Bitcoin has remained calm in the past 24 hours, with minor gains towards $11,100. Unlike the primary currency, the altcoin market has seen impressive gains, including yesterday’s birthday project – Ethereum and Chainlink.

Although the US economy suffered its worst quarter since the Second World War in terms of GDP results, Wall Street is breaking records, especially in the technology field.

Bitcoin: Back to Stability?

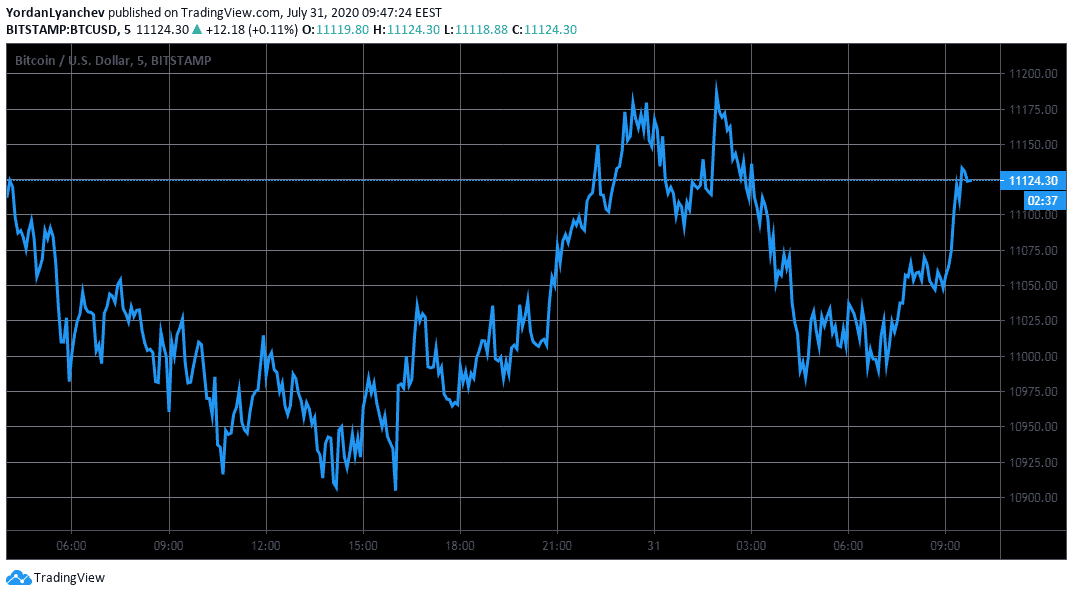

The primary cryptocurrency remained relatively stable in the past 24 hours. Bulls intercepted a small price dive to $10,800 (Binance) and pushed the asset towards an intraday high near the $11,200 resistance. However, BTC couldn’t maintain its past days’ run and retraced slightly to the current level of $11,100.

If Bitcoin is to reach the psychological level of $12,000, it has to overcome two significant resistance lines, firstly at $11,300 and then the notable 0.5 Fibonacci level at $11,400 (the current 2020 high). Alternatively, $10,800 and $10,500 (prior 2020 high) will serve as support if BTC attempts a dive.

The second-largest cryptocurrency by market cap, which celebrated its 5th birthday yesterday, surged by 5% in a matter of hours. Thus, Ethereum continued its recent bull run and, in just a few weeks, has pumped by 46% from $228 on July 16th to $336 as of writing these lines.

Chainlink has also increased its value significantly since yesterday by 8%. LINK is now trading at $7.75 and is closing down to the $8 mark. Bancor and VeChain are the most impressive gainers with 20% and 12%, respectively.

After the recent gains, THORChain has retraced today by 12%. Elrond, despite launching its mainnet yesterday, has dropped by 10% – a classic “sell the news.”

Ampleforth continued tanking by another 9.2% to $0.70. As CryptoPotato reported, AMPL investors will start losing coins as the protocol is pre-programmed to stabilize the price at around $1 by deflating the tokens in circulation.

Record Low US GDP Hardly Affects The Stock Market

The COVID-19 pandemic caused almost all countries to close their economies for a certain period. Some received a worse blow than others, as China’s GDP grew 3.2% in Q2, while the US marked its worst quarter since WWII.

According to government numbers revealed yesterday, the US gross domestic product has fallen by an annual rate of 32.9% between April and June 2020. To emphasize the seriousness of the situation – during the worst quarter of the 2008 financial crisis, the US GDP shrank by 8.4%.

More than 1.4 million Americans filed for unemployment benefits last week, marking a second consecutive week of rises.

Although these numbers suggest that the US economy is in a rather adverse state, the big trio of Wall Street stock market indexes didn’t react with a massive slump. The Dow Jones and Nasdaq went down by just 0.85% and the S&P 500 by 0.38%. However, strong earnings from Apple, Amazon, Facebook, and Alphabet have even pushed the futures contracts in the green.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato