Over the past month, since the May-19 price collapse, BTC had been trading inside a range between $30K from below and $42K from above.

Last Tuesday, Bitcoin broke below the range, and for the first time since January 2021, traded beneath $30K. This lasted only for two hours before bulls stepped in for a heavy bounce, which spiked the price over $5k in a matter of a few hours. So, in conclusion, Bitcoin went up a total of 18% since hitting the 5-month low of $28,600 on Tuesday.

While negative fundamental news is coming from China, the fact that Bitcoin bounced sharply after hitting $30K teaches us that there is still a strong bullish demand, and the bull run of 2021 might not be over yet.

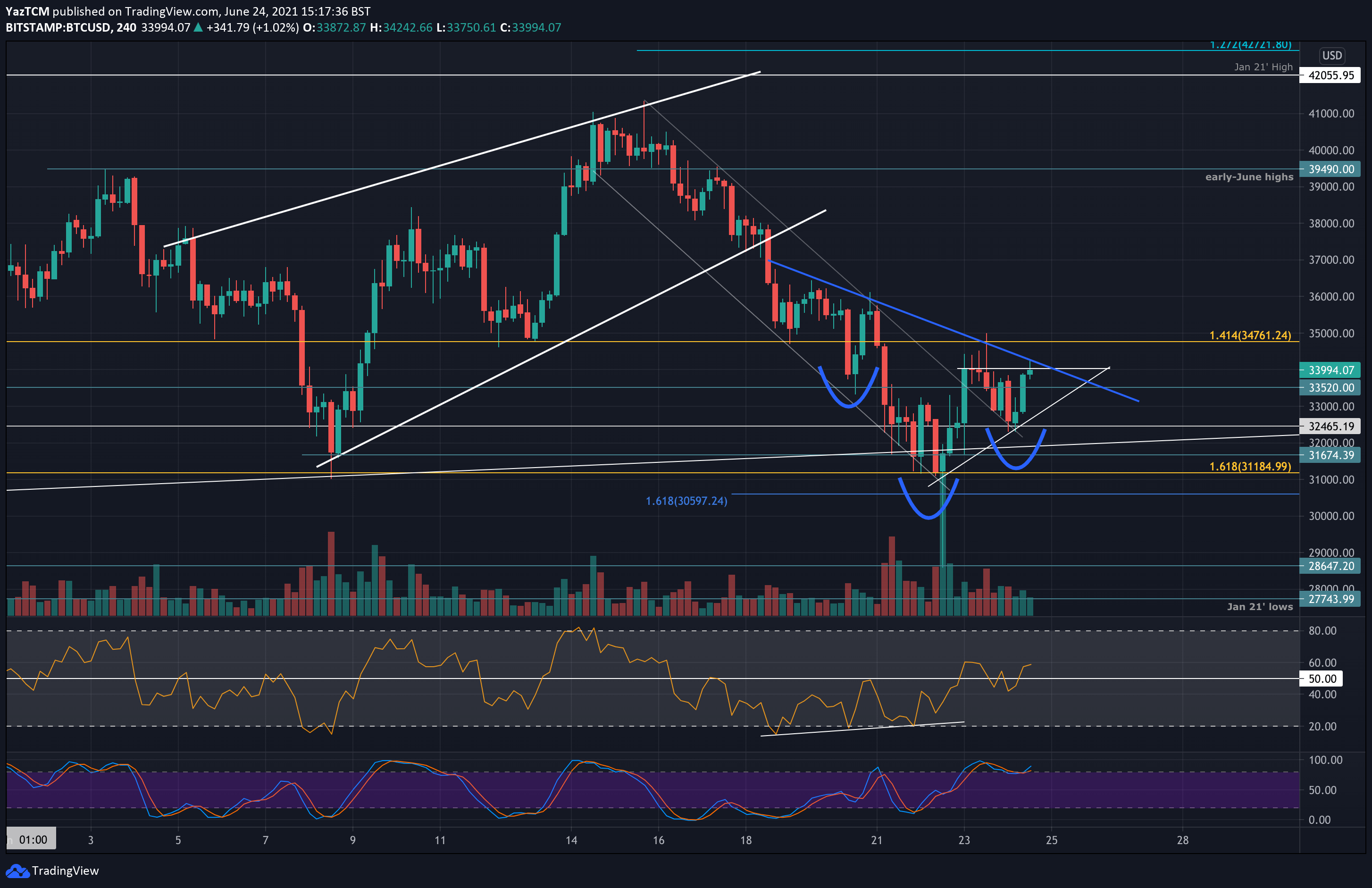

Despite that BTC had struggled to close a 4-hour candle above $34K since breaking the marked descending price channel (as shown below), Bitcoin is forming a short-term ascending triangle pattern. A breakout of this pattern should see BTC reaching as high as $37,000.

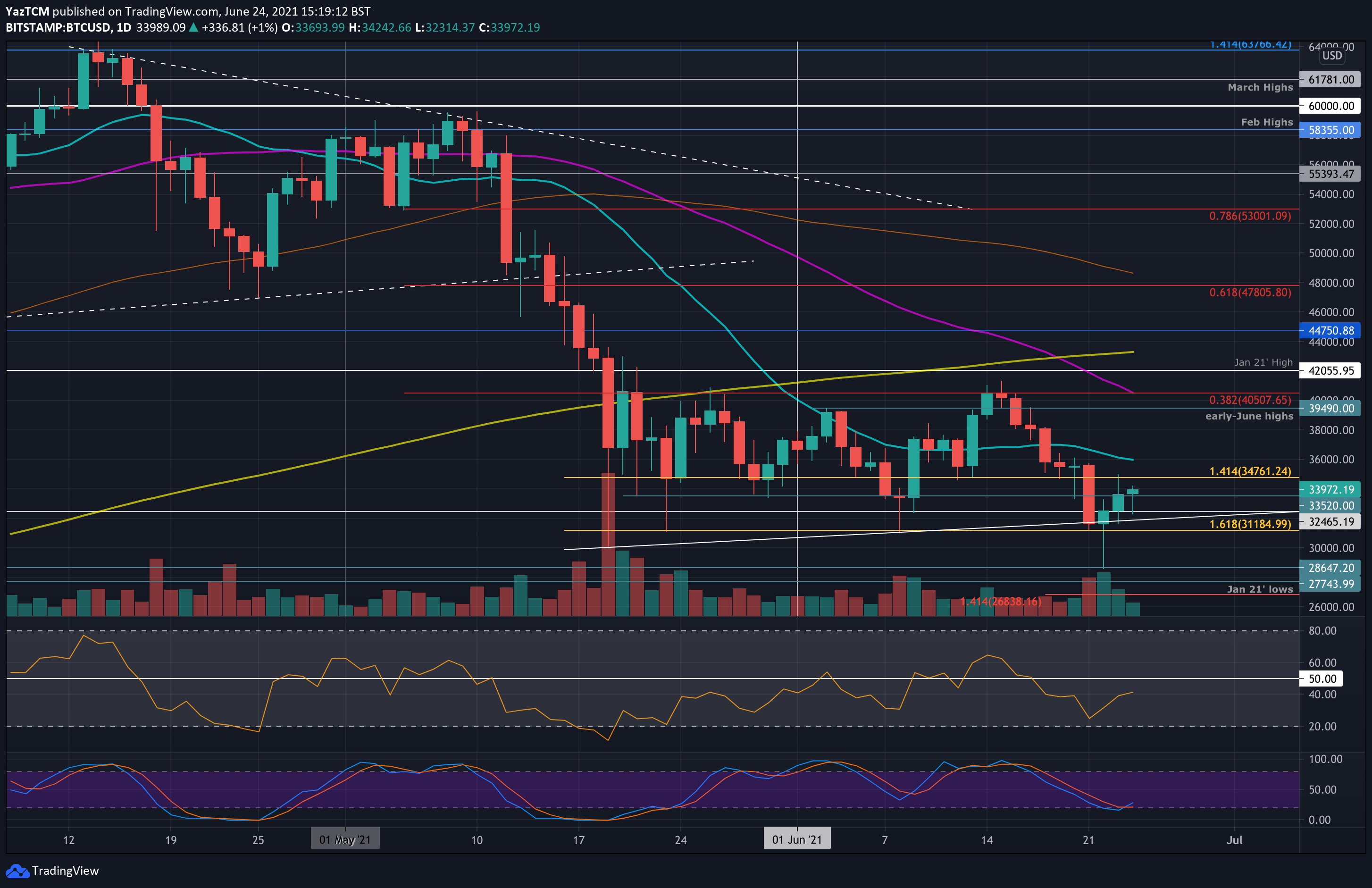

Overall, the daily chart is still indecisive inside the choppy zone, while BTC did not close a daily candle beneath $30K. After successfully confirming $32K as support, the latter becomes the first critical support zone to watch.

BTC Price Support and Resistance Levels to Watch

Key Support Levels: $33,520, $33,000, $32K, $31,185, $30K.

Key Resistance Levels: $34,700, $36,000, $37,000, $39,500, $40,500.

Looking ahead, the first resistance lies at current levels of $34,000. This is followed by $34,700, $36,000 (20-day MA), $37,000 (ascending triangle target), and $39,500. Added resistance lies at $40,500 (bearish .382 Fib & 50-day MA).

On the other side, the first strong support lies at $33,520. This is followed by $33,000 (triangle’s lower boundary), $32K, and $31,185 (Tuesday 4-Hour support). Further support lies at $30K.

RSI, short term: The 4-hour chart’s bullish divergence played out nicely and resulted in BTC breaking the descending price channel, as of yesterday. RSI is now trading above the midline in bullish territory, indicating the bulls are in charge of the short-term momentum.

The daily RSI is rising, indicating fading bearish momentum, but it is still yet to enter the bullish territory.

Bitstamp BTC/USD Daily Chart

Bitstamp BTC/USD 4-Hour Chart

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited offer).

PrimeXBT Special Offer: Use this link to register & enter POTATO50 code to get 50% free bonus on any deposit up to 1 BTC.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato