Fundstar Global Advisors Managing Partner, Tom Lee, continued with his positive predictions regarding the price of the largest digital asset. In a recent interview, he said that Bitcoin will reach $40,000 before the popular stock market index, the Dow Jones Industrial Average (DJI), gets to 40,000.

Bitcoin Price To $40,000

Lee is among the most vocal Bitcoin proponents and has regularly made positive price predictions. Speaking on CNBC’s Power Lunch, Lee reiterated on the current bullish sentiment on the market. Moreover, he said that Bitcoin’s price will reach $40,000 before the Dow Jones (DJI) reaches 40,000. The DJI is a stock market index measuring the performance of 30 large companies listed on US stock exchanges.

Nevertheless, Lee thinks that the DJI will reach 30,000 before Bitcoin goes to $30,000. At the time of this writing, BTC’s price is around $9,750, while the DJI stands at 29,276 points.

Lee listed several reasons supporting his optimistic view of where Bitcoin’s price is headed. Namely, the Halving, which is estimated to take place in May, geopolitical tensions, and risks associated with the coronavirus in China.

Moreover, he added that BTC broke above the crucial 200-day moving average. As he recently outlined, whenever Bitcoin is trading above the 200-days MA, its price increases with an average of around 190% in the following 6 months. This would put BTC at $27,000 in the next 180 days.

New ATH This Year?

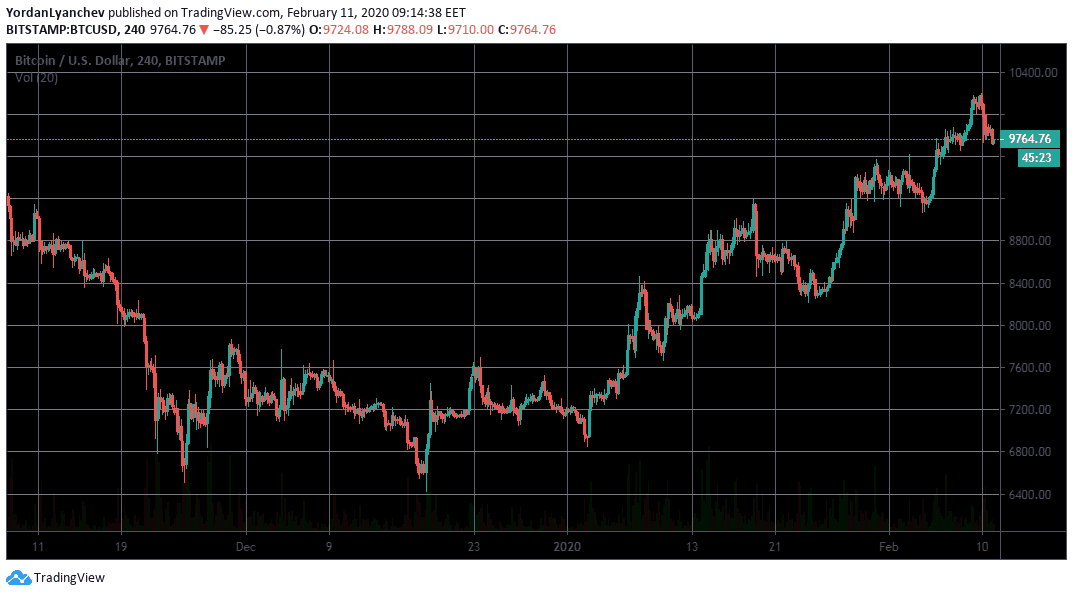

Bitcoin recently breached $10,000 before retracing slightly to where it trades now.

BTCUSD. 4h. Source: TradingView

Whether or not Bitcoin will reach and surpass its current all-time high (ATH), however, is one of the hottest topics within the cryptocurrency community. Many people, Lee included, believe so. Unlike 2017, fundamentals seem to be in place.

First and foremost, the Bitcoin halving is closing in. If history is any indicator, the price has always surged in the months after it. Of course, this is not a certain indicator but should definitely be considered.

The geopolitical tensions between Iran and the U.S. and the outbreak of the deadly coronavirus hit the traditional financial markets. At the same time, Bitcoin and Gold recorded gains. It brought back the comparison between the two and raised the question again if BTC can serve as a safe-haven. At the same time, it once again demonstrated the negative correlation that Bitcoin has with traditional markets.

In any case, in order to reach $40,000, Bitcoin’s price would have to surge by more than 300%, which is optimistic, to say the least.

The post appeared first on CryptoPotato