It feels like just a few weeks ago we were talking about Bitcoin’s $10,000 breakout, and now the cryptocurrency is positioned to go past $12,000. This wouldn’t be the first time Bitcoin has broken over this level in the past few days, but if it manages to stay above the same for at least a day, it will be the first time in over a year that the cryptocurrency has managed this feat.

On August 2 between 0400 to 0500 UTC Bitcoin rose over $12,000 for the first time since July 2019, but within an hour it crashed below $11,000, owing to a bear trap at the price mark. During this time both retail investors and institutional investors were buying up Bitcoin, pushing up the cryptocurrency’s demand, even when a large portion of the market was selling. Last week over 231,000 Bitcoins which had amassed a profit of 25 percent were sold as the price recovered, but still, the price level stayed over $11,000.

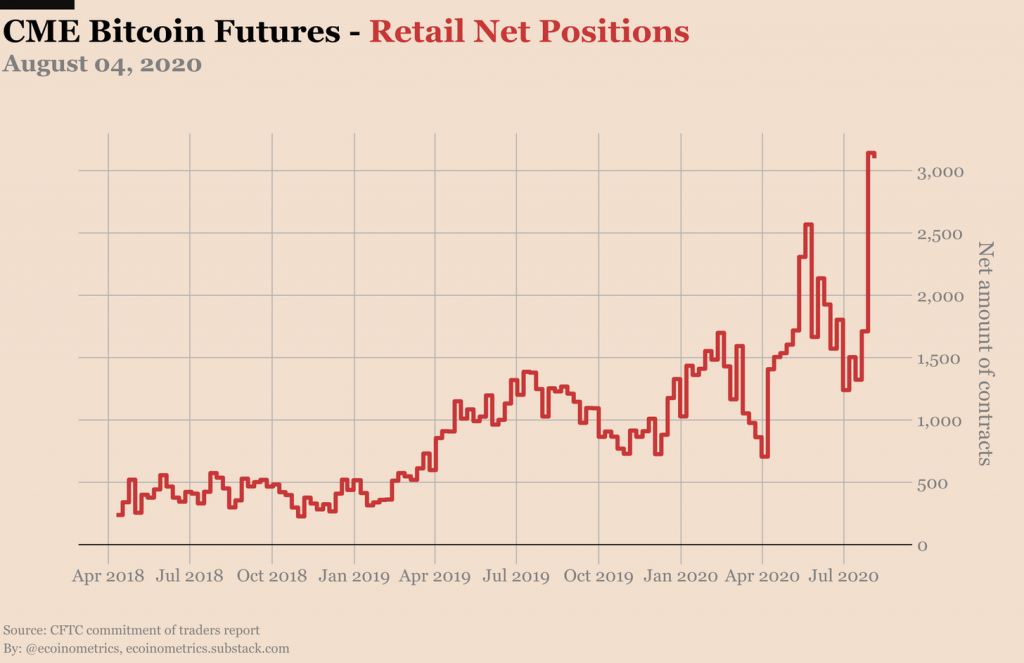

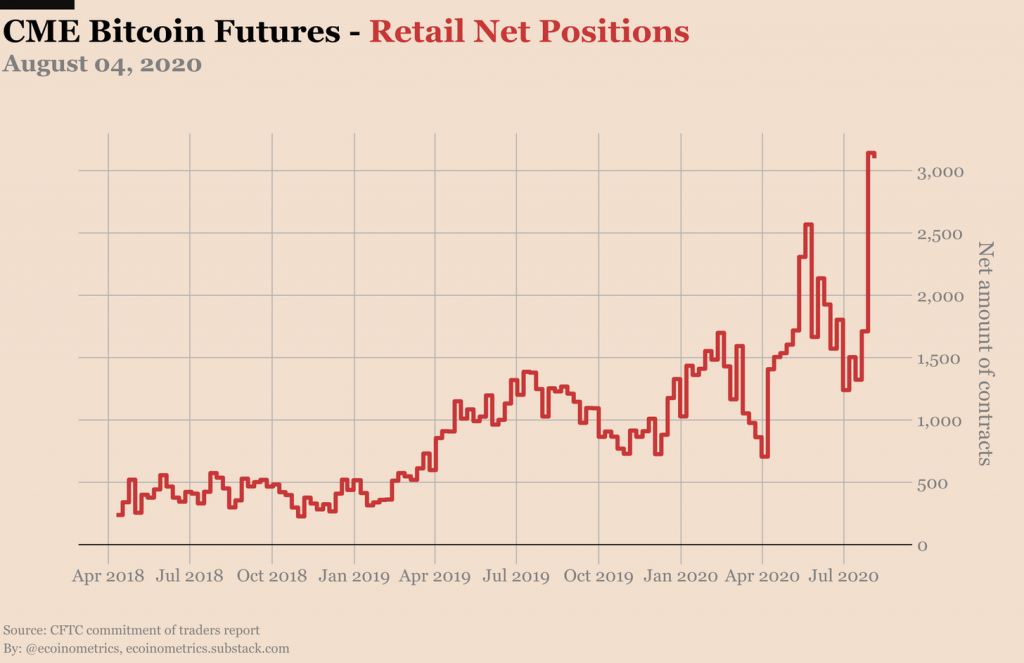

At this point, with $12,000 looking primed to break, these two groups are slowly moving in the same direction for the first time in months. According to a recent report by Ecoinometrics, the retail players, who have been “net long” for a long time are now “trending higher” which is forcing “smart money” institutions to follow along.

CME Bitcoin Futures retail positions | Source: Ecoinometrics

The report stated, last week, that “smart money” investors are using a mix of “cash and carry” to harvest premium and hedge the price of Bitcoin on spot markets versus going long on Bitcoin Futures. While this as a short term strategy works out, retail investors have put longer positions and are eating up the profits, which is why, the report notes, that long positions are “gaining momentum,” and “smart money” are taking notice,

“There is only so much juice you can extract from arbitraging between futures and spot. So I’d expect that over time the smart money will shift towards the net long side. “

Owing to this change of heart, institutions are not buckling under price pressure. This week as the price dropped from over $11,800 to $11,200, open interest i.e. the number of open and outstanding positions on Bitcoin Futures held strong and didn’t open the door for “mass liquidation” like panic. Further, volume and spreads looked unscathed to the price turning down.

This move isn’t just limited to derivatives exchanges on the west of the Atlantic either, big retail driven exchanges like Binance have seen similar movement. Speaking to AMBCrypto, Changpeng Zhao, the CEO of Binance, told AMBCrypto that in the previous quarter, open interest on the exchange increased from USDT 220 million to USDT 580 million, a 180 million jump marking the exchange’s fourth consecutive month of OI growth. He noted,

“The crypto market can see highly-volatile periods as well as relatively stable periods, and we won’t really be able to make predictions as it’s driven by demand and supply.”

Given such bullish-leanings, Binance is aiming to cater to both sides of the market. CZ referred to retail and institutional traders as “indispensable clients,” in the hope of building a “sustainable market ecosystem.”

The post appeared first on AMBCrypto