Bitcoin’s stock-to-flow (S2F) model has become one of the most popular formulas based on monthly S2F and price data. It activated various analysts across the world as many have verified the actual relationship between Bitcoin’s price and its stock-to-flow ratio.

Now, the analyst who originally came up with it has presented a new model that puts Bitcoin’s price at $288,000 by 2024.

The Original Stock to Flow Model

As CryptoPotato reported last year, a popular analyst PlanB came up with a detailed post, describing Bitcoin’s stock-to-flow.

Per his analysis, the stock is the size of existing stockpiles or reserves while the flow is the annual supply of Bitcoin on the market. He came up with a model that puts Bitcoin’s total market capitalization at $1 trillion following the upcoming Bitcoin halving in May 2020.

This means that if the model is correct, the price per a single bitcoin would be $55,000.

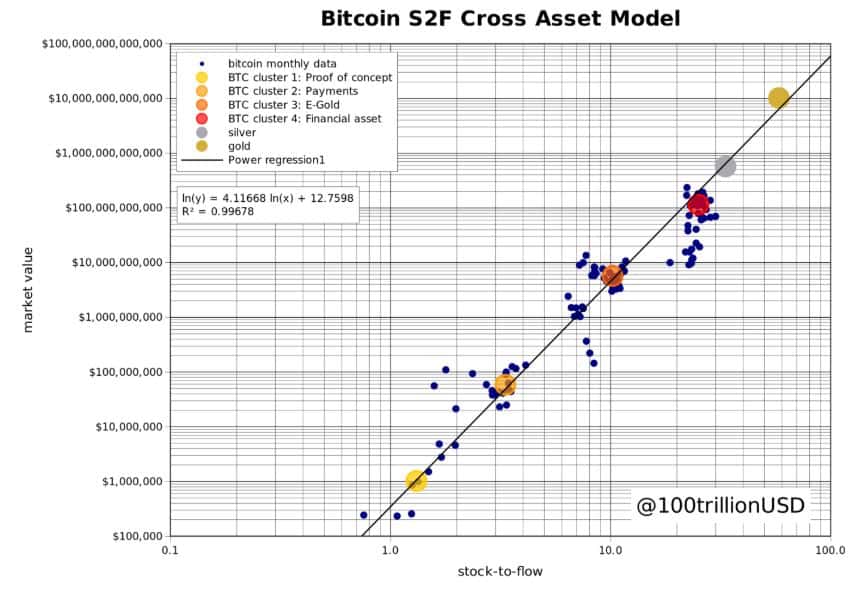

In a new post, the analyst attempts to solidify the basis of his model by removing time while adding other assets (namely silver and gold).

The Stock To Flow Cross Asset (S2FX) Model

An important point in the new approach is phase transitions. “During phase transitions, things get totally different properties.” For instance, the US dollar transitioned from a gold coin to paper backed by gold to a paper backed by nothing.

Bitcoin has also gone through different periods where the narrative has changed substantially. Quoting a study from 2018 by Nic Carter and Hasu, the analyst shows how the narrative has changed for Bitcoin since it was introduced back in 2009.

At first, it was the “proof of concept” phase right after Bitcoin’s white paper was published. Then, it was the “payments” phase once Bitcoin hit parity with the US Dollar. After that, there’s the third phase, called “E-Gold” after the first halving as the price almost reached that of gold. The last phase is the “financial asset” one after the second halving where Bitcoin received legal clarity in certain countries, futures markets at CME, and Bakkt and surpassed $1B transactions per day.

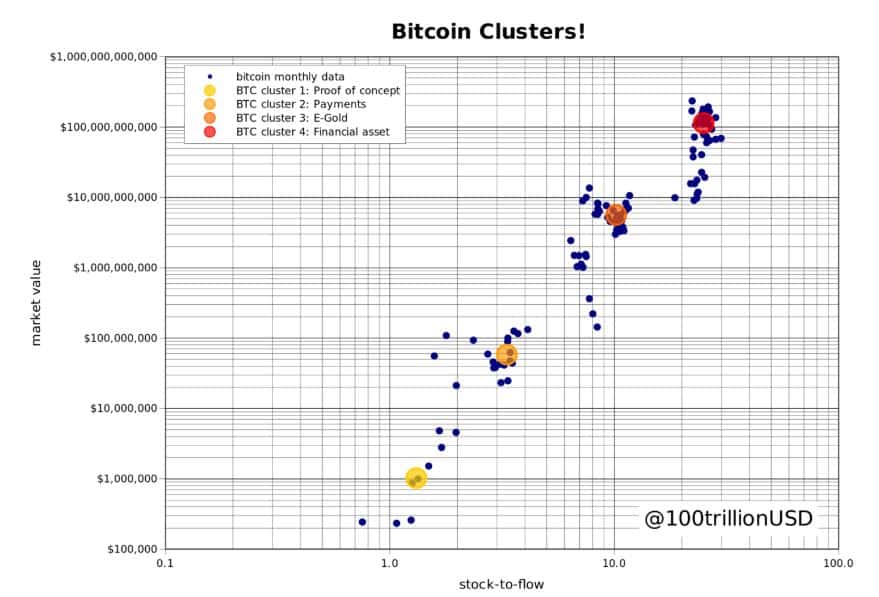

PlanB has visualized the Monthly BTC S2F and price data points used in the original model.

As seen in the chart, there are four clusters and they indicate phase transitions.

Adding silver and gold to that model “makes it a real cross-asset model.” The analyst also used regression analysis to come up with the S2FX model.

“S2FX model shows a significant relationship between S2F and market value of these six assets … with a perfect fit.” – Reads the study.

Using the S2FX formula, he comes to the conclusion that Bitcoin’s market value in the period following the upcoming halving and the next one (2020-2024) should be $5.5 trillion. This puts the price of bitcoin at $288,000, which is “significantly higher than $55K in the original study.”

However, the analyst also warns that the “S2FX model is a first step that has not yet been replicated by others.”

The post Bitcoin Price At $288,000 By 2024 According To New Cross-Asset Model Using Silver and Gold appeared first on CryptoPotato.

The post appeared first on CryptoPotato