Bitcoin sits well below $12,000 after its failure to breach the said psychological level. There are multiple factors acting in sync that has led to this particular outcome of bitcoin sliding lower.

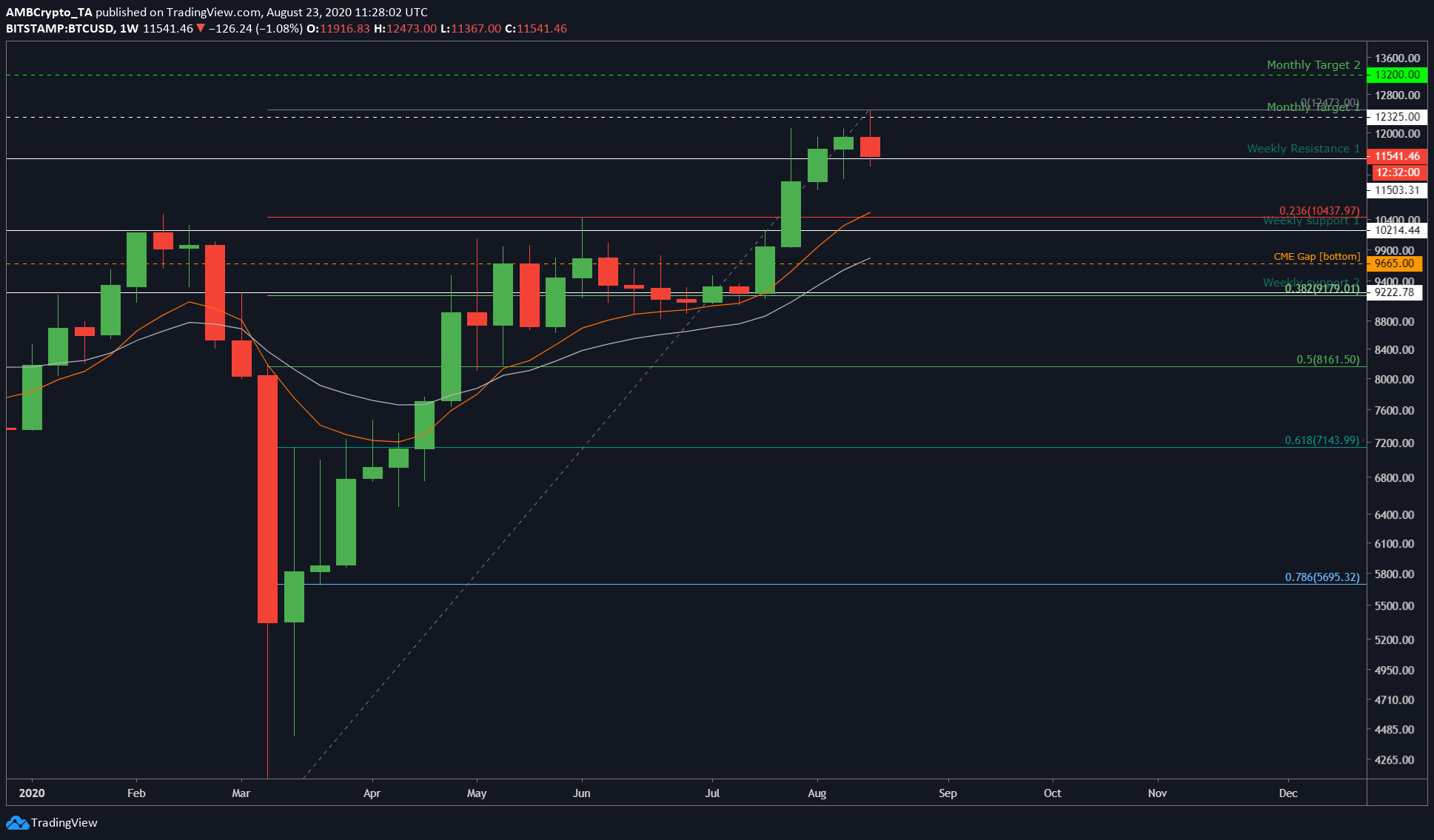

From the weekly chart, it can be seen that bitcoin’s $12,473 was the local top and also the monthly resistance. $12,473 was the resistance point that held bitcoin from surging higher back in June and August 2019.

Considering the current weekly candle, the same is taking place, yet again. If the weekly candle closes below $12,503, [which is a weekly resistance tested about 4 times in the aforementioned period in 2019], then it is bearish for bitcoin. This represents repetition events similar to mid-2019.

Adding that to the extremely greedy market sentiment makes the above outcome likely.

As for the shorter time frame of 1-hour, bitcoin has just breached an ascending channel and is heading down towards the weekly resistance, now acting as support – $12,503.

Bitcoin hourly chart

The short-term one-hour chart showed that breakout from bitcoin’s ascending triangle may take the coin to the soon-to-be tested weekly resistance at $11,503. The sloping resistance extending from the local top at $12,473 is also preventing the price from heading higher.

As mentioned before, the overly greedy market sentiment will not help bitcoin’s rally. An appropriate target would be for bitcoin to hit 50-day MA [yellow] at $10,840 during the time of writing. RSI although not completely at the oversold zone has space to accommodate this drop. Considering its close proximity to the weekly support at $10,214, this zone will play strong support for bitcoin.

Although CME gap at $9,665 and $9,995 has been not closed yet, a drop to this extent would have to be a flash crash and not a trickle-down drop. Even though a flash-crash seems unlikely, a drop to these levels should be expected in the worst-case scenario.

However, if the price decides to strut down, then the weekly support should be its last stop.

The post appeared first on AMBCrypto