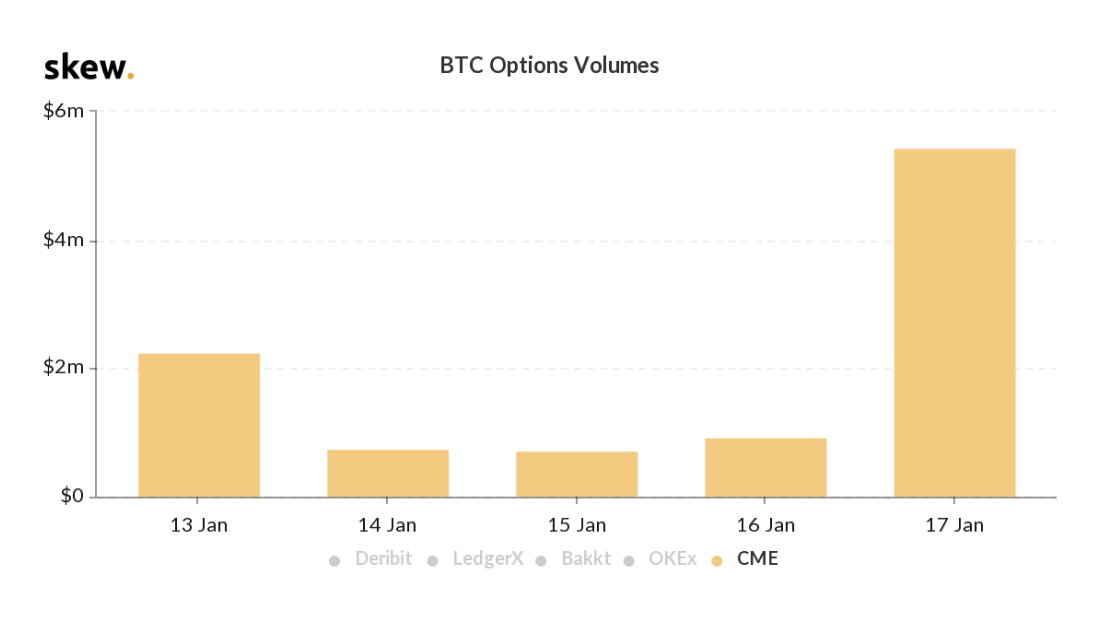

Bitcoin‘s journey this new year has left everyone on the edge of their seats. The coin has jumped by almost 17% but was noting an impending correction, at press time. Despite the crests and troughs in the market, CME‘s first week reported strong data. It has been just one week since the Chicago Mercantile Exchange [CME] launched Bitcoin options trading and the data reflects great promise.

According to Skew markets, a crypto-data analytics platform,

“First week of CME options closed on a strong note with 610 bitcoin options trading on Friday”

Source: Skew

As per CME, 122 Bitcoin Options contracts were transacted on 17 January, the day when Bitcoin’s price showcased upward momentum. Approximately, 610 BTC [$5.3 million] contracts were traded on Friday alone. On the other hand, Bakkt noted a volume of $178,000 on the same day.

The latest research by Arcane also noted the gaining popularity of the platform and observed that many institutional investors were leaning towards CME for the time being. Irrespective of the CME’s popularity, Deribit and OKEx ruled the Bitcoin Options volume, as Deribit acquired a major chunk of the market.

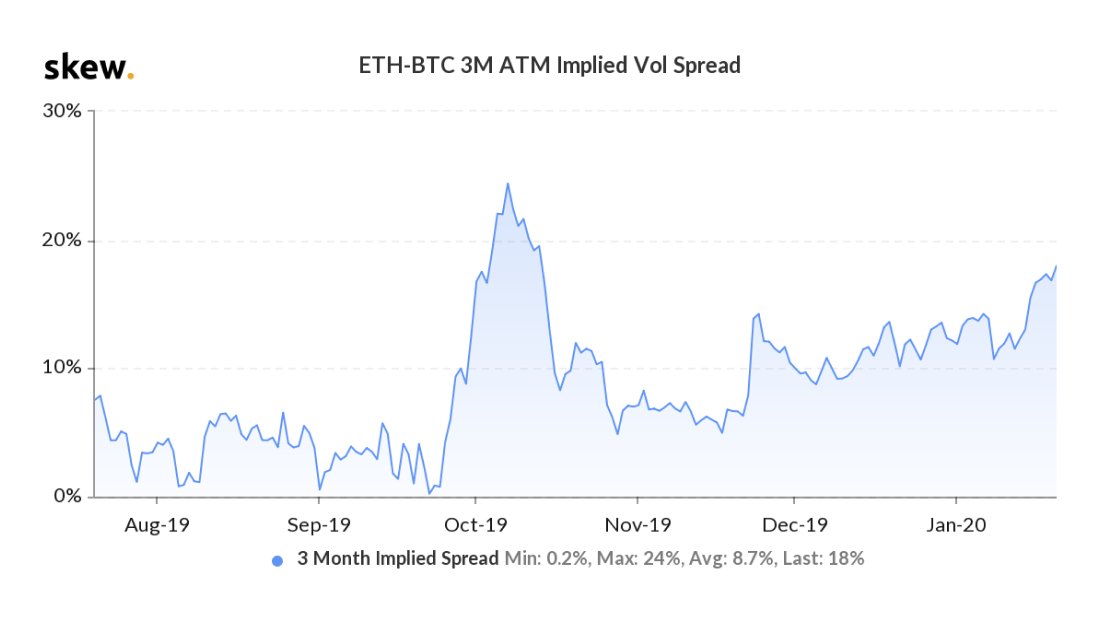

Apart from Bitcoin, Ethereum‘s market also noted interesting trends taking shape. The traders appeared positive over the future of cryptocurrencies. According to Skew markets, the market has been witnessing traders hold on to their Ether options. Skew pointed out an interesting trend at play,

“Traders do not seem too keen to sell ether options at the moment

Implied spreads have been widening relative to bitcoin”

Source: Skew

The market is filled with hodlers at the moment, and as the implied spread widens, the future of the market will be filled with volatility.

The post appeared first on AMBCrypto