Bitcoin’s 3.5% increase led to its highest price level in about 12 days, while also increasing its dominance over the market.

The top 10 coins by market cap see more rotations, as some alts have followed BTC’s move upwards.

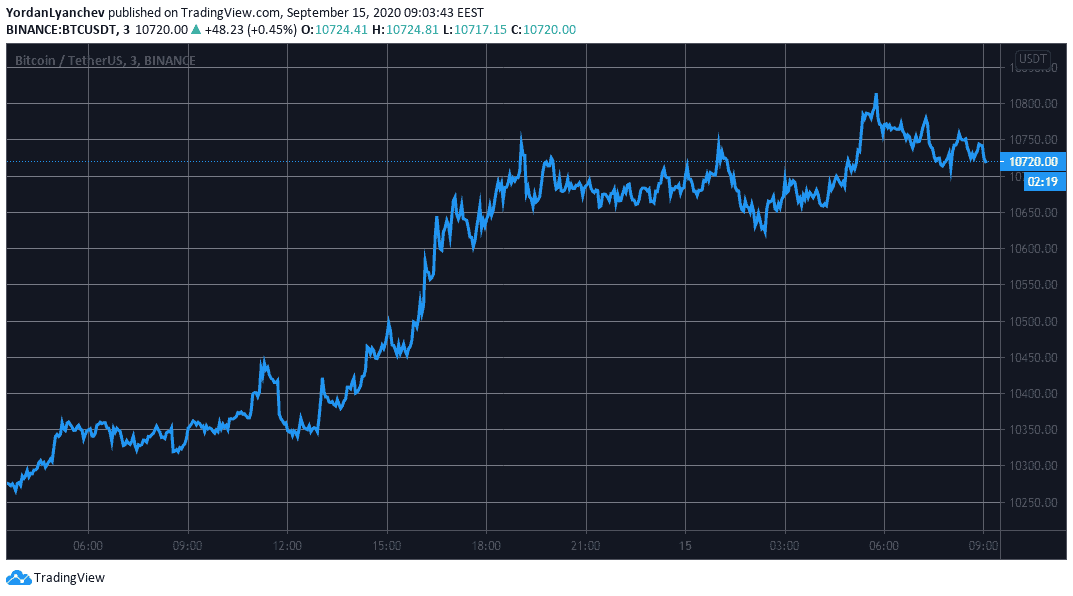

Bitcoin Tops At $10,840

As reported yesterday, the primary cryptocurrency had issues with the resistance at $10,500. After a few attempts to overcome it, the asset got rejected and headed towards $10,250.

Bitcoin attempted another leg up in the past 24 hours. This time, though, it appears to be more successful. BTC reclaimed the February 2020 top of $10,500 and continued further to its intraday high of about $10,840 (on Binance) which is the highest price Bitcoin has reached in the past 12 days. Since then, the asset has retraced and currently sits at $10,720.

Interestingly, the top reached a few hours ago is the 0.382 Fibonacci level serving as the first resistance. If BTC conquers it, the asset could head towards $11,000 and the 0.5 Fibonacci at $11,150.

It’s worth noting that Bitcoin’s movement north resembled gold’s performance again. The precious metal traded at about $1,940 per ounce before it accelerated to its daily high of $1,970. Equity markets in the face of the S&P 500, Dow Jones, and NASDAQ, have also recorded a positive Monday.

Alts In Green, BCH Takes The 6th Spot

Most alternative coins have followed Bitcoin’s move upward. Ethereum is 2% up and currently trades at $375. Ripple (1.6%) is nearing $0.25.

Further below in the top ten, Bitcoin Cash continues the recent rotation trend. BCH jumped by 7% and has overtaken Chainlink and Binance Coin for the 6th position. In fact, BCH is even close to Polkadot, as DOT declined by 1.5%.

Hyperion leads the way as the most impressive gainer in the past 24 hours. HYN has skyrocketed by 75% to over $0.35.

NXM follows with 35%. Nervos network (12.5%), Bytom (12%), Celsius (11%), Swipe (10.5%), and NEO (10%) also jumped by double-digit percentages.

Contrary, UNUS SED LEO (-7.3%), Syntetix Network (-5.7%), Waves (-5.4%), Augur (-5.3%), and ZB Token (-5%) are the most substantial losers.

Ultimately, Bitcoin has reclaimed some ground in terms of market dominance. The metric comparing BTC’s market cap with all other coins dipped to 55.8% on September 13th but has increased to 56.9%.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato