The cryptocurrency financial service company Bitcoin Suisse announced that it will start offering high-security staking for Tezos holders. The large organization claims that the addition comes after increased interest from institutional investors towards staking services for digital assets.

Bitcoin Suisse To Offer Tezos Staking

According to the announcement, the demand from institutional investors towards digital assets and various crypto-related financial products has been surging lately. Therefore, aside from serving as custodial, Bitcoin Suisse will now support staking of Tezos (XTZ) through its PwC-audited custody solution.

The organization, already managing a reported amount of over $1 billion in assets, will allow XTZ stakers to do it “with the security of an institutional-grade crypto custody provider.” Stakeholders can assign their assets “to a staking address, which participates in the operation of the Tezos protocol and thereby earns rewards for the owner of XTZ.”

The statement also informed that the Swiss company will provide a “complete package” for asset managers, fund managers, and high net worth individuals by utilizing the audited custody services through the Bitcoin Suisse Vault coupled with the staking services available on the platform.

“We are excited to be adding XTZ to the Bitcoin Suisse Vault, thereby making XTZ available for clients requiring a fully audited custody service. We are also very impressed by the development of the Tezos ecosystem and by including XTZ in our institutional-grade infrastructure are proud to contribute to that development.” – said Philipp Vonmoos, Head Storage at Bitcoin Suisse.

Roman Schnider, CFO, and Head of Operations at the Tezos Foundation noted that the addition of XTZ on Bitcoin Suisse is another significant step towards more institutional adoption.

Tezos Staking And Price

Tezos staking has been particularly popular amongst cryptocurrency investors as of late. Numerous digital asset exchanges are already offering XTZ staking, including Kraken, Coinbase, and Binance.

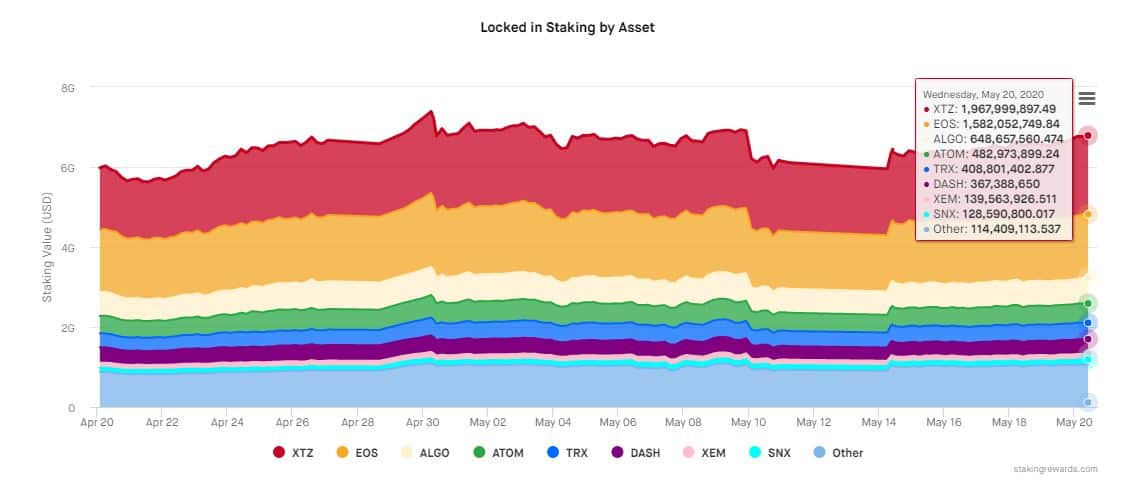

The increased interest was exemplified in a report from last month, illustrating that Tezos has become the leading coin in terms of assets locked in staking. At that time, that amount equaled $1.81b. That number has now jumped to nearly $2 billion, and XTZ is still well in the lead.

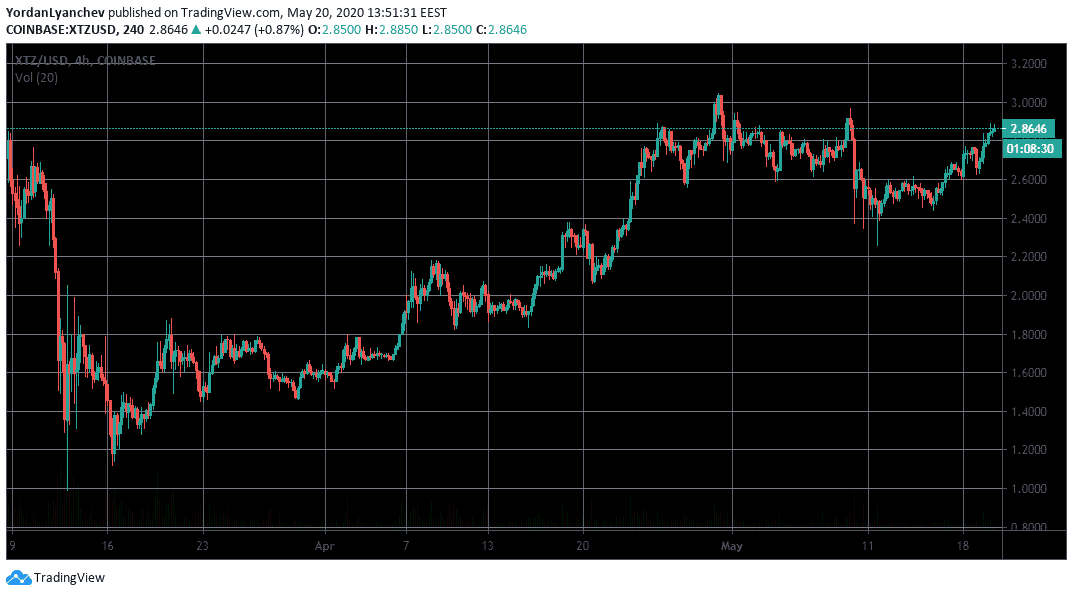

As far as pricing goes, Tezos has been on the rise ever since the notorious Black Thursday in mid-March. XTZ plunged to below $1 during the massive sell-offs but is now trading at $2.86. This represents a notable surge of over 190% in two months.

Yet, if XTZ is to reach $3 again, it would have to break the first resistance line at $2.89. Alternatively, $2.7 has now turned into support if the price dives, followed by $2.375 and $2.06.

The post Bitcoin Suisse To Offer Tezos (XTZ) Staking For Institutional Investors In Custody Audited By PwC appeared first on CryptoPotato.

The post appeared first on CryptoPotato