The cryptocurrency market is on the move again, and the dominant color is green. With some impressive numbers across the charts, the total market capitalization rises to $227 Billion.

The green is led by Bitcoin, which is seeing decent gains of 5% since yesterday. BTC started 2020 at $7,200 and is up with 18% since then.

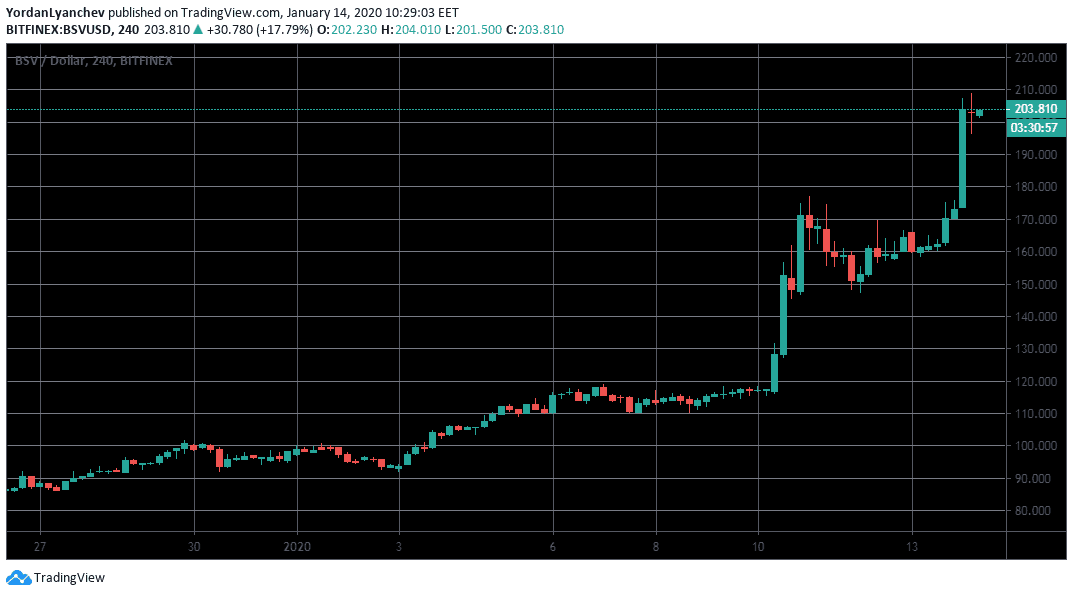

Among the top 20 coins, Bitcoin SV showing the most impressive gains, following a 27% increase against the dollar to $204. Moreover, just a few days ago, it was trading at $115, almost 80% since last Friday (!). This is the highest price level of Craig Wright’s version of Bitcoin since July 2019.

Considering the recent surge, Bitcoin SV’s market cap increased to $3.7 Billion, which places the coin as the 6th largest cryptocurrency on the total market cap table.

BSV/USD 4h Bitfinex. Source: TradingView

Besides BSV, most of the alternative coins are showing serious gains as well: Ethereum is up by 4% and is closing down to $150, while XRP is up 3.27% to $0.218. Litecoin (7%) and EOS (6.39%) continue their positive run to $54 and $3.30, respectively.

Interestingly enough, two private coins, Dash and Zcash, are both enjoying 20% increases over the last 24 hours. The former is currently at $78, while the latter is at $42.50. Time for privacy coins?

Cryptocurrency Overview. Source: Coin360.com

Total Market Capitalization: $227 B | Bitcoin Market Capitalization: $155 B | Bitcoin Dominance: 68.1%

Major Crypto Headlines

CME’s Bitcoin Options Launched Yesterday: The Chicago Mercantile Exchange launched options on Bitcoin futures yesterday to compete with Bakkt’s similar product. According to a JP Morgan analysis, CME brought a huge amount of interest, and this is considered a move in the right direction.

The Lightning Network Sees Considerable Growth, According To BitMEX Research. A recent analysis coming from one of the most popular Bitcoin margin trading exchanges, BitMEX, showed that the Lightning Network demonstrates considerable growth in several different aspects.

Coinbase Hands Nearly $1M To Cryptsy Victims After Settling Class Action Lawsuit. The desperate users of the former Cryptsy cryptocurrency exchange filed a lawsuit against the Cryptsy CEO for allegedly laundering millions, and using his Coinbase account for that.

Coinbase has recently settled it by agreeing to turn $962,500 over to an escrow agent responsible for handling class action claims related to the lawsuit against Cryptsy.

Significant Daily Gainers and Losers

BlockStamp (44.16%)

With several coins recording double-digit gains, BST stands above all of them at the moment, following a 44% increase against the dollar to $1.60 and a corresponding 38% surge against Bitcoin to 18756 SAT. BlockStamp’s market cap rising to $42 Million, which also places the cryptocurrency back on the top 100 list.

The company recently posted its 2020 goals, and it also appears that it’s taking full advantage of the positive price movement.

Bitcoin Gold (25.60%)

The former Bitcoin fork, Bitcoin Gold, also showing impressive gains against both USD and BTC – 25.60% and 20%, respectively. This means that BTG is trading for $8.40 at the moment, which is roughly 98806 SATs.

The reason might be that Fibercoin Exchange announced last week that it’s adding Bitcoin Gold on its platform, along with the fact that Bitcoin forks, such as Bitcoin Cash and Bitcoin SV, are also on the rise.

Nexo (-6.24%)

Not too many cryptocurrencies can be seen in red today. Nexo is one of the few, showing the most significant loss of over 6% to $0.11. Moreover, it drops even further against Bitcoin (-10.4%) to 1284 SAT. Nexo market cap is $60 million, among the top 100 coins.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Cryptocurrency charts by TradingView.

Technical analysis tools by Coinigy.

You might also like:

The post appeared first on CryptoPotato