Bitcoin price is recovering with yesterday’s surging breakout to $11.8K. The arrival of the new bullish momentum coincided with the US trading markets opening for the week and caused $6 billion to flood back into the crypto space within a few hours.

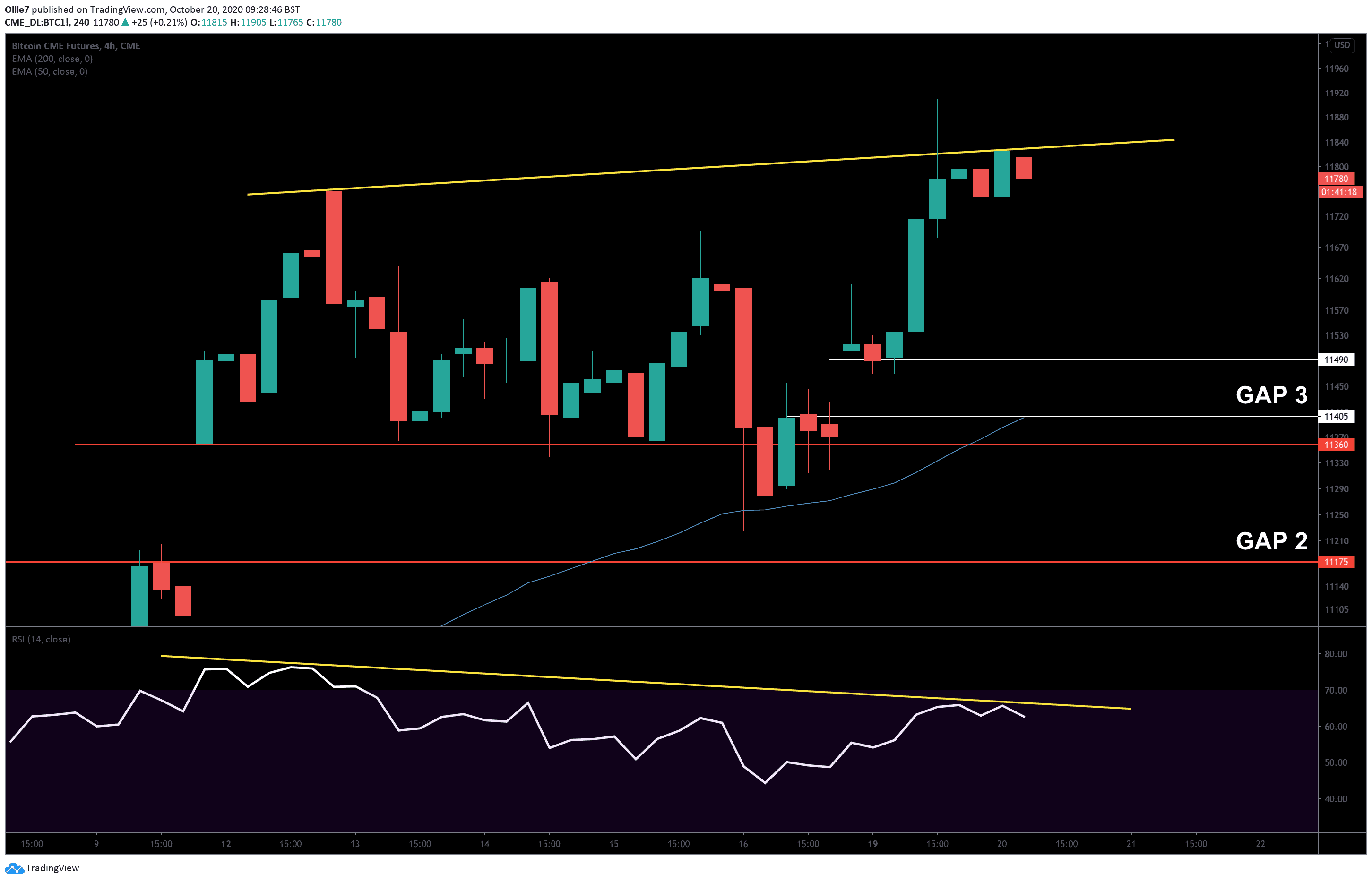

This sharp rise in trading volume has created a third gap on the CME bitcoin futures chart (GAP 3) between $11,490 and $11,405, which will undoubtedly be adding pressure on top of the current uptrend. Not far beneath it is the second unfilled gap (GAP 2) between $11,360 and $11,175, which could also be filled if bears take control over the bitcoin market.

BTC Price Levels to Watch in the Short-term

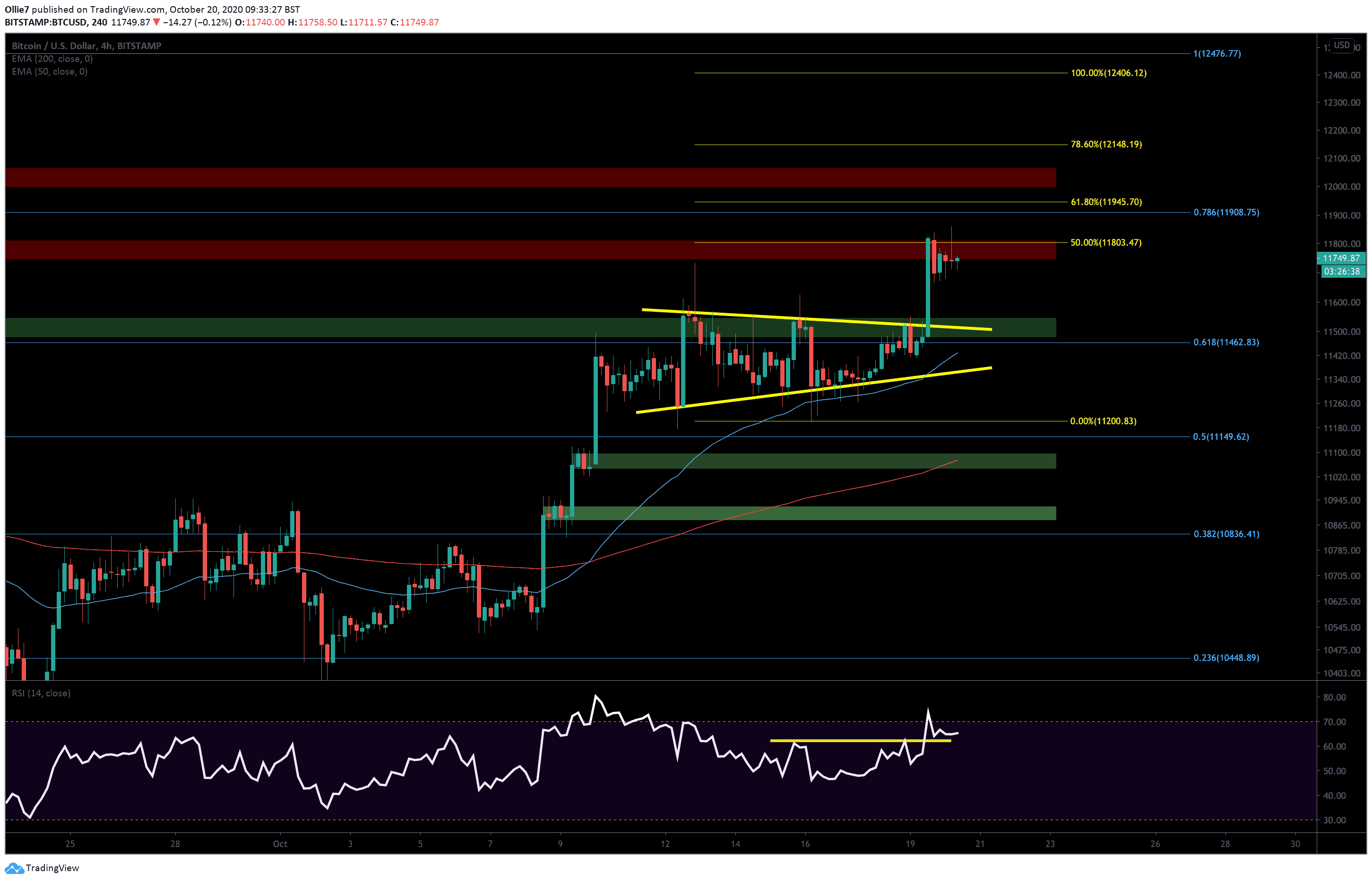

On the 4-hour BTC/USD chart, we can see that the key resistance to break above right now is the $11,800 level. This price point has already pushed back bulls on two separate occasions in the last 48 hours and has been a strong daily resistance level in the past.

On the 1-hour timeframe, the price action does appear to be in the early stages of forming a bullish pennant. However, we still need to see further consolidation before we can confirm this.

If it does turn out to be a bullish pennant and bitcoin breaks to the upside again, then the 0.786 Fibonacci level at $11,908, the 0.618 Fibonacci extension level (yellow) at $11,945, and the primary resistance zone (red shaded area) around $12K will be the first set of likely targets during the new leg of the uptrend.

Next Possible Targets For BTC

Further above lies the major resistance area of $12,000 – $12,100. Despite a false breakout, the latter was the upper roof for Bitcoin throughout the month of August.

Next is the $12,500 resistance, which is the current 2020 high recorded on August 17, 2020. Further beyond lies $12,800, before $13,500 and the high from June 2019 at $13,880.

From the other hand, if bulls fail to break above $11,800, however, then the 1-hour 50 EMA at $11,600 and the first main support zone (green shaded area) between $11,540 and $11,480 should provide bulls with a solid footing to throw back from.

From there, we also have the 0.618 Fibonacci level at $11,460 and the 4-hour 50 EMA (blue) at $11,430, which could provide additional support if bitcoin breaks back into its former consolidation pattern.

The RSI divergence on the bitcoin spot market has now resolved, however, there still remains a significant divergence between the RSI and the CME Bitcoin futures price action (yellow line), which suggests derivative buying momentum is waning.

Total market capital: $369 billion

Bitcoin market capital: $217 billion

Bitcoin dominance: 59.0%

*Data by Coingecko.

Bitstamp BTC/USD 4-Hour Chart

CME Bitcoin Futures 4-Hour Chart

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato