Let’s be honest, you were more surprised than anything seeing Bitcoin trade at over $16,000. You probably thought to yourself, “How long will this last?”

With the cryptocurrency trading at its highest point since January 2018, and up by over 120 percent since the beginning of the year, the sentiment is firmly bullish, but that could change any minute. As we’ve seen in March, the price could drop by double-digit percentages overnight, and the way the market is going currently, such a drop would be down to the macroeconomic market, not just the cryptocurrency market in isolation.

According to a recent report by blockchain analytics firm Chainalysis, Bitcoin’s rise and fall over the previous week were indicative of the impact of macro factors. On Monday, on the back of promising news of the COVID-19 vaccine by Pfizer, the crypto’s price dropped from $15,800 to $15,000, a development that suggests that Bitcoin is a bet against uncertainty, and the more the uncertainty in the markets, the more Bitcoin you should hold.

However, since the vaccine news cooled off and pessimism crept in, so did uncertainty, and Bitcoin broke $16,000. The report went on to suggest that until concrete news on either a vaccine or a stimulus package to combat the economic ramifications is announced, Bitcoin and other ‘safe-haven assets’ would see a retreat.

“That prices have gone higher since suggests that financial markets need to see more progress on Covid before there is a retreat from safe haven assets.”

Moving on from the macros, the on-chain indicators of the two largest cryptocurrencies, Bitcoin and Ethereum, have been ‘supportive.’ Inflows into exchanges over the past week have been increasing, indicating that people are profit-taking at high prices. To balance this supply of BTC and ETH in the markets, trade intensity has also risen.

Chainalysis measures ‘trade intensity’ as orderbook trades to cryptos flowing into exchanges. This metric is also increasing, suggesting that there is enough buying power or demand for cryptocurrencies, even as investors sell at prices over $16,000.

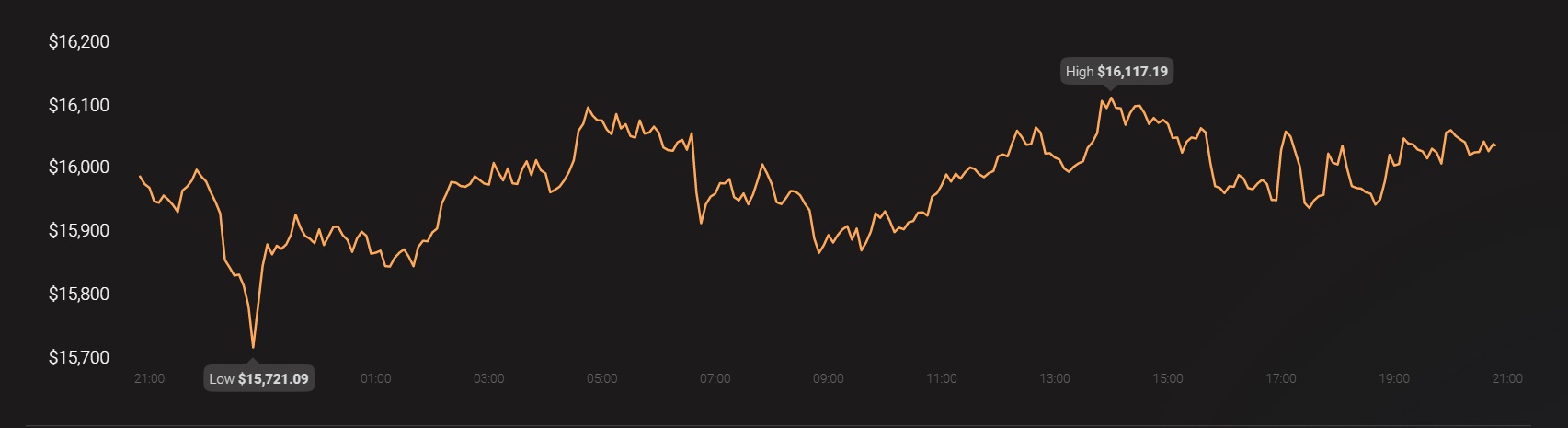

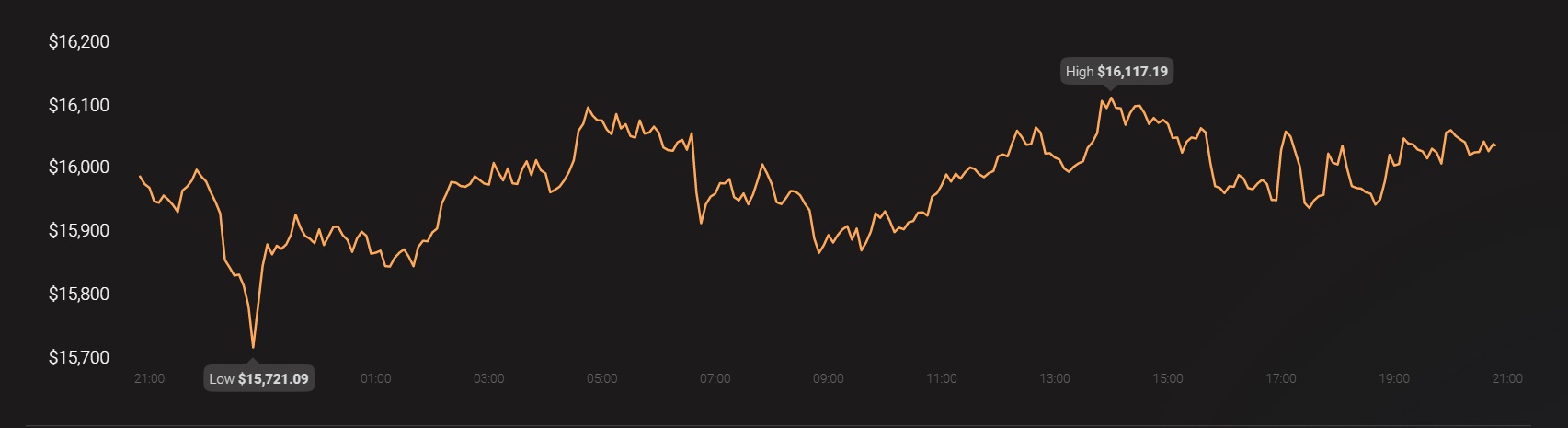

Source: Coinstats

While the balance is maintained as things stand, it could be a positive provided the uncertainty mentioned above holds. Bitcoin, in the current market, is looking like digital gold, and in fact, performing better than gold itself. Investors are venturing into the crypto-markets because they are unsure of what is going to happen to traditional stocks if the economic slump continues and if governments keep reducing interest rates, bond yield will also decrease. Beyond the traditional equity and debt options, gold has risen too quickly to venture into again, hence, the remaining asset is crypto, and more specifically, Bitcoin.

Since the primary use-case for Bitcoin investment is the link to market uncertainty, what investors should look out for is volatility, in every direction, not just upwards. The report concluded by stating,

“Price could keep climbing. The narrative, use cases, and market infrastructure have never been better for cryptocurrency… These conditions are a reduction in macroeconomic uncertainty, investors making sufficient gains given their portfolio, or if bitcoin stops looking like digital gold…Given this, investors should be thinking about volatility rather than just price appreciation.”

The post appeared first on AMBCrypto