Only a few days ago, the price of Bitcoin plunged to $6,850 (Bitstamp) in a violent red candle. However, the bulls quickly took charge, and the price recovered to over $7,200 in the next few hours, and since then, the state of BTC has been ever healthier.

The largest cryptocurrency is currently trading safely above $7,400, which is a 1.5% increase in the last 24 hours. This comes shortly after marking $7500 as the daily high, as of writing these lines. As CryptoPotato recently reported, Bitcoin recorded most of its gains last year during the weekends, and this trend continues to the first week of 2020.

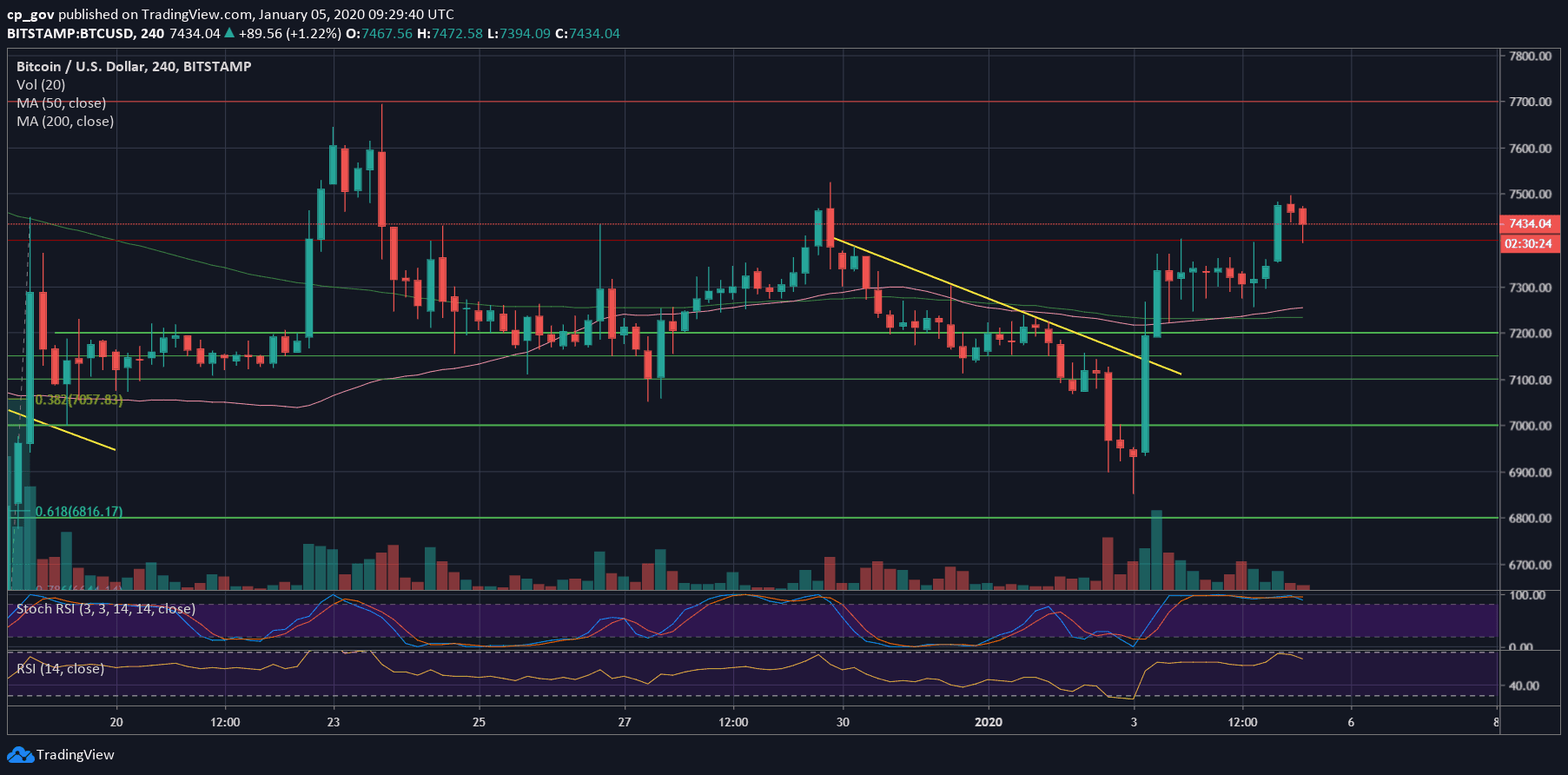

Technically, Bitcoin is now retesting good old support turned resistance level. If Bitcoin continues above, then the next target might be the $7,700 resistance, before getting to the $8K benchmark again. Looking at the other option, the first level of support is at $7,200, followed by $7,000.

BTC/USD 4-hour chart. Source: TradingView

Bitcoin is not the only asset heading upwards today. In fact, most of the market is in green – Ethereum rises with almost 3% to $138, and ripple is at $0.196, which is an increase of around 1.5%. In the matter of trading against Bitcoin, the dominance hasn’t changed, so the altcoins aren’t gaining nor losing against their BTC value.

Other gainers within the top currencies include Litecoin (2%) to $43.5, EOS (2.22%) to $2.71, BNB (2.26%) to $14.12. Bitcoin SV is the most impressive one in the top 10, with a 4.29% surge to over $110.

Total Market Capitalization: $199.5B | Bitcoin Market Capitalization: $136B | Bitcoin Dominance: 68.2%

Major Crypto Headlines

South Korea Won’t Tax Cryptocurrency Profits, For Now. The county has changed its mind regarding taxation for cryptocurrency profits. After initially stating that they will be taxed, South Korea’s Ministry of Finance and Strategy noted that this is no longer the case.

Telegram Refuses To Share Financial Records With SEC. After the U.S. market regulators requested Telegram to provide access to its financial records, the company refused to do so. Telegram gather $1.7 billion in two token sales for the development of their TON blockchain but is yet to deliver an actual product, which raised concerns at SEC.

Germany’s Central Bank Chief Wants To Tune Down on Libra and Digital Euro. The President of Bundesbank, Jens Weidmann, appears somewhat skeptical about Facebook’s Libra, saying that banks should raise their game to eliminate the need for such a project. Moreover, he adds that the E.U. has to be more clear on its idea for the digital euro, before releasing it to the public.

Significant Daily Gainers and Losers

V Systems (18.87%)

VSYS is the most notable gainer at the moment of this writing in the top 100 cryptocurrencies by market cap. It rises with almost 19% against the dollar to $0.031 and with over 16% against Bitcoin to 416 SAT.

A few days ago, the company released its 2019 achievements update and noted that V Systems would launch more projects this year.

Dash (12.05%)

DASH is next on the list with impressive gains against both USD and BTC – 12.05% and 10%, respectively. DASH/USD is trading now at just shy over $49, and DASH/BTC is 0.0065 SAT. The recent price surge naturally means an increase in the market cap, which is now north of $450M, placing it in 24th place.

Just a few days ago, the company announced a partnership to serve Burger King Venezuela.

Seele (-13.15%)

On the contrary, it stands SEELE with a 13.15% loss against the dollar to the current trading price of $0.143. The drop against the largest crypto is even more notable at almost 15% to 1909 SAT.

Interestingly enough, yesterday, SEELE was at $0.175 with a market cap of over $122M, and the latter is now slightly below $100 Million.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Cryptocurrency charts by TradingView.

Technical analysis tools by Coinigy.

You might also like:

The post appeared first on CryptoPotato