Bitcoin continues to trade in the five-digit territory and even spiked towards $10,400. Binance Coin (BNB) is among the best performing tokens today, while most other larger-cap alts are marking minor gains.

Bitcoin Struggles At $10,400

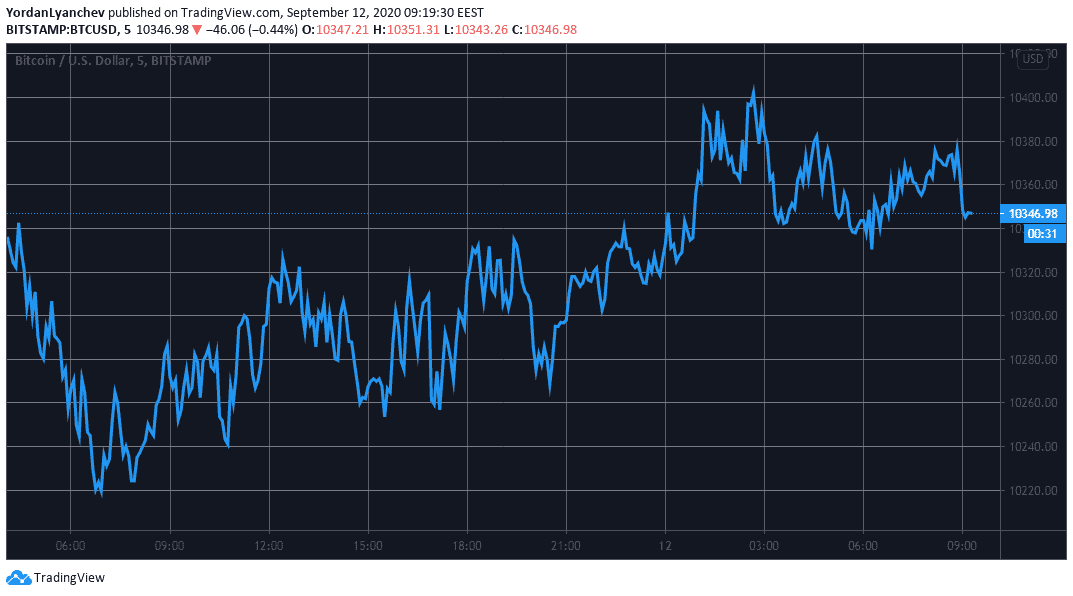

After the unsuccessful attempt to overcome $10,500, Bitcoin dived yesterday and bottomed at about $10,200. However, the bulls interfered at that point and didn’t allow any further declines.

In the following hours, BTC fluctuated in a tight range between $10,250 and $10,400. As of writing these lines, Bitcoin has retraced slightly to $10,350.

From a technical perspective, the primary cryptocurrency has to fight off the first resistance at $10,500 before having a chance to aim at $10,780, $10,900, and $11,000.

In contrast, the psychological level of $10,000 remains as the most critical support. If Bitcoin breaks below it, it could rely on $9,815 and $9,700. Should BTC fill the CME gap at $9,650 and dip further, the next support is $9,400.

On a macro scale, a veteran cryptocurrency trader and analyst pointed out that Bitcoin’s price has to stay above the 128-day moving average, which currently sits at about $10,100, to remain in the bull trend that started earlier this summer. If BTC fails to do so and drops below it, history shows painful consequences, including the March sell-off.

DeFi Coins And BNB Surge

Most larger-cap alts are slightly in the green on a 24-hour scale. Ethereum (3%) is back to above $370, Ripple (1.4%) trades at over $0.24, Chainlink (1%), and Bitcoin Cash (1%) complete the top six.

Polkadot surges by 4.5% and is closing down the gap to BCH and LINK in their battle for the 5th spot.

However, the two most impressive gainers from the top 10 are the native digital assets of Crypto.com and Binance. Crypto.com launched its own DeFi Swap, a fork from Uniswap V2, enabling users to stake CRO to farm new tokens and earn rewards. Consequently, the price of CRO reacted with a 7% surge to $0.16.

With DeFi Swap, Crypto.com actually followed the example set from Binance a few days ago. The leading cryptocurrency exchange released a similarly-operating platform called Binance Launchpool. Naturally, users need to stake different coins, namely – BNB, BUSD, or ARPA.

BNB’s price has been on a roll since then. In the past 24 hours alone, the asset is up by 13% to over $26. This is the highest price marked since February this year.

DeFi-related tokens also surge today. DFI.Money leads with 30%, NXM (20%), Loopring (13%), Yearn.Finance – YFI (12.5%), UMA (12.5%), Blockstack (12%), and Qtum (12%) follow.

After the unexpected turn of events yesterday, when the former SushiSwap lead developer returned his cashed-out coins to the treasury, SUSHI’s price is also up by 11% today, after reaching the $3 mark a few hours ago.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato