Disclaimer: The findings of the following article are the sole opinion of the writer and should not be taken as investment advice

16.78% and 48.22% – That’s how much Bitcoin has surged since 1 November and 1 October, respectively. Suffice to say, Bitcoin has been on a roll in the last quarter [since September – 34%].

So, is it all sunshine and daisies and rainbows and butter mellows for Bitcoin?

Of course not. As described in a previous article, things do look grim for Bitcoin, at least in the short-term. This article will take a look at the short-term price movement of Bitcoin and what to expect from a purely technical analysis perspective.

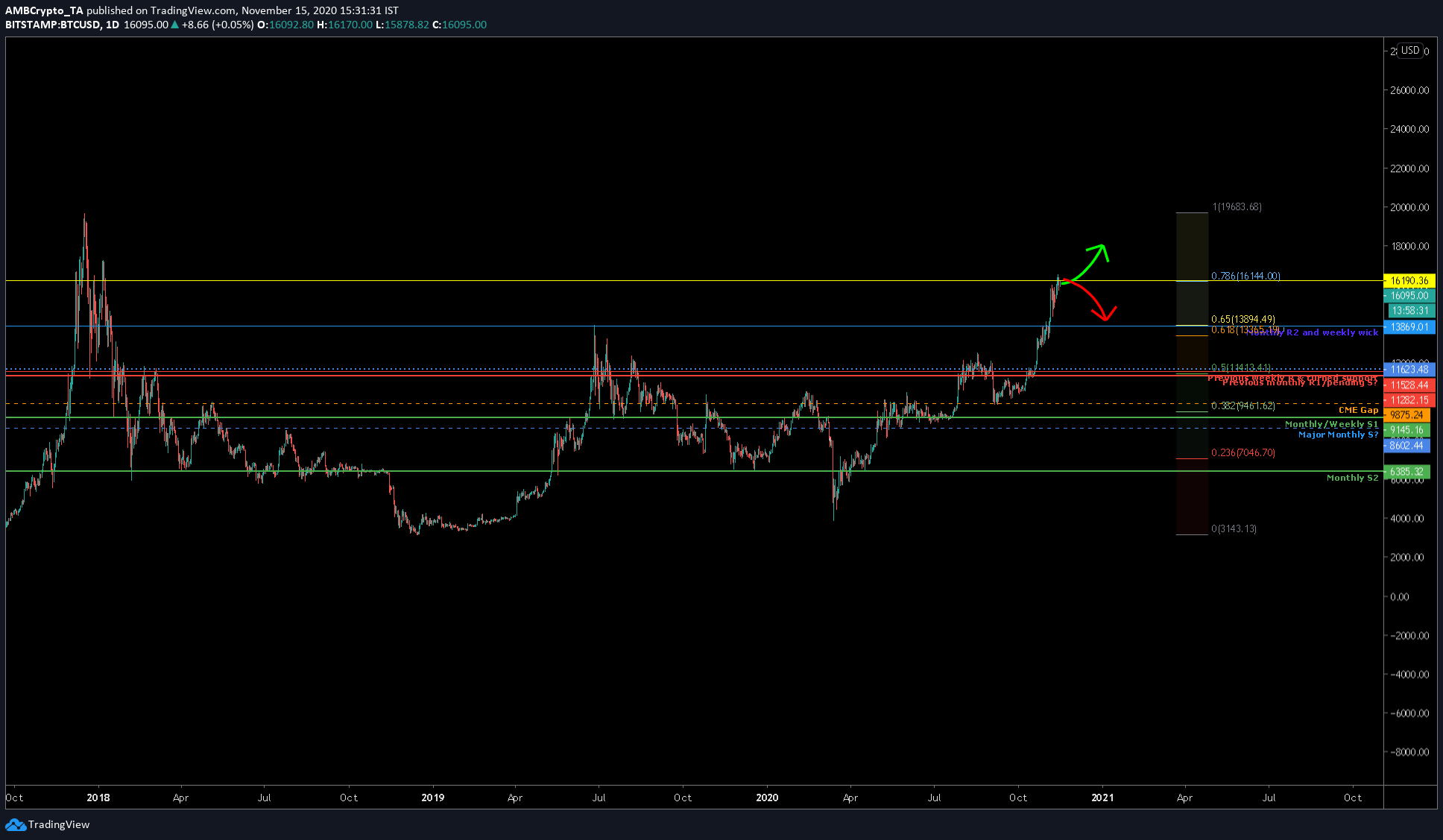

Bitcoin 4-hour chart

Source: BTCUSD on TradingView

A short position would be the best way to go about trading Bitcoin. The reasons are simple, Bitcoin bulls are exhausted from their 3-month rally and this isn’t a full-blown bull run yet, hence, while bulls rest, the market’s bears will take control.

We can expect a 3% to 6% drop soon on the charts.

Rationale

The rationale from a TA perspective is the formation of a bearish pattern – rising wedge. The bearish breakout will push Bitcoin to its nearest support level(s). Moreover, there is a double bearish divergence between the price and the volume and the price and the RSI.

For both these indicators, the price had formed a higher high, and neither the volume nor the bullish momentum justified it. Hence, we will need to be ready for a drop soon.

In fact, the drop/breakout had already happened, with the price retesting the bottom of the wedge.

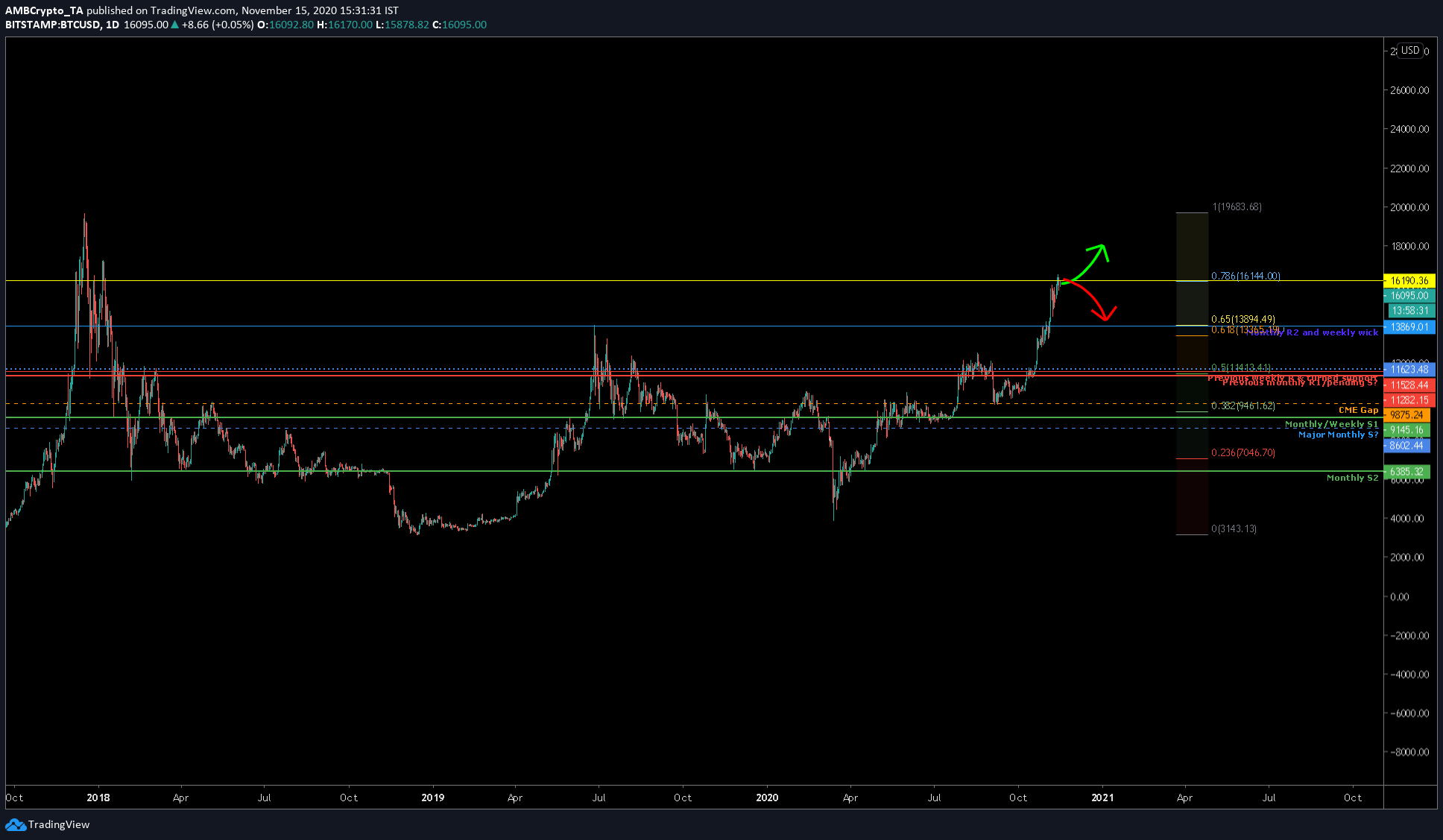

Source: BTCUSD on TradingView

The final rationale is the 0.786-Fibonacci level that the price was at. There is a 50-50 chance that the price will face a rejection here. In such a case, it will only strengthen the already bearish narrative explained here. However, there is a chance the price could surge above this level as it did with the 0.618-Fibonacci level.

Conclusion

Although the proof is concrete that a short position is the best way to go, there is still a chance that Bitcoin might head higher since it is in a pre-bull run stage. So, it is better to keep a tight stop-loss in case one decides to short this.

The post appeared first on AMBCrypto