Bitcoin attempted another bullish movement yesterday, but it got rejected when it approached the next resistance line. The majority of the altcoin market is retracing slightly today, following a few days of gains.

The S&P 500, Dow Jones, and Nasdaq marked increases yesterday, following an announcement from the Fed pledging to keep the interest rates unchanged near zero.

Crypto Market Movements

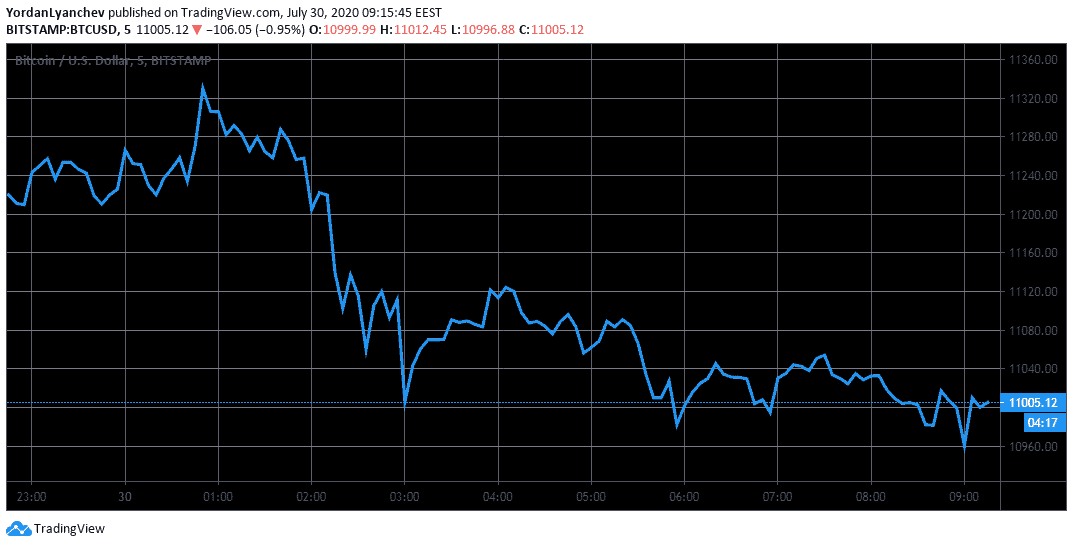

The primary cryptocurrency has been on a roll ever since it broke out of its $9,000 – $9,300 range last week. In a few consecutive days, BTC shot up to about $11,000 and yesterday attempted to conquer the next resistance at $11,390. However, to no avail, as it got rejected before having a real chance to face it. At the time of this writing, Bitcoin hovers again at about $11,000.

Should BTC successfully break above $11,390, it has to face a key weekly resistance at $11,490 before coming up against the psychological $12,000 level. In contrast, $10,800 and $10,400 are Bitcoin’s line of defense in case the asset heads downwards.

Ethereum, Ripple, and Bitcoin SV have kept steady over the past 24 hours with insignificant changes. Losses are visible from Cardano (-2.7%) and Litecoin (-2.5%) after yesterday’s gains. Chainlink (-2%), Tezos (-4.2%), Stellar (-2.3%), Monero (-2.2%), and Tron (-3.5%) are also in the red today.

However, Ampleforth continues to showcase double-digit price losses. AMPL has tanked by nearly 60%, and it’s even below $1. This may cause issues for investors as its protocol will start deflating the existing tokens in circulation to stabilize the price at around $1.

Travala.com’s AVA coin is the most significant gainer with a 21% increase, while THORChain and Aave follow by 14.16% and 12.14%, respectively.

The Fed Impacts The Stock Markets

The US Federal Reserve left benchmark interest rates unchanged near zero. Fed Chair Jerome Powell doubled-down on his assurance that the US government will provide all the necessary support to Americans until the threat of the novel COVID-19 to the US economy passes.

These events had a positive effect on the most prominent Wall Street stock market indexes. During yesterday’s trading session, the Dow Jones closed with an increase of 0.60%, while the S&P 500 and the Nasdaq Composite gained over 1%.

Despite the short-term beneficial effects on the markets, prominent economists continue to warn that such actions could ultimately tank the system.

“I think they are playing with fire. If Congress was counting on the fact that the economy was going to reopen, then they wouldn’t need to do another package, clearly, that Plan A is gone.” – commented senior portfolio manager at TCW Diane Jaffee, referring to the massive stimulus packages initiated by the government.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato