Bitcoin has failed to sustain its recent bullish run and has dropped to approximately $10,600. Most alternative coins have mimicked BTC’s move, resulting in a $10 billion loss from the total market cap.

Bitcoin Fails At $10,800

As reported yesterday, Bitcoin had reacted positively on news that US President Donald Trump left the hospital after a few days and returned to the White House. The primary cryptocurrency, copying gains on Wall Street, accelerated in price and peaked at $10,800.

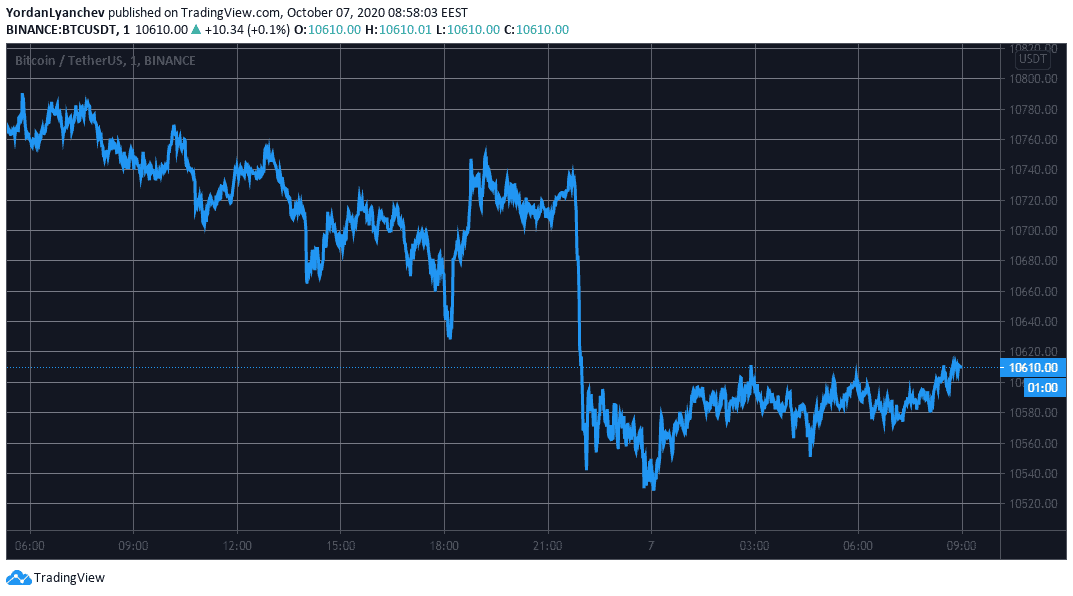

However, the situation has reversed in the past 24 hours. Bitcoin was unable to maintain its run and dropped sharply from $10,750 to an intraday low of $10,525 (on Binance). Despite recovering some ground since then to above $10,600, BTC is still down by over 1% in a day.

With its move south, Bitcoin has once again resembled the price developments on Wall Street. The three most prominent US stock market indexes closed Tuesday’s trading session in the red.

The Dow Jones Industrial Average and the S&P 500 went down by about 1.4%, while Nasdaq lost nearly 1.6%.

Altcoins Follow Bitcoin, Market Cap Losses $10B

Red dominates the altcoin market as most coins have followed Bitcoin on the way down. Ethereum has tanked by approximately 4% and trades below $340.

After a few days of impressive price performance, Ripple has also lost a significant chunk of value (5.3%). XRP has dipped to $0.245.

Bitcoin Cash (-1%) has taken advantage of the 5% BNB dump and has taken the 5th spot. Polkadot (-8%) and Chainlink (-9%) are the most significant losers from the top 10.

Further losses are evident from lower and mid-cap altcoins. Ocean Protocol (-20%) leads this adverse ranking. Elrond (-19%), Aave (-18%), Yearn.Finance (-17%), The Midas Touch Gold (-16%), Solana (-15%), Uniswap (-15%), Uma (-14%), Kusama (-14%), and Balancer (-14%) are only a part of the double-digit price drop representatives.

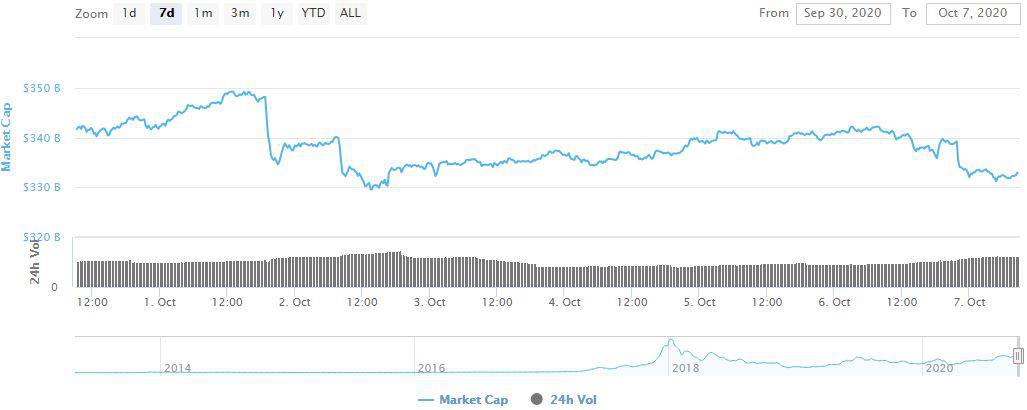

With so much red spread across the field, the total market cap has felt the consequences. The cumulative market capitalization of all cryptocurrencies has plummeted from $342 billion to $332 billion.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato