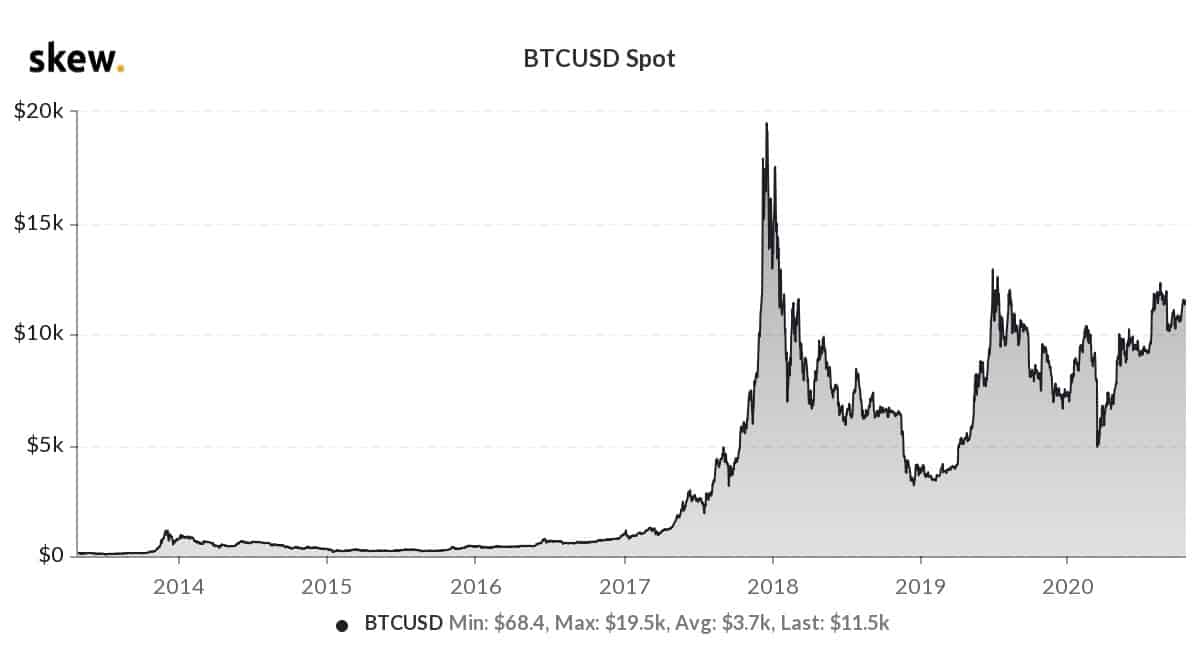

With Bitcoin’s price hovering around $11,500, recent data indicated that the asset had spent only about three months of its existence above that particular level.

BTC: Only Three Months Above $11.5K

The official launch of the first-ever cryptocurrency came in early January 2009. Born during the last massive financial crisis, Bitcoin was this “magical money” that actually lacked any significant attention in its initial years. Consequently, its price traded close to zero for a while.

Since then, however, Bitcoin started gaining traction that ultimately resulted in severe volatility throughout the years. The massive fluctuations took the asset towards an all-time high in December 2017 of nearly $20,000, and just a year later, BTC saw its price beneath $4,000.

Fast-forwarding two years and Bitcoin is currently positioned around $11,500. Although this level is nearly twice as less as the all-time high, recent data from the analytics company Skew informed that BTC hadn’t spent a lot of time above $11,500.

More precisely, BTC’s price has hovered above $11,500 for only 93 days (or three months) since January 2009.

Fundamentals in Place

Apart from the data above, Bitcoin’s hash rate has experienced a significant boost even after the completion of the third halving in May. As CryptoPotato reported recently, the metric measuring the computing power miners use to validate transactions on the BTC blockchain reached a new all-time high of 170 exahashes per second. This represented a 40% increase in the five months following the halving.

Although the hash rate is not correlated with the price, another report suggested an upcoming price increase. By indicating that Bitcoin whales, meaning entities with at least 1,000 coins, have slowed down accumulation, Glassnode asserted that this could ultimately be a bullish sign for the asset price.

Historically, once whales have stopped buying massive quantities, this has led to an opportunity for retail investors. According to the analytics company, Bitcoin may be in the “beginning of a run-up to a market top.”

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited offer).

The post appeared first on CryptoPotato