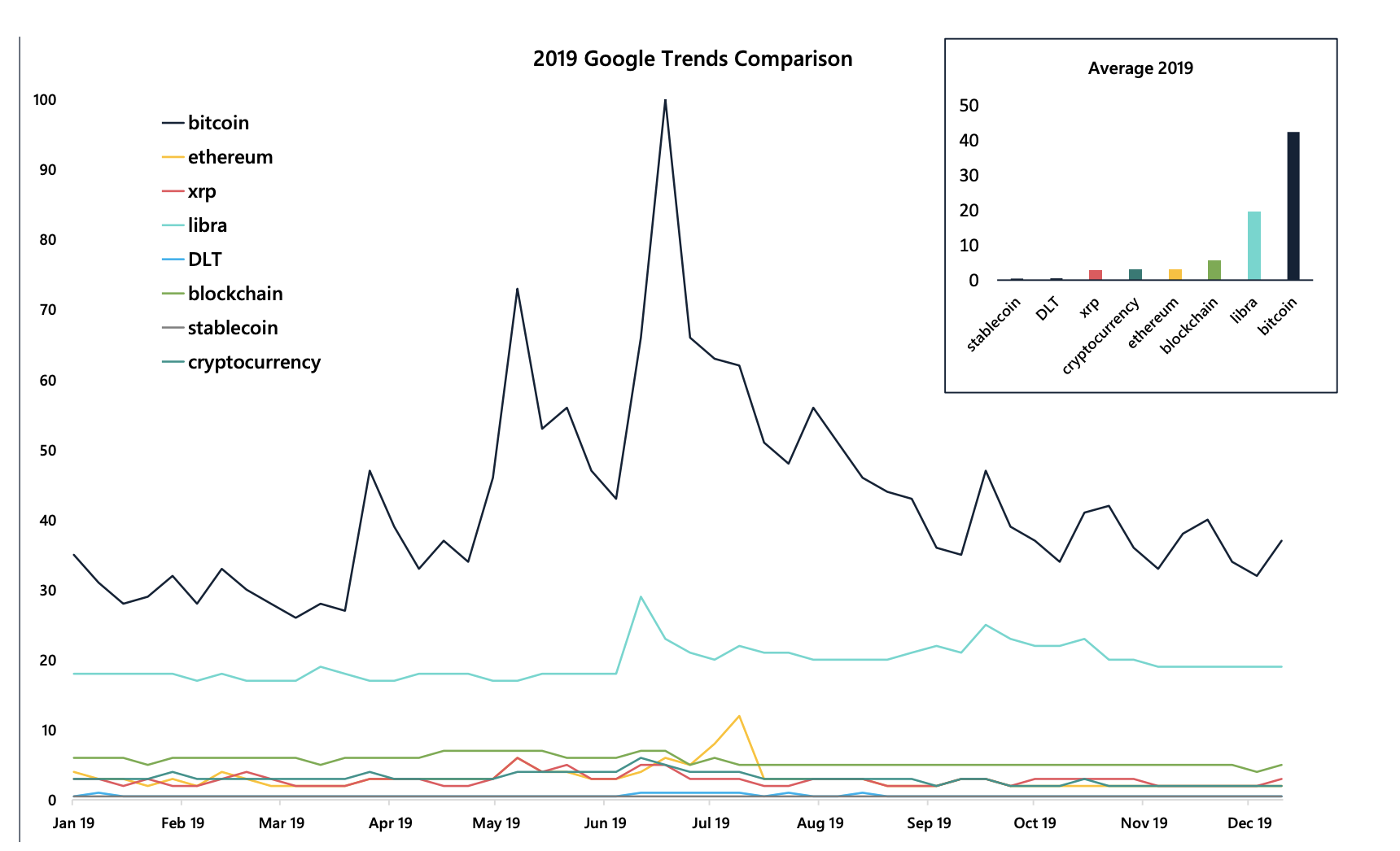

The year also saw blockchain technology being adopted by many nation-states, despite the fact that most of them shied away from cryptocurrencies. However, Google trends indicated that ‘Bitcoin’ had more search volume than blockchain, despite its lack of political acceptance. Further, the report revealed that other cryptocurrencies couldn’t hold a candle to Bitcoin‘s popularity.

Source: Arcane Research

Despite high search volumes, BTC’s volume had reduced over time and appeared weak. According to the report, BTC’s “7-day average real trading volume went down to levels we haven’t seen since May.” While the volume noted a small bounce last week, the volume was below the average levels seen over previous months.

Source: Arcane Research

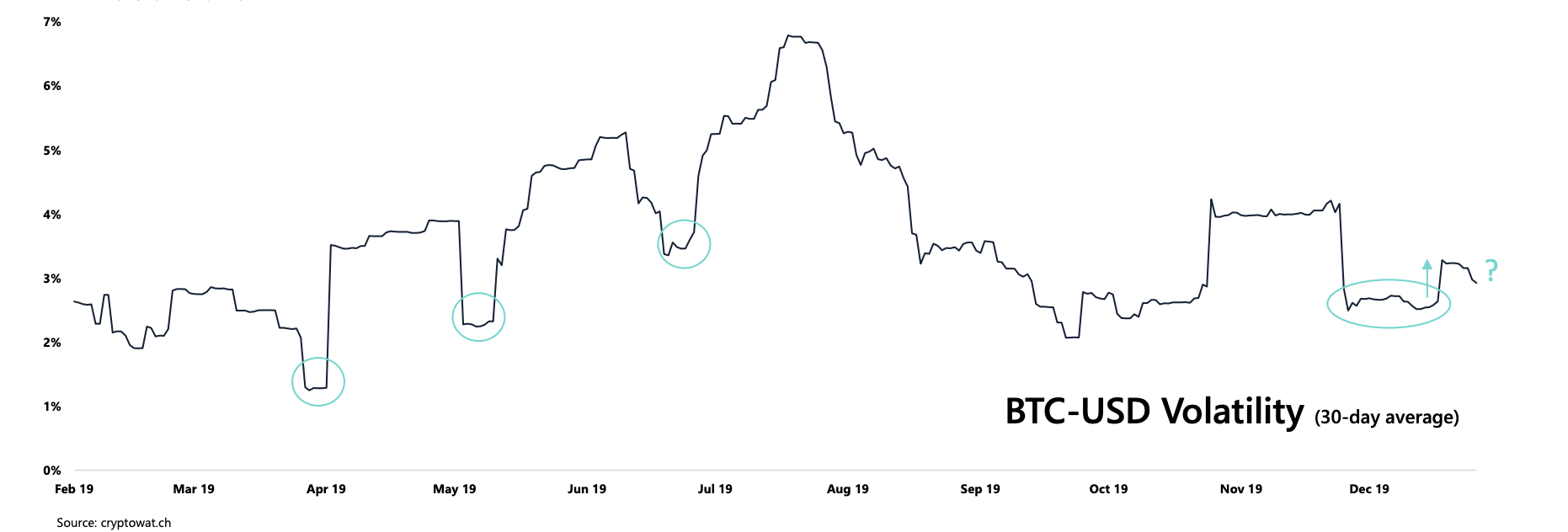

The 30-day Bitcoin volatility noted a spike after the price went down to $6,500 and up to $7,600 over a short period of time. A bounce in the volatility was expected, but it turned out to be a minimal move. However, as per the report, a more significant price movement could be imminent as the price of the coin has been hovering at around $7,000 for over a month.

Source: Arcane Research

Apart from the volatility factor, many Bitcoiners have speculated that the Futures’ market too is pulling the price of the digital asset down. Bobby Ong of CoinGecko agreed with the same, adding that even though it is one of the reasons, it isn’t the only one.

Ong said,

“This is probably one factor but I think there are other reasons in play too. There is usually heavy price volatility each time we lead to CME’s contract expiry on the last Friday of the month at 4pm London time.”

The post appeared first on AMBCrypto