Bitcoin’s price just crossed the $9,000 mark. The halving, which is arguably one of the most anticipated events in the cryptocurrency space in 2020, is just months away. Still, there is no real coverage on behalf of mainstream media, unlike what happened toward the end of 2017 when Bitcoin was charting daily surges, and traditional outlets were battling to report on it. This raises the question of what would happen if the attention from the 2017 parabolic price increase returns?

Bitcoin Now and In 2017: The Difference In Media Coverage

Even though it has been less than a month from the beginning of 2020, Bitcoin’s price is already breaking serious grounds. Since January 1st this year, BTC is up more than 25% as it poked over $9,000 today. Going further, Bitcoin’s halving is just a few months away.

The event will see the reward miners receive for adding new blocks to the network slashed in half, hence reducing the supply of freshly minted bitcoins substantially. Historically, this has caused massive increases in terms of price, both times the halving took place in the past.

Amid all this, there’s an apparent lack of mainstream media coverage. For some reason, traditional news outlets don’t seem excited about the developments in the cryptocurrency field.

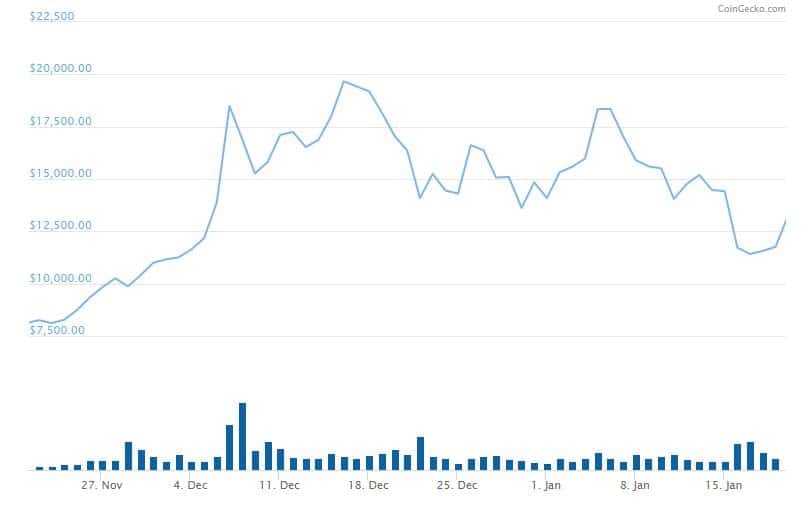

The difference between the current situation and what happened back in 2017 when Bitcoin reached its all-time high of about $20,000 is more than evident. Back then, it felt like every movement of the cryptocurrency was overly reported by different giant traditional media. Reports even circulated that people are taking out mortgages to buy Bitcoin. Naturally, BTC making headlines over and over again got it in front of the eyes of retail investors, which propelled even further increases, ultimately leading to ATH prices.

Bitcoin Price, 2017. Source: CoinGecko

The first time it crossed the $10,000 mark was in late November, and it took it less than a month to double-up, once traditional media stepped in. This time around, however, things are different. Apart from the occasional market update carried out by certain financial media outlets, there’s a notable lack of coverage.This begs the question of what would happen if mainstream media stepped in the way it did back in 2017.

Can Media Propel Bitcoin’s Price To $90,000?

The popular cryptocurrency commentator, Crypto King, was the one to bring this up on Twitter. He seems to believe that Bitcoin is going to $90,000 and that we are still early in the development cycle.

BTC is going to $90,000. ??

Forget $9,000.

Notice how quiet Twitter is?

Notice media attention covering BTC’s 200%, 1 year climb?

Notice how NO mainstream media is covering the halving?

We are early. It’ll take 2 years to prove it. Likely less ?.

— Crypto King (@JBTheCryptoKing) January 28, 2020

Indeed, Bitcoin hasn’t been making the same moves it did back in December 2017, but its growth is still more than impressive. And yet, for some reason, mainstream coverage is lacking. According to the analyst, it will take two years or less for Bitcoin to shoot up to $90,000.

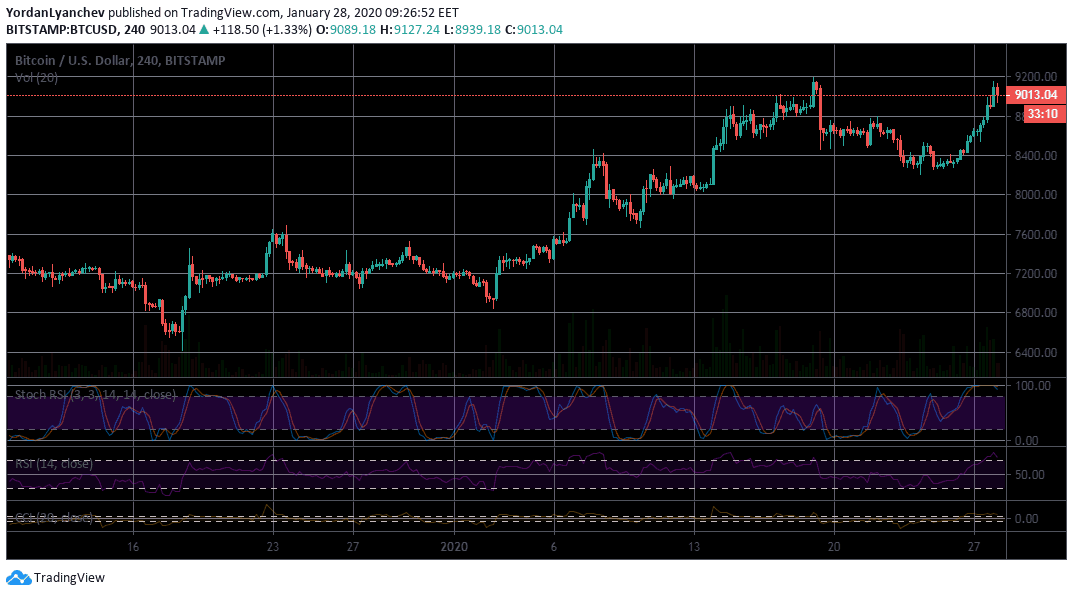

He’s not alone in his stance that BTC is primed for bullish momentum. Well-known analyst Josh Rager has also commented on BTC’s recent movements, sharing that the monthly candle “looks like it wants to overtake the Nov. open.” He also adds that it “would be extra bullish if this month closed above $9,250” and that “price would likely look to push up over $10k and re-test the POC of the June to Sept ’19.”

Bitcoin’s Latest Rally

The price of the largest cryptocurrency has been continuously increasing in the last few days and, for the second time in a week, has climbed over $9,000.

BTC/USD 4h. Source: TradingView

It’s also worth noting that this takes place during times of serious economic turmoil amid the recent outbreak of the coronavirus in China. As the country works hard to limit the spread of the virus and shuts down cities, major stock indexes such as the S&P500, Nikkei 225, and the FTSE100 have been suffering in response.

Gold and Bitcoin, on the other hand, have both increased in value, possibly hinting at the fact that investors are looking for a safe haven for their cash.

The post appeared first on CryptoPotato