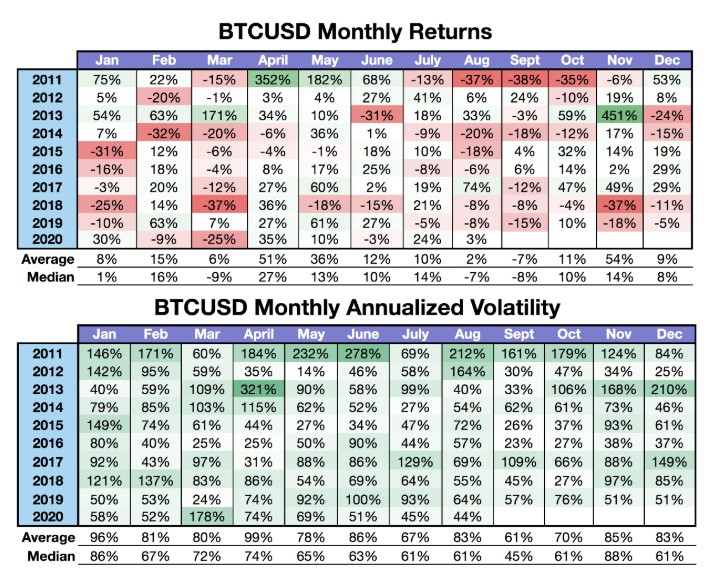

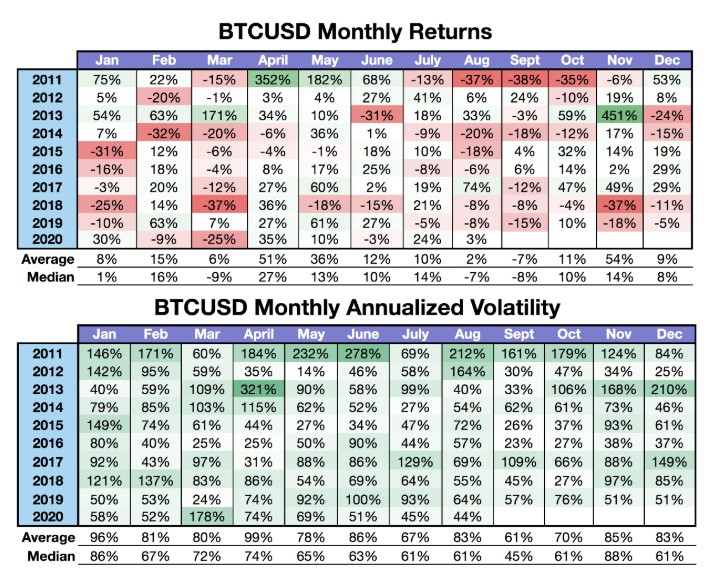

Bitcoin’s range-bound roller coaster has started to head higher as the price rose to $10,400 level. As for the volatility, bitcoin has never had a poorer monthly [August] volatility in its 10-year history. August closed with monthly volatility of 44% a lot lower than its 10-year average 83% and a 10-year median of 61%.

Source: Kraken Volatility Report

Based on Kraken’s August volatility report, it can be seen that, although the volatility was lower than average, the price pulled through. The average 10-year monthly [August] return was at 2%. Not only is this higher than the 10-year median, which is at -7% but also higher than the 10-year average of 2%.

This is could be due to the price’s low volatility and range-boundedness.

How will this affect the price and what can we expect next?

Compared to August, September has relatively lower volatility and lower returns as well. Considering the CME gap ranging from $9,645 to $9,995, which further fuels the negative monthly returns for September.

September might be a lot like August, at least in the first two weeks – ie., higher volatility and price drops. This could be due to the CME gap which will surely increase volatility if the price crashes towards it.

Since we have seen that any drops under $10,000 are quickly being bought up, this shows that $10,000 is a strong support level and that there is a lot of demand for bitcoin under $10,000.

Hence, even if we see volatility inducing price drop in early to mid-September, we might see a quick bounce where the price reverts to the mean. If the latter arrives sooner rather than later, then we can see positive returns for September, which seems unlikely. However, the same will happen in the month of October, which has a good monthly return track record.

The post appeared first on AMBCrypto