Disclaimer: The findings of the following analysis should materialize over the next 24-48 hours

Bitcoin SV, just like the rest of the market, was in a state of conflict at the time of writing after depreciating significantly on the 2nd of August. With BSV trading at a price point as low as $196 yesterday, the fork coin’s market seemed to be primed for another rally. However, it might not be bullish this time.

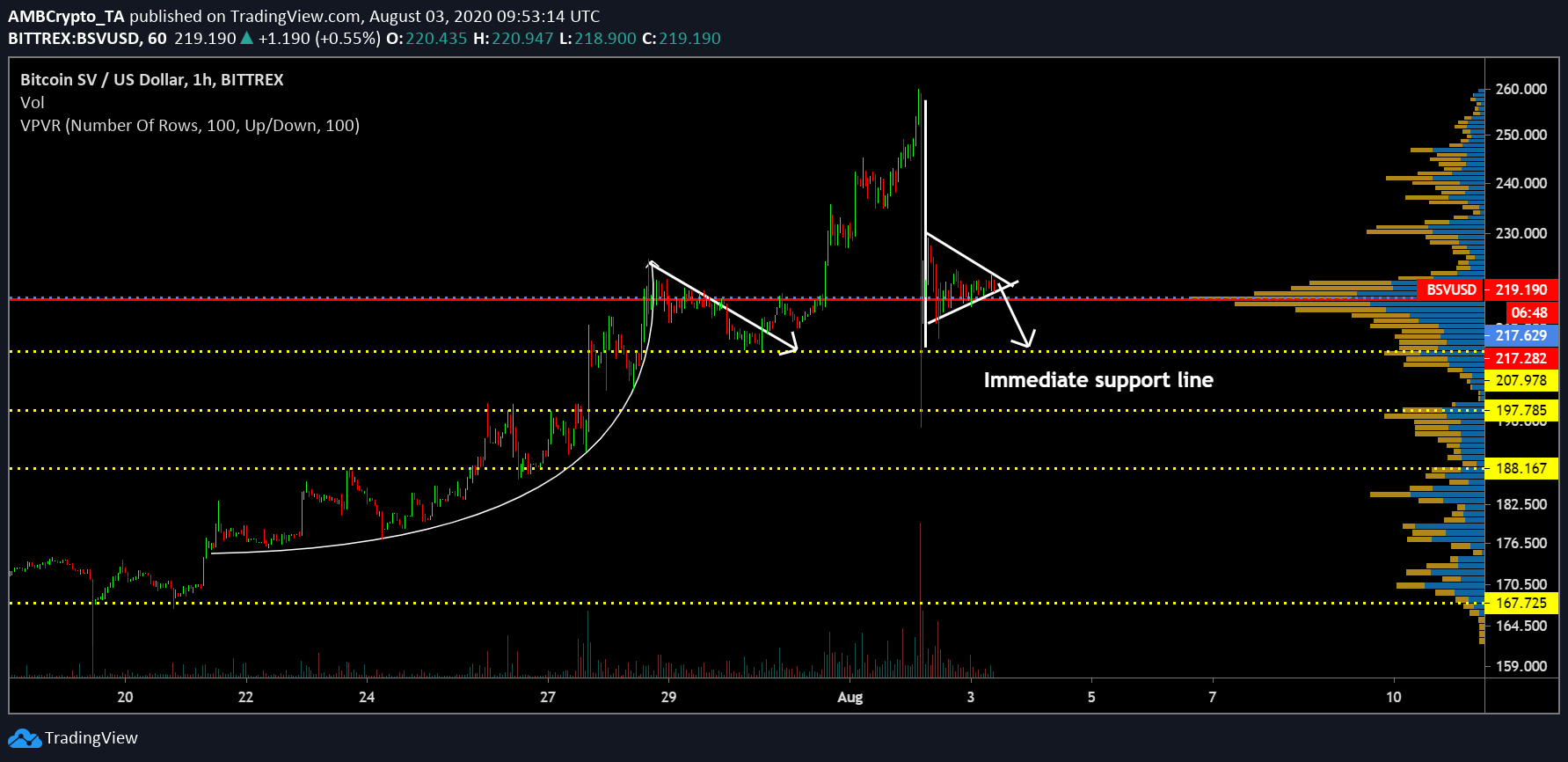

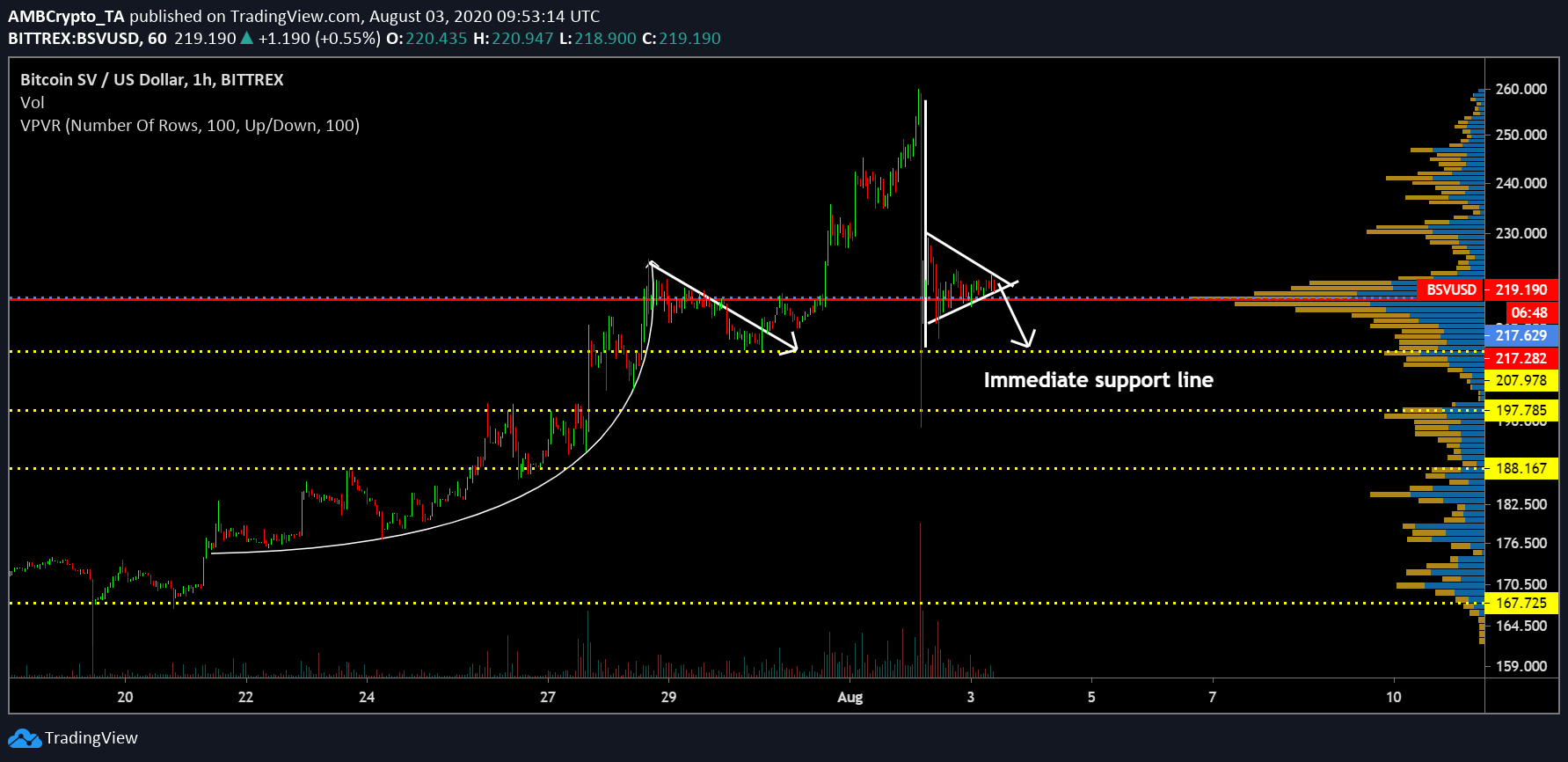

Bitcoin SV 1-hour chart

Source: BSV/USD on TradingView

After its short-term pullback following the parabolic rise, Bitcoin SV breached its long-term resistance at $207 to register a price point at $257. However, within an hour of reaching that range, BSV noted a drop of $60 on the charts, dropping below its $207 support line once again. The crypto- asset has been able to muster itself towards $207 again, but the bearish pennant formation is likely to be positive in nature.

As illustrated, BSV’s price at press time was oscillating within the pattern of a bearish pennant, a development that may push the price below $207 once again. According to VPVR, the trading volume was still evident between $220 and $197, and this has been the case since the 20th of last month.

Interestingly, market indicators were a little unclear, at the time of writing. With the MACD registering a bullish trend, the Relative Strength Index implied that buyers were still struggling to impose their pressure on the market. The drop from the overbought zome diluted a lot of the buyers’ market’s momentum too.

Despite the fact that Bitcoin SV’s price has moved up over the past month, it is quite evident that the crypto-asset continues to remain on thin ice with it comes to on-chain fundamentals. Besides an anomaly of over $5 million transactions on the 10th of July, BSV transactions over the past week have rarely flinched over the course of its bullish rally, an observation that is indicative of BSV’s dependence on the rest of the digital asset industry.

Conclusion

The price movement of Bitcoin SV is likely to head south under the resistance of $217 over the next few hours.

The post appeared first on AMBCrypto