Bitcoin price is trading below $10,000 and a further pullback could drive price even lower. | Source: Shutterstock

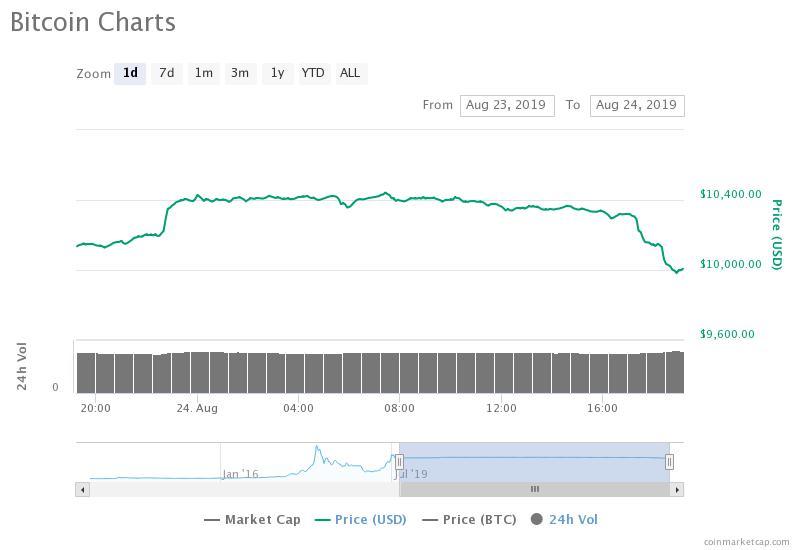

By CCN Markets: The bitcoin price has fallen below $10,000 in a minor pullback, dropping from $10,300 to $9,880 on major cryptocurrency exchanges within a two-hour span.

The bitcoin price drops $500 in a minor pullback from $10,300 to $9,880 (source: coinmarketcap.com)

Prior to the abrupt $500 drop, several cryptocurrency traders stated that the bitcoin price is likely to correct to the $8,000 region before reclaiming the yearly high and initiating a stronger rally.

Why traders potentially see $8,000 bitcoin price in short term

Since July, the bitcoin price has demonstrated a high level of volatility, retesting a key psychological level at $10,000 six times in the past two months.

Although the dominant cryptocurrency has defended supports in the $9,000 to $9,200 range strongly following a dip to the $8,000 region on July 17, it has struggled to maintain momentum above $10,000.

$8.5k before $14k $BTC

— CryptoThies (@KingThies) August 23, 2019

According to one cryptocurrency trader, bitcoin has been hovering at support and a close below $10,000 would indicate a bearish short term trend, potentially leading the asset to a drop to the $8,000 region.

“It isn’t a good gut feeling seeing BTC lingering at support. That being said, I have no interest in shorting support. A close below $10k and I start to think we see the $8000s. Yesterday I got chopped longing too early. For now, sitting on my hands and holding long term spot,” he said.

DonAlt, a technical analyst, noted that a false rally may have been initiated by the optimism of retail investors towards the launch of Bakkt, a bitcoin futures market operated by ICE, the parent company of the New York Stock Exchange.

“Consolidating in the lower part of the trading range after a false breakout caused by Bakkt FOMO. That’s bearish to me. The more time BTC spends down here the more bearish it gets. Bulls need to reclaim 10350 quick otherwise I’ll expect a breakdown,” he said.

Bakkt is set to be the first bitcoin futures market to offer physically-settled contracts that could have bigger impact on the daily price movements of bitcoin as it allows investors to physically hold bitcoin.

However, the potential effect of Bakkt on the price movement of BTC remains unclear at the current juncture, which has left some technical analysts indicating a bearish formation for BTC in the short term.

Click here for a real-time bitcoin price chart.

This article is protected by copyright laws and is owned by CCN Markets.

Source: CCNThe post appeared first on XBT.MONEY