Bitcoin has recovered some of its dominance over the market in the past 24 hours after breaking above $11,600. At the same time, large-cap altcoins have calmed and even taken a hit, but fluctuations are evident among lower-cap alts.

Bitcoin Moves Ahead

As CryptoPotato reported a few days ago, Bitcoin’s price chart was forming a bullish reversal pattern suggesting a possible increase. At the time, BTC was trading at about $11,200 – $11,300, where it stood for a bit longer. In the past 24 hours, though, the primary cryptocurrency went on a hike and so far has climbed successfully above the resistance at $11,500.

Moreover, Bitcoin even managed to touch $11,800, where it got rejected and had its price decreased to $11,650. Nevertheless, the bullish reversal pattern’s primary target is at $12,000 and would be compelling to follow if the asset will indeed reach it. Should it succeed, BTC would have to fight off the next resistance level at $12,350 to continue upwards.

It’s worth noting that gold has also kept its momentum going. Upon breaking the $2,000 mark, the precious metal topped at $2,055 just hours ago. According to a recent JPMorgan analysis, gold is still the preferable choice for elderly retail investors, while the younger generations pick riskier and more volatile assets such as Bitcoin.

Low-Cap Alts On The Move

Most large-cap alternative coins have calmed after several consecutive days of price action. Ethereum is up 1% to $395, Ripple is still at $0,30, while Cardano and Binance Coin are retracing slightly by about 1%. Even Chainlink, which briefly spiked above $10 on some exchanges yesterday, displays less volatility at the time of this writing. Consequently, they lose ground against Bitcoin as BTC is up by over 3%.

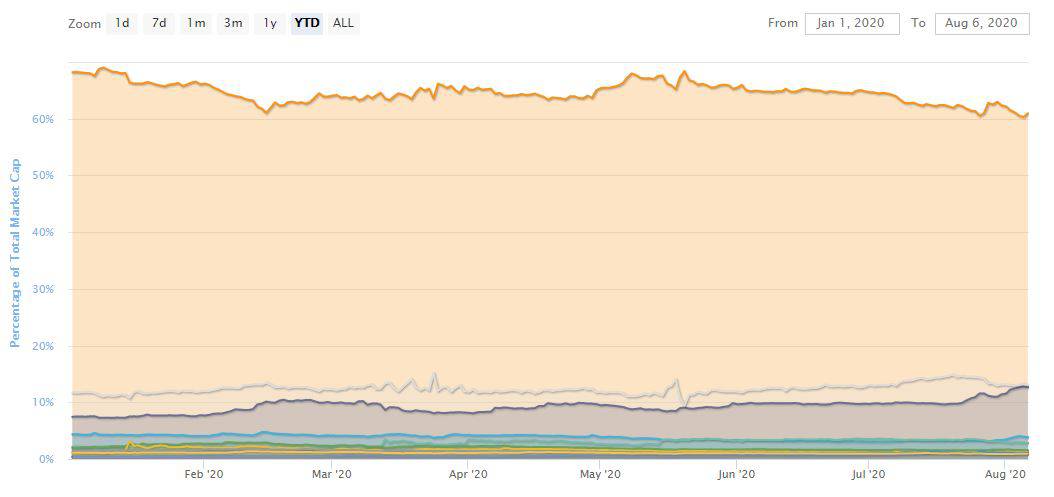

The contrasting price developments from Bitcoin the large-cap alts have affected BTC’s dominance. After falling to 60.4% days ago, the metric comparing Bitcoin’s market cap against all other digital assets has recovered to 61%.

Yet, lower-cap alts are marking some notable price movements. Beginning with Band Protocol – the most impressive gainer of the day with a surge of 35%. This increase has arrived somewhat expectedly as the leading US-based cryptocurrency exchange Coinbase announced plans to list BAND to its platform, starting on August 10th.

Another substantial increase follows another listing on a leading exchange. This time the pump is from Travala (AVA) after Binance informed that it will open trading for AVA/BNB, AVA/BTC, and AVA/BUSD starting today. The asset price has responded in a bullish fashion with a 24% pump.

Other double-digit jumps include Bancor (20.8%), Kava (11.4%), Ren (10.5%), and Aurora (10.1%). In contrast, Nexo loses the largest chunk of its value by a 22% drop, followed by Ampleforth (-7%), and THORChain (-6.6%).

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato