Disclaimer: The following price analysis is witnessing a bearish breakout that should continue over the next 24-hours.

In line with the rest of the cryptocurrency industry, Bitcoin SV was able to recapture some of the bullish momentum evident in the past few days. However, the returns were nothing to be excited about as the token continued to struggle with the resistance at $188, as witnessed over the past couple of months.

At press time, Bitcoin SV was valued at $180.19 with a market cap of $3.33 billion. BSV was able to take back its 6th place in the ranking leading Cardano by $100 million in the industry.

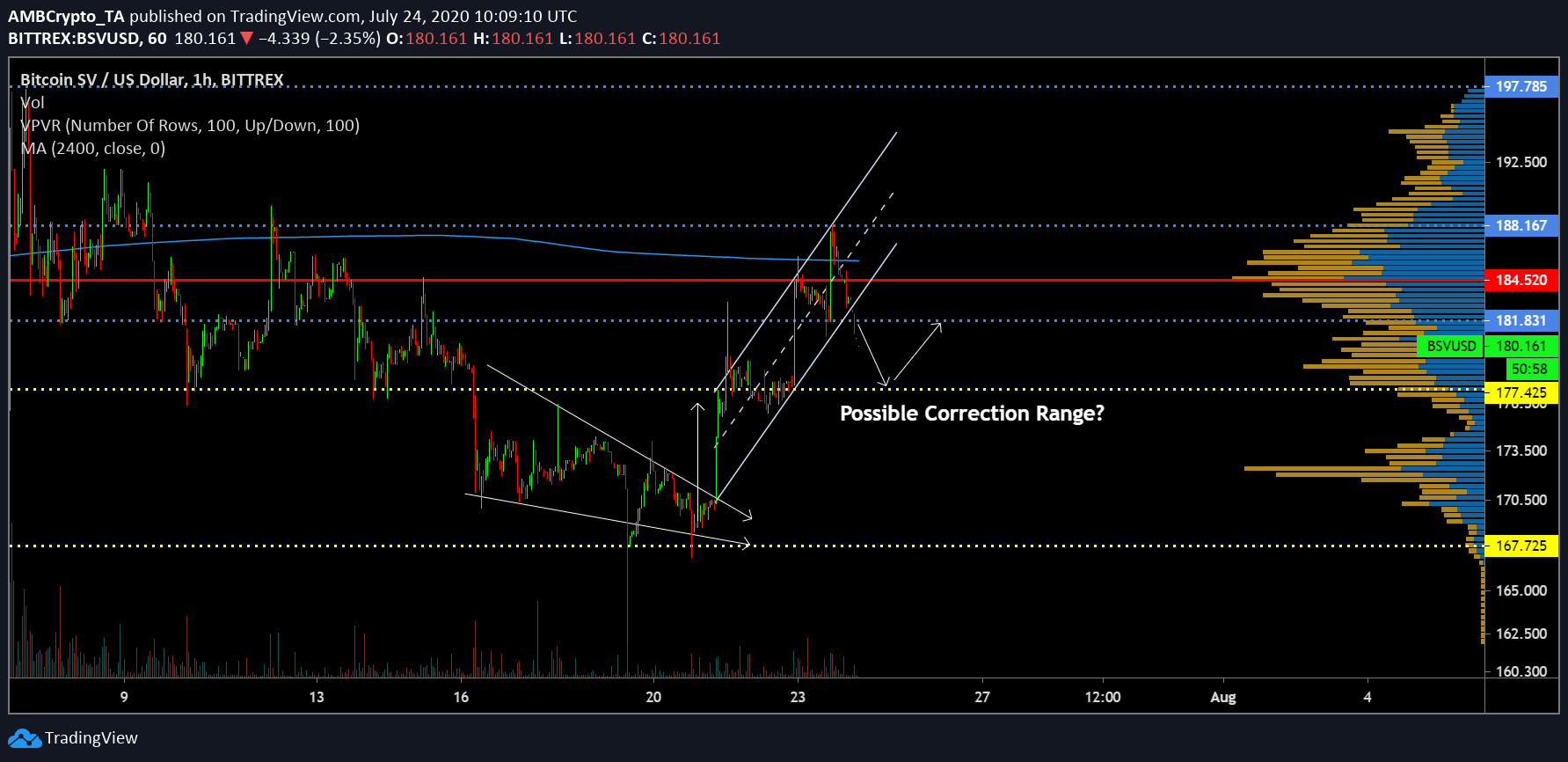

1-hour chart

Bitcoin SV’s price movement has been pretty rudimentary during the last few days. The 6th largest digital asset has followed oscillation within the trendlines of a couple of patterns, registering a breakout with respect to the formation.

As illustrated in the chart above, the first bullish breakout took place after a falling wedge orchestrated a bullish squeeze on the price. The price surge that followed was pretty significant as BSV hiked past resistance at $177 and $181. However, the asset was finally restricted by the resistance at $188, which was held strong since the start of June. Overhead resistance provided by the 100-Moving Average was also evident, making it difficult for BSV.

Now, as in the past couple of days, the asset has given rise to an ascending channel. Bearish implications have followed in the process and at the time of writing, Bitcoin SV was undergoing a pullback. Immediate support remains at $177, as the token plummeted below resistance at $181.

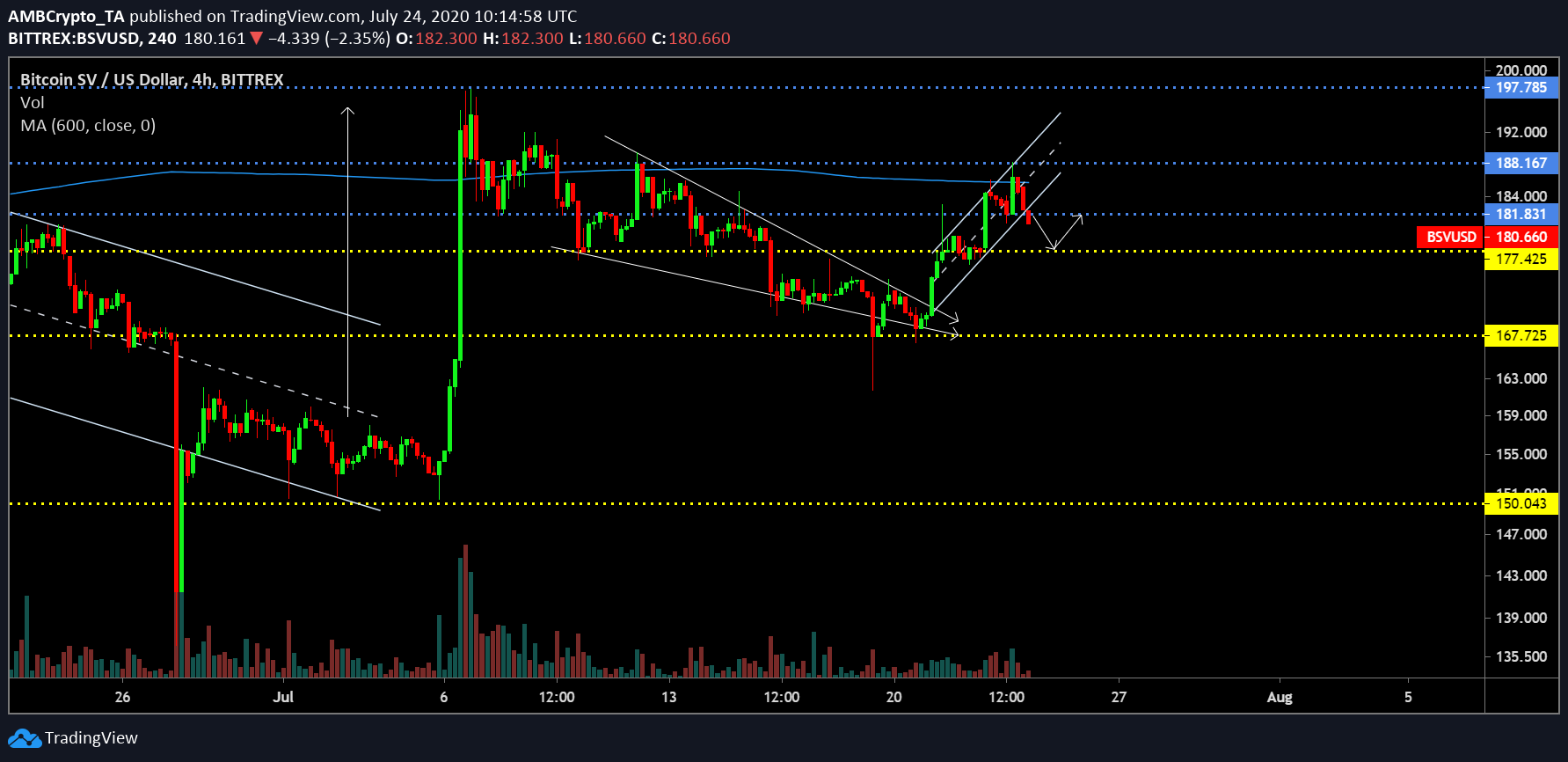

4-hour chart

The bearish breakout on the 4-hour chart remained evident as well, with Bitcoin SV possibly eyeing consolidation between $181 and $177. Another observation made in the analysis is related to the weak trading volume, which seems to be evident alongside the rising price in the past day. Such a situation foresees a bearish divergence, which might be taking effect at the moment.

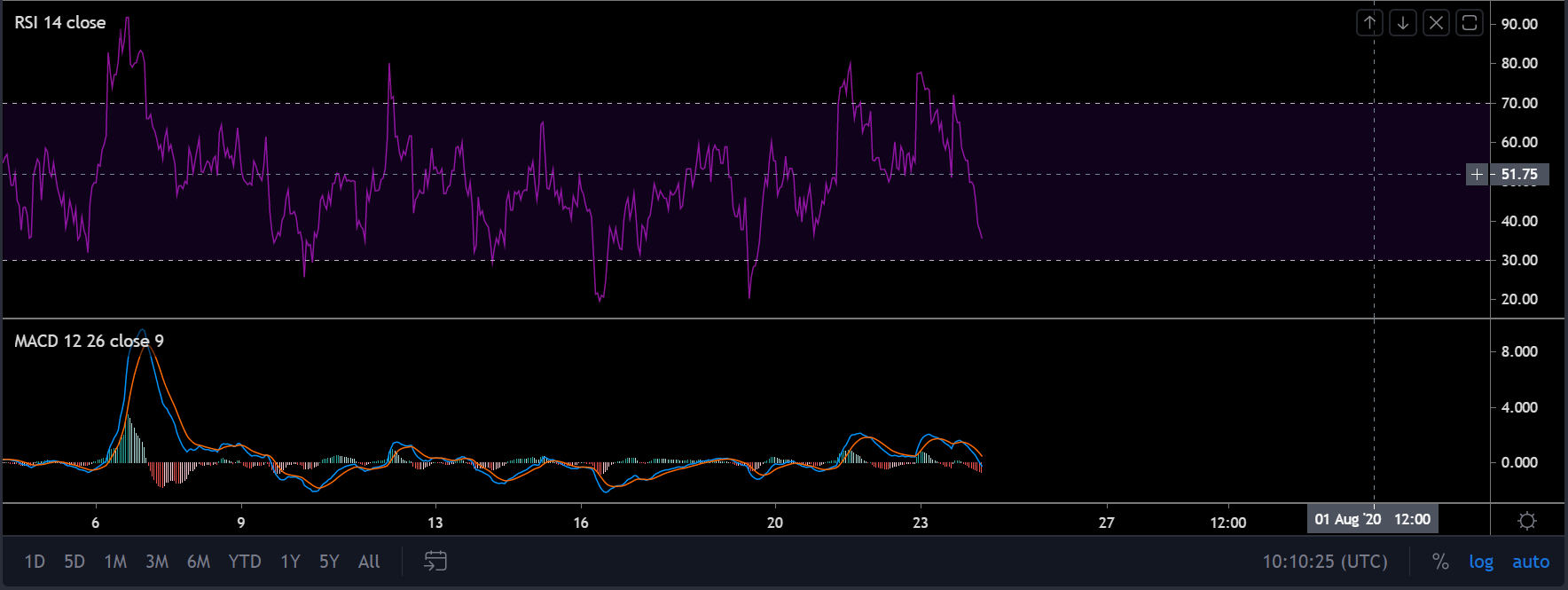

Market Indicators were extremely bearish as well. Relative Strength Index or RSI suggested that the buying pressure was rapidly getting outdone by sell pressure, and MACD maintained a bearish trend at press time.

Conclusion

Bitcoin SV should consolidate between $181 and $177 for the next 24-hours, following which further depreciation is possible.

The post appeared first on AMBCrypto