For the past ten days, the Bitcoin price was trading mostly inside a $200 range between $9000 and $9200.

This behavior is very uncommon to a volatile asset such as Bitcoin. Some technical signs point on an end to this saga very soon, probably as the new week starts.

Bitcoin Recent Price Action

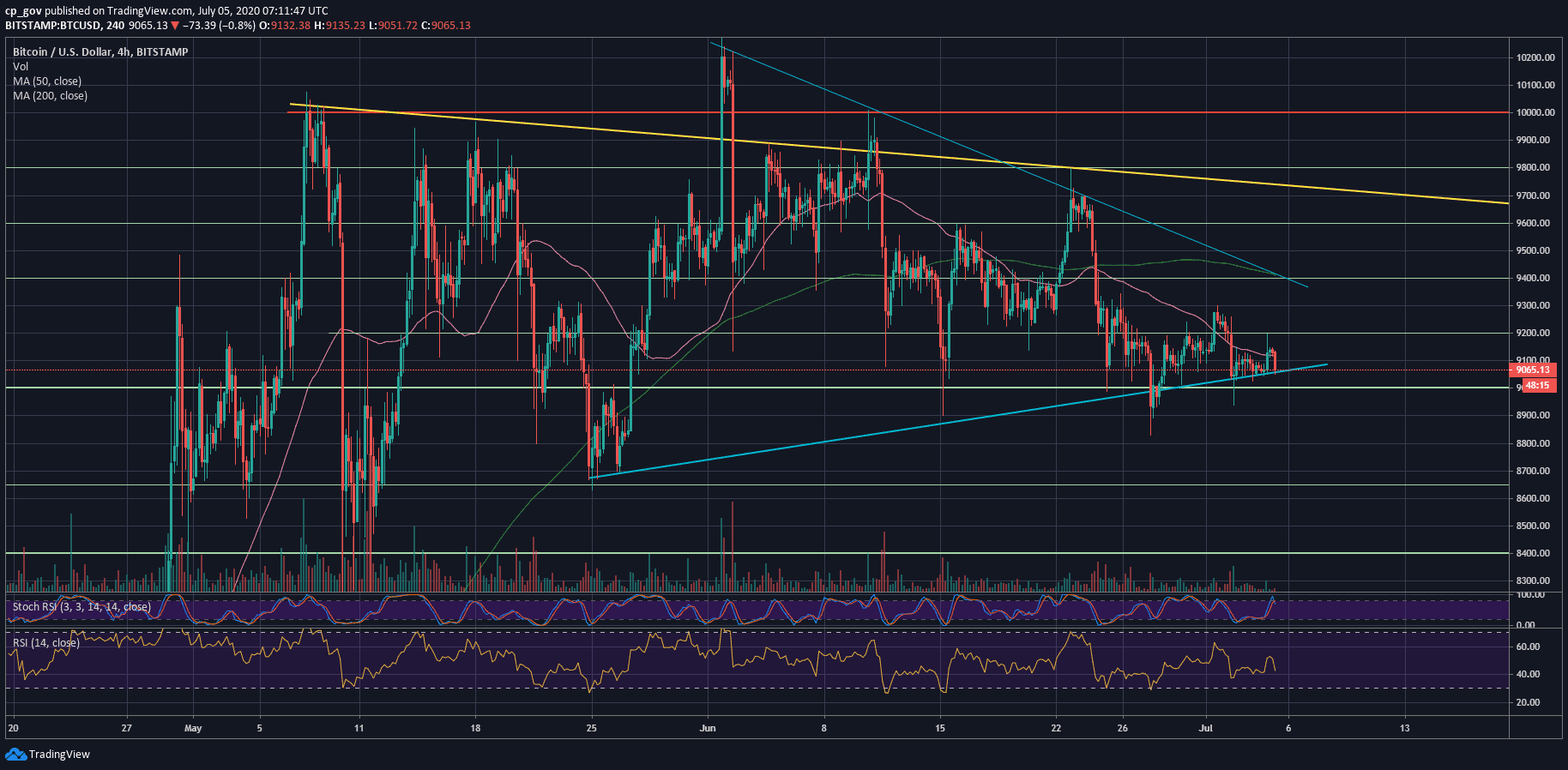

As can be seen on the following 4-hour chart, Bitcoin is trading inside a symmetrical triangle pattern.

While yesterday BTC was about to break it down from its lowest angle, Bitcoin found support and produced a quick $150 price movement. Guess where? Accurately the top of the mentioned range at $9200.

As can be seen below, this candle ended with a massive wick to the upside, no breakout, and as of writing theses lines, Bitcoin price is testing the same lower angle (blue) of the triangle once again.

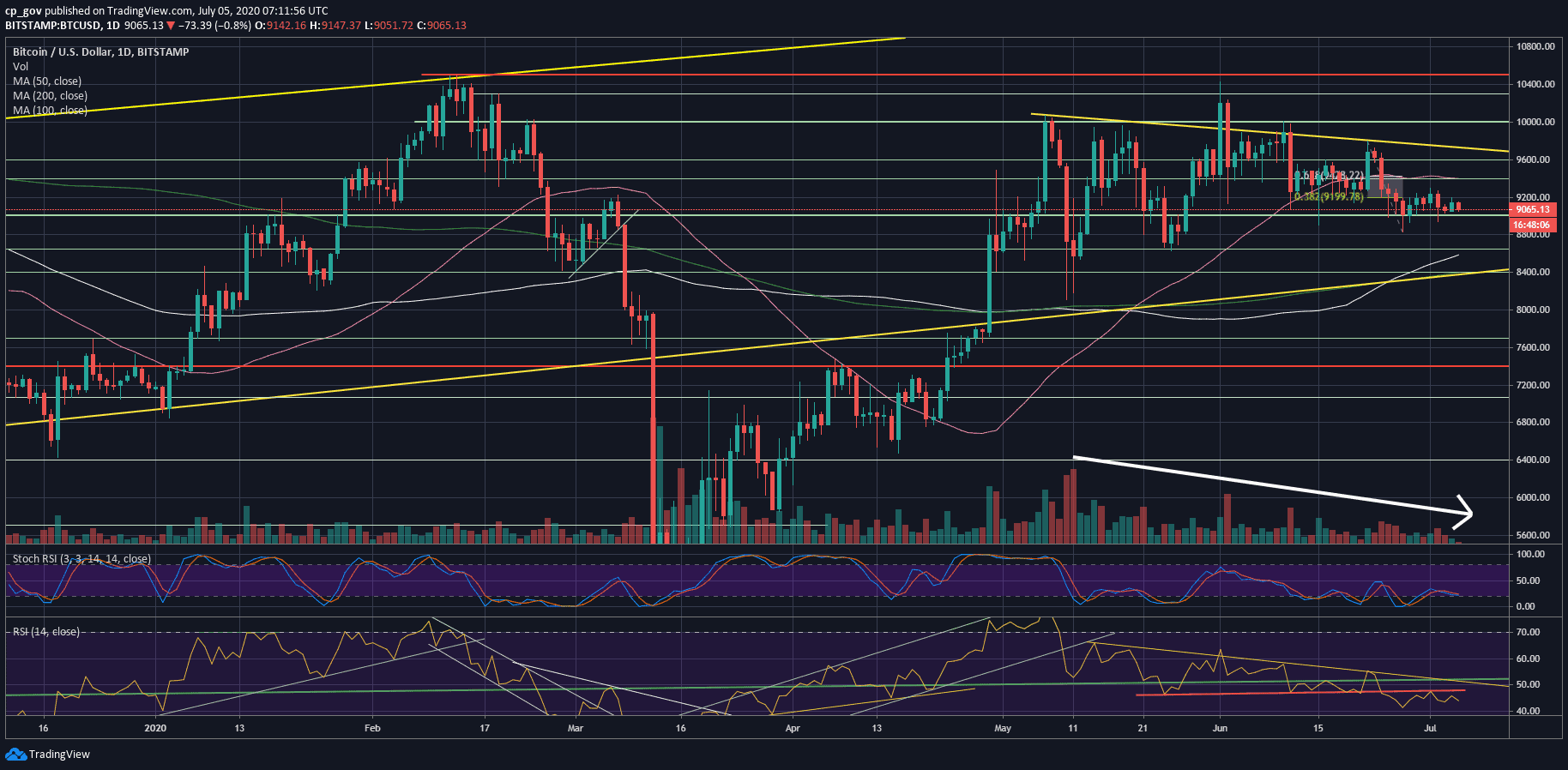

The trading volume: looking at the following daily chart, since May 11, 2020, which was the halving event of 2020, we are witnessing a declining pattern of volume candles. This is marked on the chart by a white arrow.

In fact, the last two weeks’ volume had seen the least amount of volume since March 2020. This is another sign of a coming up move that will raise some volume.

The daily RSI tends to the bearish side. As can be seen below, the red line (around 45-46) served as strong support. After breaking it down, Bitcoin confirmed it as resistance, and since then, the RSI is hovering at the bearish territory. A bullish trend can develop only in the case of an RSI above 50-52.

Price Levels To Watch In The Short-term

As mentioned above, Bitcoin is trading inside the tight range of $9000 – $9200. Any breakout will likely point out the next short-term direction for the price of Bitcoin.

From below, the first level of support lies around $9050, which is the lower angle of the blue triangle. This is followed by $9000.

Further below lies $8830 (last week’s low), $8600 (along with the 100-days moving average line – marked white) and $8400 (long-term ascending trend-line along with the significant 200-days MA).

From above, the first level of resistance is the $9200 level. This is followed by $9400, which includes the 50-days MA (pink) and the upper angle of the 4-hour blue triangle. Further above lies $9600.

Total Market Cap: $260 billion

Bitcoin Market Cap: $167.2 billion

BTC Dominance Index: 64.3%

*Data by CoinGecko

BTC/USD BitStamp 4-Hour Chart

BTC/USD BitStamp 1-Day Chart

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato