Following our recent price analysis, we saw Bitcoin starting to go lower for a deeper correction. At least lower than the usual 38.2% Fib level correction we had seen three times before since the magnificent 2020 begun.

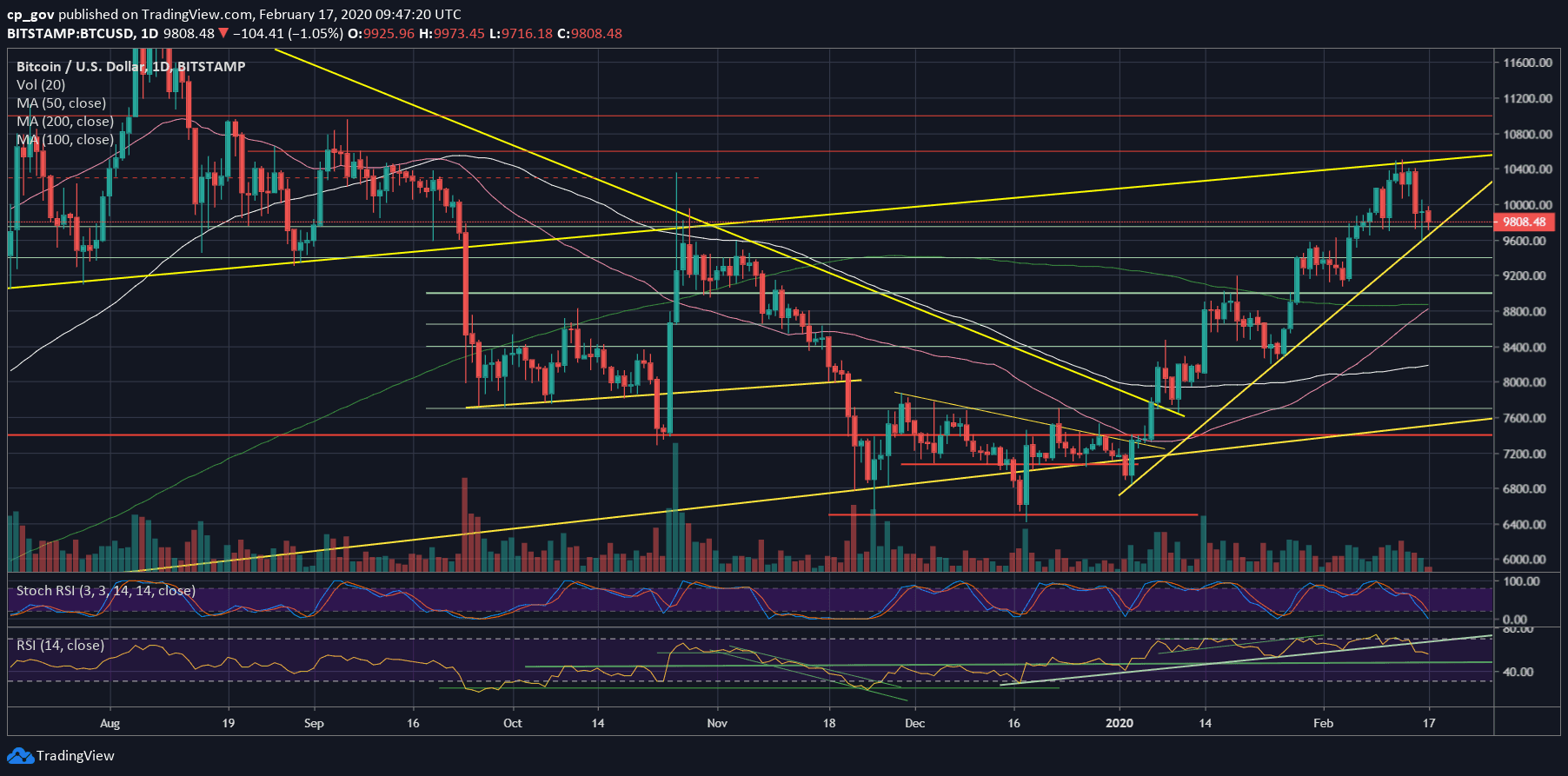

After Bitcoin was testing the long-term ascending trend-line at $10,500 – a trend-line which had started forming in July 2019 – we saw Bitcoin getting rejected severely, breaking down the 38.2% Fib level at $10,200.

On our recent price analysis, we expected Bitcoin to go even lower, and this is precisely what happened. Yesterday’s low was $9,598 (Bitstamp).

Is this the end of the correction? Would Bitcoin make a come back above $10,000 very soon? Could be.

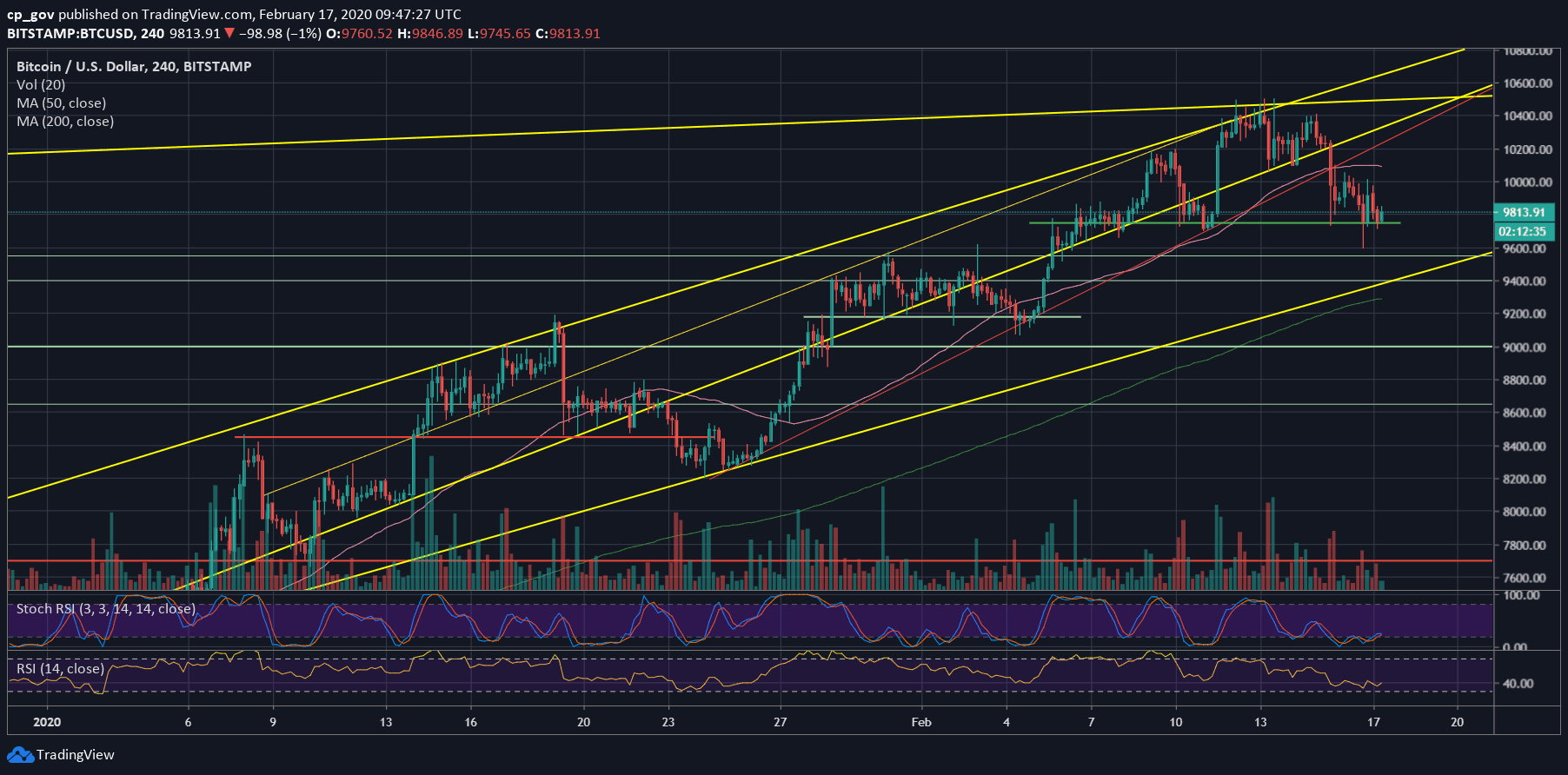

One bullish supporting sign might be coming from the speed of the buyers that rapidly bought Bitcoin around yesterday’s $9600 low. Besides, the $9600 is also a mid-term ascending trend-line, as can be seen on the following daily chart.

Altcoins Crashing

At first, the recent Bitcoin price correction didn’t cause a further sell-off of altcoins. However, today the story is different. After the dominance of Bitcoin reached a low of 61%, the latter had surged to over 63%. The altcoins are plunging today in their Bitcoin value, many of the top ones seeing double-digit losses.

Total Market Cap: $282 billion

Bitcoin Market Cap: $178.8 billion

BTC Dominance Index: 63.3%

*Data by CoinGecko

Key Levels To Watch & Next Possible Targets

– Support/Resistance levels: After Bitcoin found supported by the ascending trend-line, along with horizontal support at $9600, Bitcoin is now back above the critical level of $9770.

The next significant resistance lies at $9900, before the $10,000 resistance mark. In case of a break-up, then the next possible target is the $10,200 support turned resistance level. The next major level is $10,400 before the 2020 high at $10,500, along with the above mentioned long-term ascending trend-line on the daily chart.

From below, the first significant area of support now lies around the $9750 mark. This includes a robust horizontal support area which was kept since February 5. Besides, the Golden Fib level of the 2017 bull-run lies at $9770.

In case Bitcoin does break down the latter, the next support is yesterday low at $9600, before the significant $9400 support, along with a mid-term ascending trend-line shown on the 4-hour chart. Further below lies $9170 and $9000.

– The RSI Indicator: Following the breakdown of the higher lows’ trajectory in the RSI, we see the significant momentum indicator facing the 60-support area.

The stochastic RSI oscillator is very close to the overbought territory, so there is a little more room to go down; however, it might also signal on a possible end to the negative correction.

– Trading volume: In the last two days, the volume was low. This might prove that the market is indecisive and waiting for the next big move.

BTC/USD BitStamp 4-Hour Chart

BTC/USD BitStamp 1-Day Chart

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato