Bitcoin took another swing at $11,800 but it got rejected and retraced to its current level of about $11,680. Ethereum has returned above $400, while lower-cap alts continue to fluctuate massively.

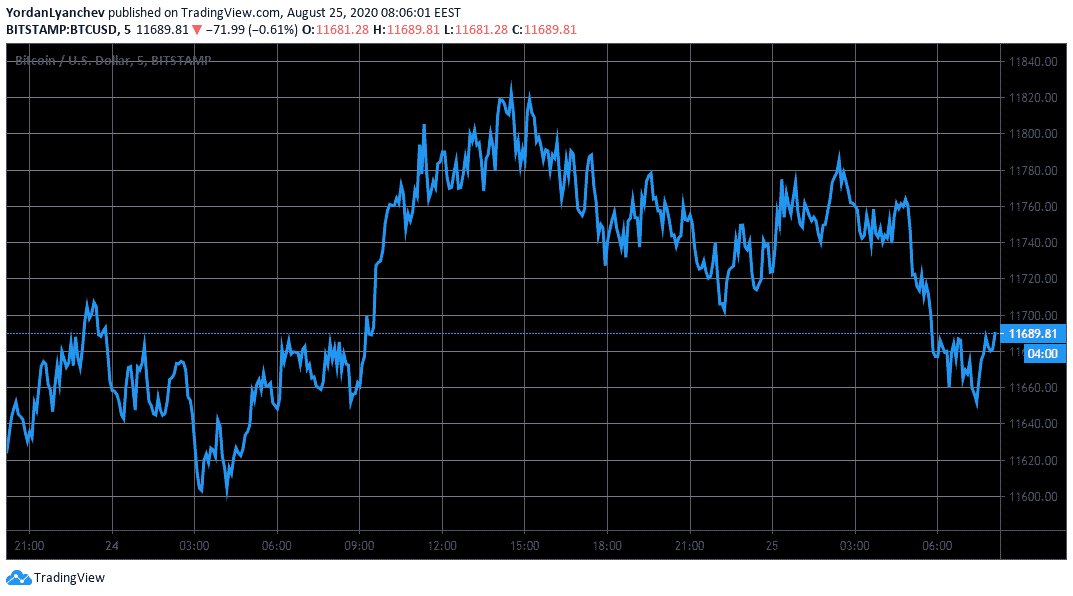

Bitcoin Tries $11,800

As CryptoPotato reported yesterday, $11,800 is a key resistance standing in the Bitcoin’s way upwards. The asset indeed attempted to overcome it after a price pump from its daily low of $11,600 to its intraday high of $11,830 (on Bitstamp).

However, bears intercepted the move at that point, and BTC couldn’t maintain its price above it. As a result, the asset dipped firstly to $11,700, bounced off to just below $11,800 again, and then retraced to $11,650-$11,700 where it sits at the time of this writing.

If BTC conquers $11,800, it could head towards the next resistance line at $11,940 before challenging $12,000 and $12,400. In contrast, $11,400 serves as support, followed by the psychological level of $11,000.

Interestingly, Bitcoin’s price continues to resemble that of gold. The precious metal also attempted to claim $1,960 but it got rejected and retraced back to $1,930.

And while the two assets display increased correlation as of late, the stock markets marked increases yesterday following news of a potential coronavirus treatment. The S&P 500 registered a new all-time high of 3,430 after a 1% jump, the Dow Jones (1.3%) exceeded 28,000 for the first time since February, and Nasdaq (0.6%) reached 11,380.

Ethereum Above $400, Alts Fluctuate

After diving to $380 a few days ago, the second-largest cryptocurrency by market cap has returned to above $400. ETH even topped at $410 but has retraced slightly to about $402.

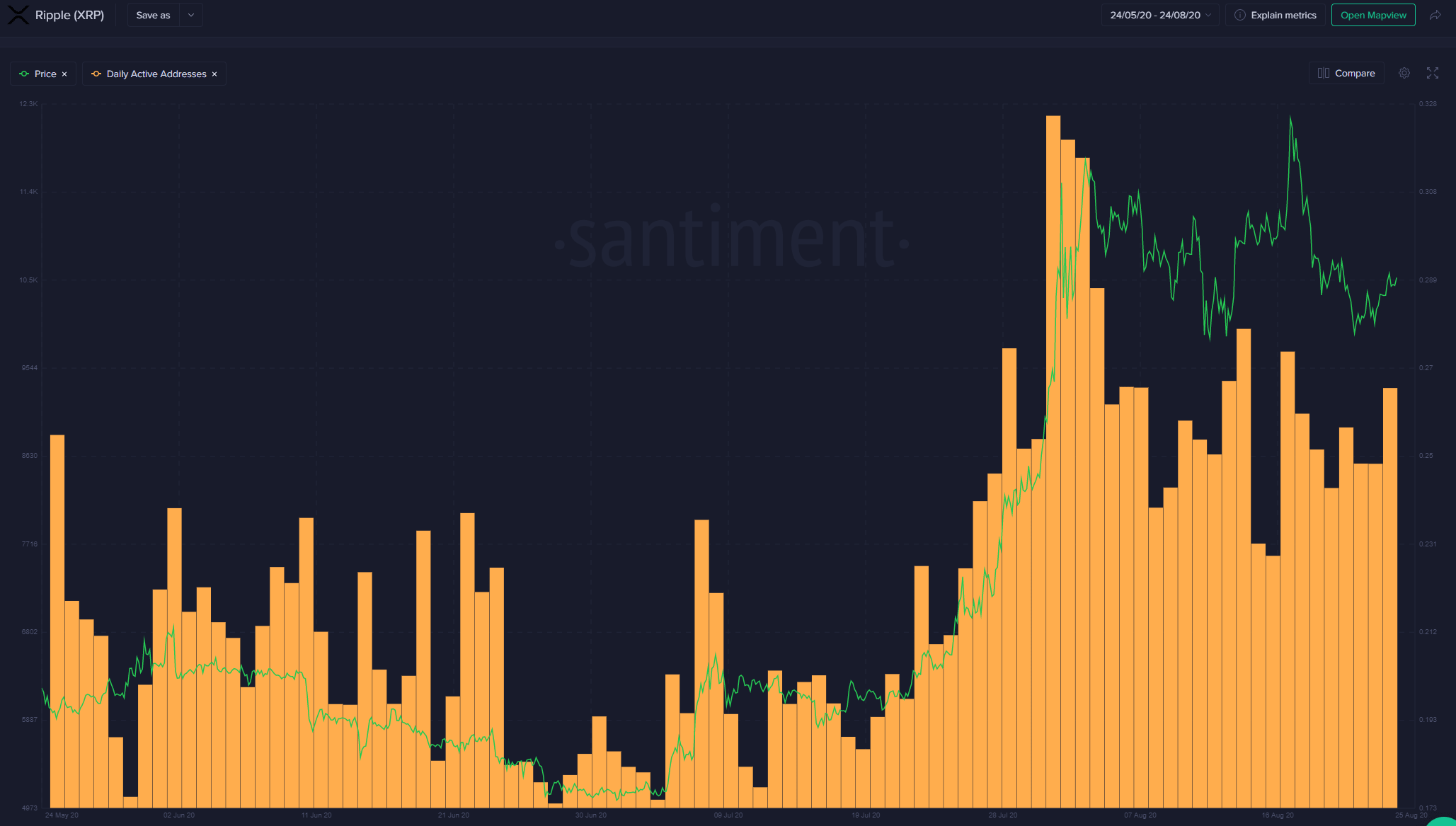

Ripple’s 1% increase since yesterday is insufficient for XRP to overcome $0,30. The asset is down by approximately 10% in the past week. However, the data analytics company Santiment pointed out potentially bullish news for its price. The daily active addresses for XRP have remained high, and it is one “of the few alts with a DAA bullish divergence.”

As it typically happens, the most impressive gains come from lower-cap alts. Kusama is in the lead with a 45% price surge, followed by Aave with 31%. Reserve Rights is next with 24% after being listed on the leading cryptocurrency exchange – Binance.

JUST (13.5%), Divi (13%), Yearn.Finance (8%), Loopring (7.6%), and iExec RLC (6.5%) are also well in the green.

On the other hand, Basic Attention Token (-9%), Ampleforth (-8.6%), ICON (-7.4%), and OMG Network (-7%) are the most substantial losers in the past 24 hours.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato