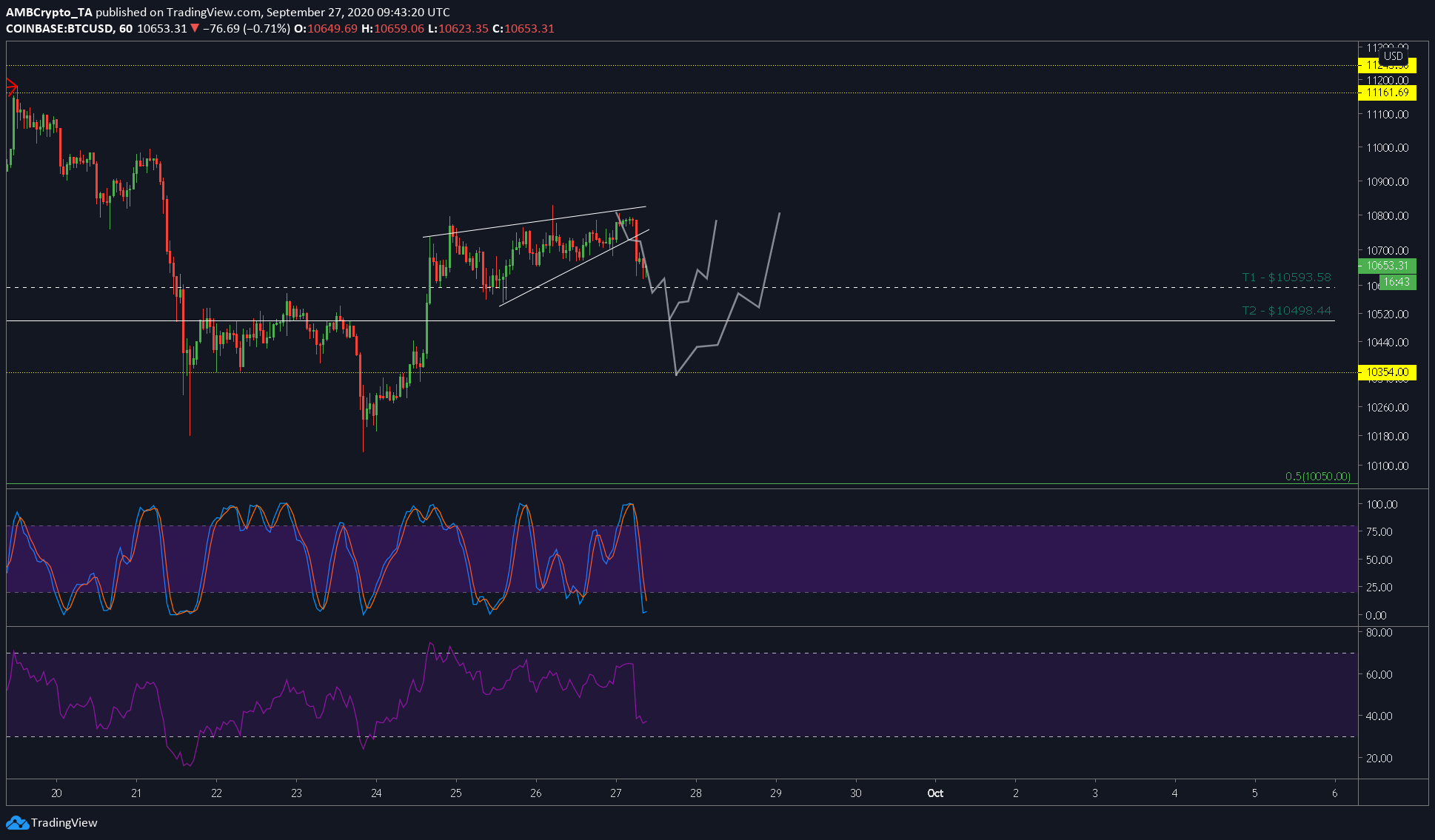

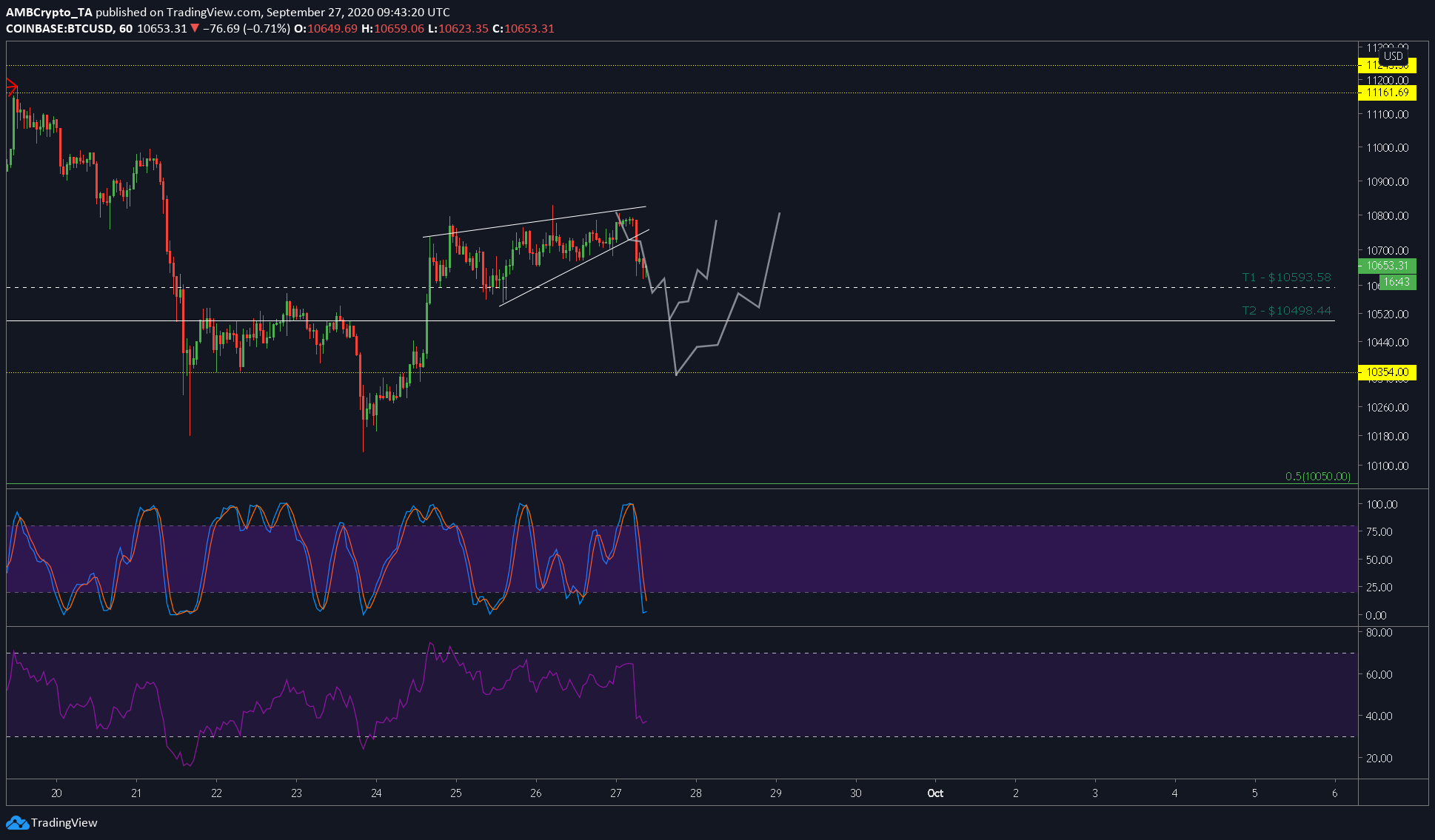

Bitcoin climbing to $10,700 may have been a fleeting moment since, at the time of writing, the price seemed to be dropping yet again below the aforementioned level. On a longer-term timeframe, it was bullish, but on a short-term timeframe, the price had just broken out of a bearish pattern at the time.

Bitcoin 1-hour chart

Source: BTCUSD on TradingView

The one-hour chart for Bitcoin showed a drop from the rising wedge, a development that has brought it towards the first target at $10,593. Since hitting this point, the price has rebounded and might even see $10,650.

Target 2 at $10,498 is also a viable place for Bitcoin to hit in a couple of hours. Although the Stochastic RSI looked oversold, the RSI still had a long way to go before it hits the oversold zone. Hence, we can expect the price to dip up to target 2.

In a worst-case scenario, we can see the price head as low as $10,350 and rebound sharply from that level.

The bounce of Bitcoin from any of these targets would take it back to $10,700 – a level seen earlier today. Clearly, the price will face a setback at the aforementioned targets on its climb higher.

The short-term price looked bearish, however, the overall fundamentals of Bitcoin showed good profitable levels.

On-chain metrics

Short term on-chain metrics indicated that the worst might come to an end soon. In the last 24 hours, the total Bitcoin minted was 975, out of which, around 717 BTC were sold, which represents today’s drop.

Bitcoin’s MVRV Z-score indicated that Bitcoin recovered from being undervalued and stood at 1.07%, a bullish figure, at press time.

Taking this into consideration, one can also noted that whales accumulating Bitcoins between the $10,300 and $10,700 levels has hit a new high.

Moreover, the short-term market sentiment has shifted towards a more positive side after being fearful for a very long time, a finding that also helps Bitcoin’s bullish case.

The post appeared first on AMBCrypto