Bitcoin continues above $10,000, while Ethereum’s free fall has only intensified in the past 24 hours.

The DeFi space is also facing major hurdles, but over the past few hours, a lot of DeFi coins have bounced following new developments with SUSHI.

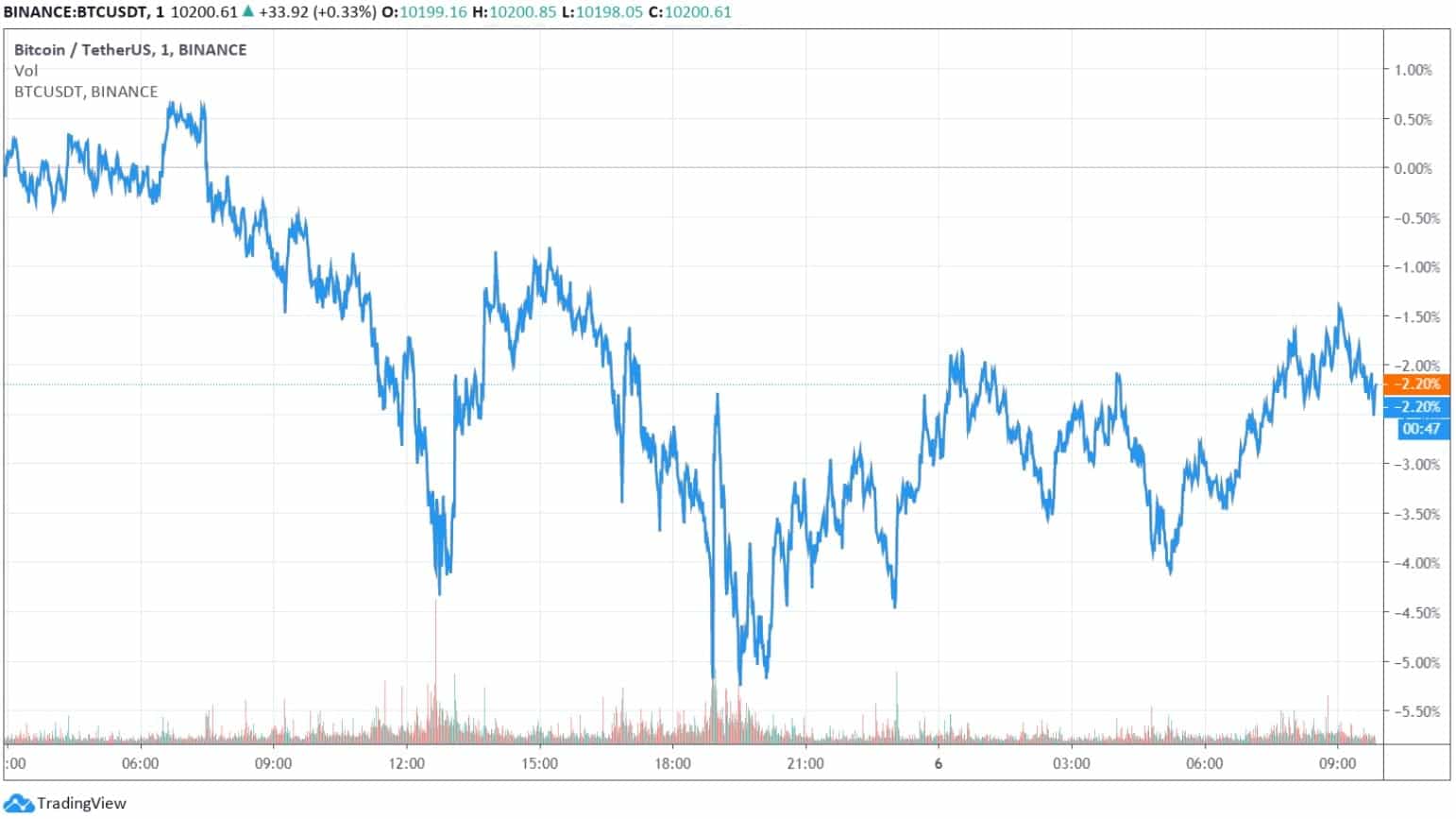

Bitcoin Fights To Stay Above $10K

As CryptoPotato reported yesterday, Bitcoin bottomed at about $9,825 (on Binance). The asset managed to recover some ground in the next few hours to approximately $10,200.

Bitcoin bounced off the critical support at $10,000 and added $200 to its current value. If BTC breaks below it, though, it could test the next support lines at $9,800 and $9,600, which is also the CME gap from July.

Alternatively, Bitcoin has to reclaim the first resistance at $10,250 to head upwards. If successful, the primary cryptocurrency could aim at the previous 2020 high from February at $10,500, followed by $10,800 and $11,000.

DeFi Coins Bounce on SUSHI News

SUSHI, the governance token of the popular Uniswap fork SushiSwap, has plummeted in the past few days. Yesterday, however, the lead developer of the protocol sold his tokens and crashed the price as SUSHI reached lows around $1.

Today, he announced that Timelock admin control has been transferred to the CEO of FTX, and the price jumped, bringing a lot of the DeFi coins with it.

SUSHI increased to its current levels of $2.6, Chainlink (LINK) also jumped to about $12, UMA, YFI, Aave’s LEND, Maker, and other tokens also reacted similarly.

Still, it’s worth noting that on a 24-hour scale, all of these tokens are charting serious losses, most of them in double-digit territory.

The total market cap recovered about $7 billion since our last update but is still down almost $50 billion in the past four days.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato