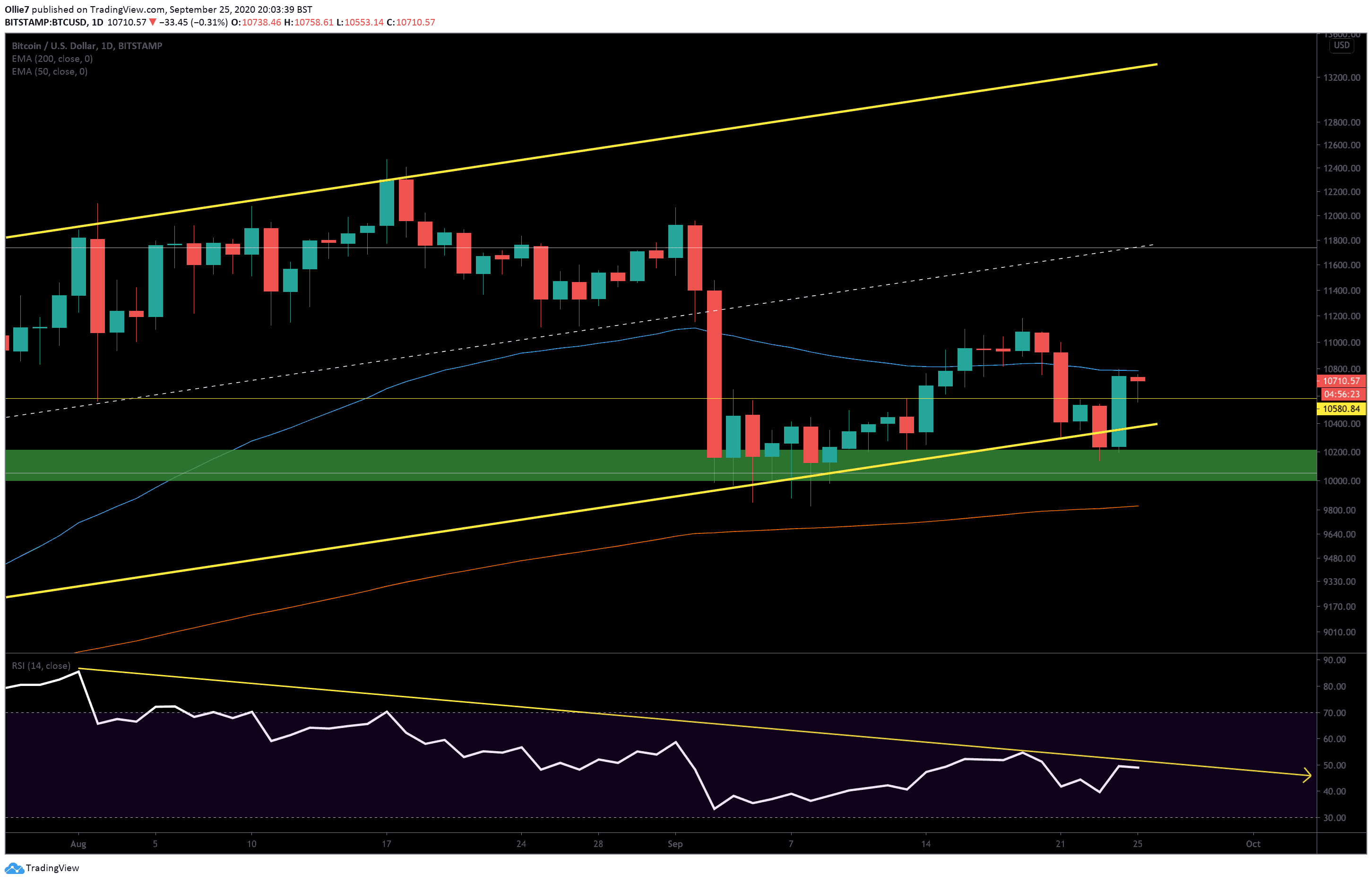

Bitcoin bulls appear to be recharging after successfully breaking back into the main channel (yellow) above $10,360 and surging to $10,790.

An influx of $5 billion into the global crypto market cap over the past 24 hours has really helped prop up BTC prices above $10,700 and is also giving several altcoins a moment in the sun.

However, while this is promising news, we still need to see the global crypto market set a new higher-high above $355 billion (total market cap) to break the current downtrend and confirm the market has flipped bullish.

Right now, the only thing standing in the way of Bitcoin returning to the psychological $11,000 level is the 50-EMA line (blue) on the following daily BTC/USD chart. Currently around $10,780.

Price Levels to Watch in the Short-term

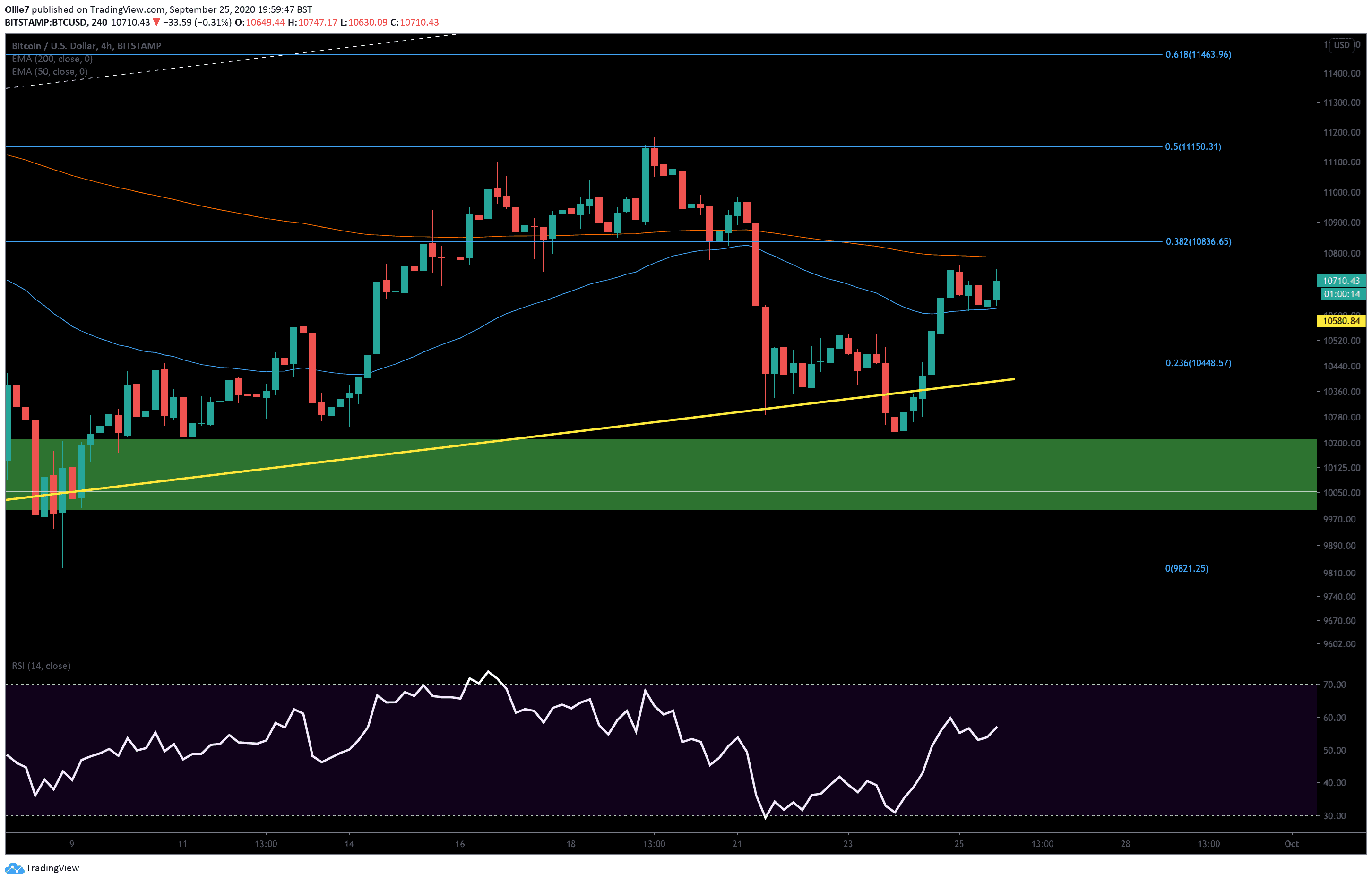

The daily 50 EMA is the main target right now for bullish traders; however, just slightly above that at $10,787, we also have the 4-hour 200 EMA (red), which received a noticeable reaction from bearish traders yesterday during Bitcoin’s surging rally.

These two price points will need considerable buying pressure to break, but if bulls are successful again, it should be an easy ride to $11,000.

Looking above that, we have the $11,200, the $11,360, and the $11,530 as the next set of likely resistances if Bitcoin manages to sustain its current momentum.

If bearish traders manage to defend the daily 50-EMA line, however, then we should look to the $10,580 as the first area of support, followed by the $10,440 and the main channel support line at approximately $10,390.

On the daily RSI indicator, we can see that Bitcoin has still not broken above the long-standing resistance (yellow arrow) with a higher high since August 1, 2020. This will be a crucial factor to observe over the next week as the leading crypto asset attempts to retake $11,000. If the indicator line moves above this resistance it will provide a strong buy signal to traders and could help drive prices up towards a new monthly high.

Total market capital: $347 billion

Bitcoin market capital: $198 billion

Bitcoin dominance: 57.1%

*Data provided by Coingecko.

Bitstamp BTC/USD Daily Chart

Bitstamp BTC/USD 4-Hour Chart

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited – first 200 sign-ups & exclusive to CryptoPotato).

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato