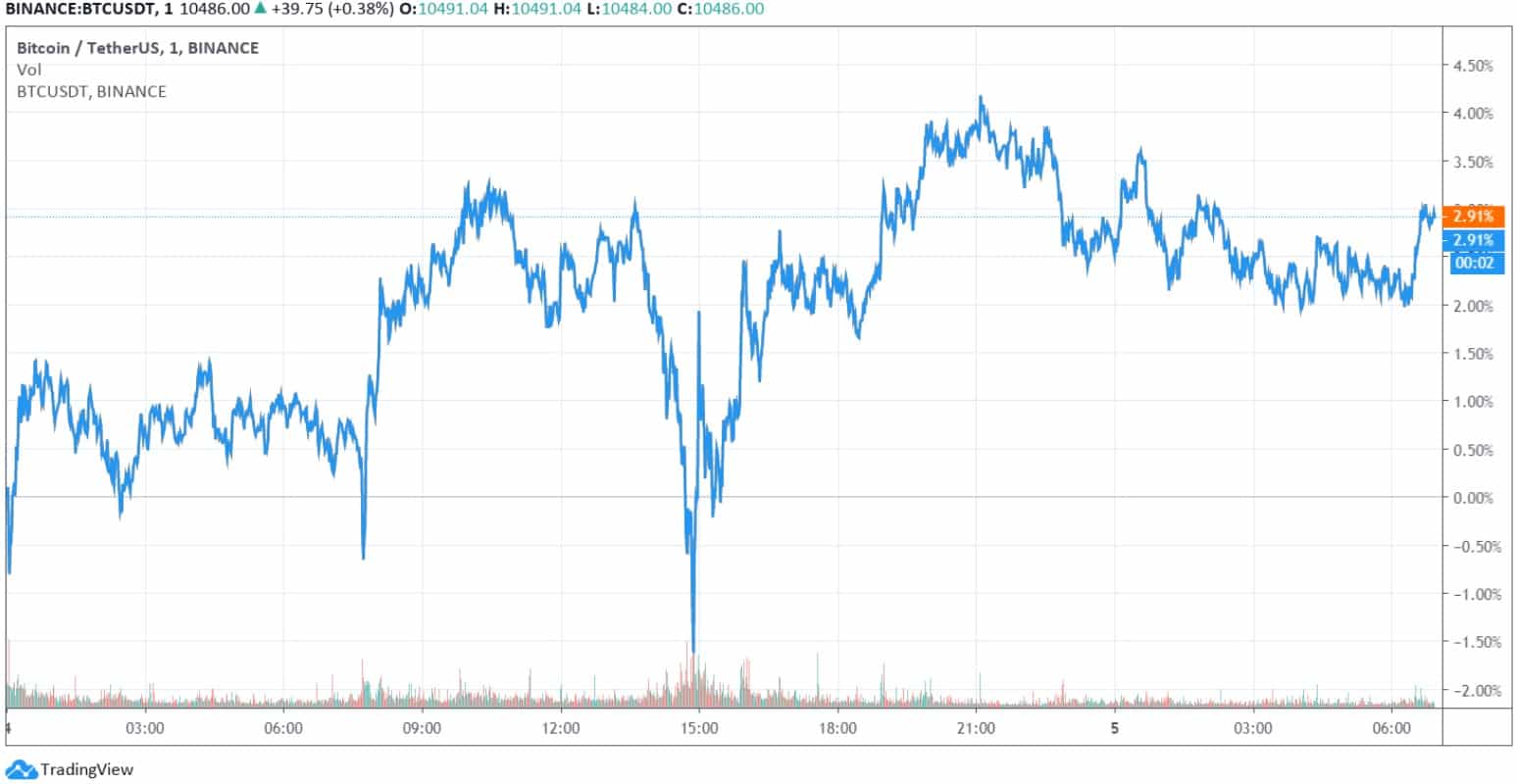

After a few days of declines, Bitcoin has regained some value and is hovering around $10,500. Most altcoins are also recovering, with the total market gap increasing by $10 billion from yesterday’s bottom.

Bitcoin Bounces Off $10K

The bears dominated the cryptocurrency field in the past few days. Bitcoin dipped below $10,000 on two occasions just days after exceeding $12,000. Since the second drop, though, BTC has displayed signs of recovery and is currently trading around $10,500.

From a technical perspective, should Bitcoin dive again, it can rely on $10,140 and the psychological $10,000 as support. In case it breaks below them, $9,815 and $9,750 follow.

Contrary, if BTC continues its recovery, it would have to overcome the resistance levels at $10,600, $10,750, and $11,000.

As reported yesterday, Bitcoin’s movements resemble the stock markets’ developments in the past few days. The sharp price drops on Wall Street were also met by a quick recovery. Nevertheless, the three most prominent US stock market indexes all closed in the red. The Dow Jones declined by 0.55%, the S&P 500 ended with a decrease of 0.8%, and Nasdaq dropped by 1.27% at the closing bell.

Altcoins Recover, Chainlink Back In Top 5

Most alternative coins are in the green today, following the massive price drops. Ripple gains 2% since yesterday and trades above $0.25. Bitcoin Cash is up by 4%, Litecoin (4%), Binance Coin (2.5%), EOS (16%), Cardano (5%), Tezos (7%), and Stellar (6%) are among the most impressive gainers in the top 20.

Polkadot and Chainlink continue with their race for the top 5 position. LINK’s 5% gains have helped reclaim its place as DOT has lost 12% of value in the past 24 hours.

Tron has also dropped a significant chunk of value since yesterday (13%) to $0.035. TRX was one of the few coins that was surging while the rest of the market plummeted.

Although Ethereum has recovered from its intraday dip below $365, it’s still down on a 24-hour scale. ETH currently trades at $387.

The most impressive gainers include OMG Network (28%), Storj (24%), Aave (17%), DFI.Money (15%), VeChain (14%), THETA (14%), UMA (13.5%), and 0x (12%).

Ultimately, the total market cap has increased to $342 billion after bottoming at $332 billion yesterday. Bitcoin’s dominance has also reclaimed some ground. The metric comparing BTC’s market cap against all alts dipped to 55.5% but is now 56.5%.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato