Interest in cryptocurrencies, especially bitcoin, in Latin America is on the rise as popular bitcoin Peer-to-Peer trading platform LocalBitcoins has been recording tremendous surges in its weekly BTC trading volume in Venezuela and Argentina.

P2P Bitcoin Volume Spikes

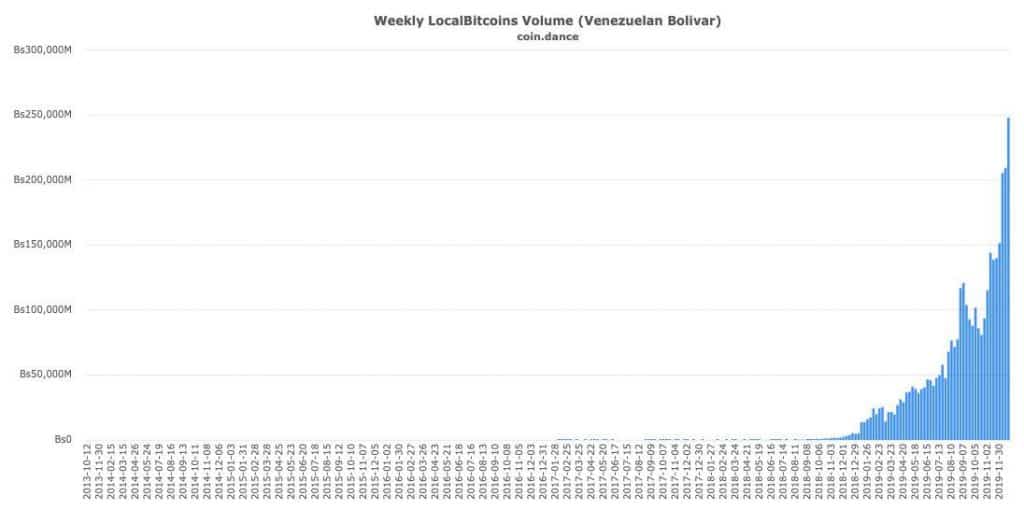

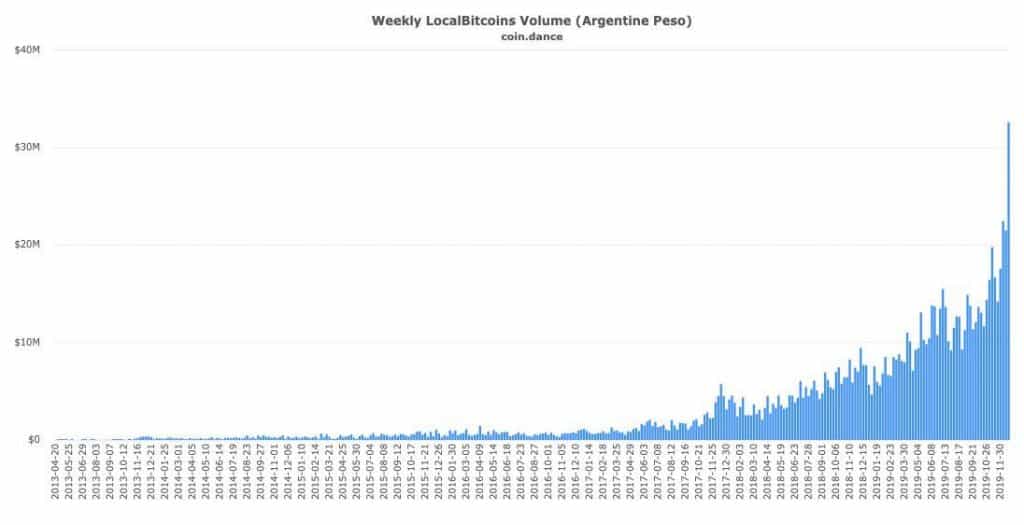

Data from CoinDance, a crypto statistics platform, reveals that there was a spike in trading activities on LocalBitcoins last week, leading to a new all-time high in the weekly trading volume of Bitcoin in the local currencies of Venezuela and Argentina.

As much as 248 billion bolivars (app. $24.8 million) was traded on LocalBitcoins in Venezuela between December 15 and December 21, which is 18.46% more than what was traded in the previous week and about 20.67% higher than the first week of December.

LocalBitcoins Traded Volume Venezuela. Source: coin.dance

Although the trading volume (BTC/ARS) in Argentina was not as high as that of Venezuela (BTC/VEF), the increase was gigantic compared to what was traded during the weeks before. From Dec 15 and Dec 21, more than 32.6 million Argentine pesos (appx. $544,905) were traded on LocalBitcoins, which is 51.6% spike from the week before.

LocalBitcoins Traded Volume Argentina. Source: coin.dance

What Caused The Spike?

From the charts above, the P2P trading volumes of Venezuela and Argentina have been rising steadily since mid-year. The reason for this could be traced to the harsh economic situation in the region.

Many Latin American countries, including Venezuela and Argentina, are experiencing severe economic problems such as the crash of their national currencies and food crisis, a situation that is not expected to change soon, according to experts.

Aside from that, Argentina is also facing social and political problems as a result of the stern methods that will be used to revive the economy. Back in November, the Central Bank of Argentina (BCA) issued a series of guidelines reducing monthly spending limit to $200 as well as prohibiting the use of credit, debit, and prepaid cards for the purchase of bitcoin.

You might also like:

The post appeared first on CryptoPotato