If just 0.023% of Bitcoin addresses hold 50% of the total wealth, isn’t the new boss turning out to be a lot like the old one? | Source: Shutterstock

By CCN Markets: Research released by blockchain analysis group PARSIQ this week did much to weaken Bitcoin’s image as a global freedom currency.

The findings detail the massive accumulation of wealth in the hands of a minuscule few, resulting in inequality greater than what can be found in the established “old money” institutions.

Just 0.023% of the top Bitcoin addresses hold 50% of the total funds. None of the major cryptocurrencies come out of this research looking good. Ripple (XRP) has its wealth concentrated to the greatest extent, with 50% of its total wealth found in just 14 addresses.

A tiny number of addresses contain the majority of the world’s cryptocurrency | Source: PARSIQ

“Exchanges are a minority stakeholder…”

In the hours since the findings were revealed, crypto enthusiasts leaped to the defense of their favorite coins, claiming the data doesn’t take exchanges into account. It’s true that when users deposit their funds on an exchange, it goes into a normal cold storage crypto address on the blockchain, and would thus be picked up in the data gathering process.

However, PARSIQ’s Andre Kalinowski told CCN’s Josiah Wilmoth that even if crypto exchange addresses were removed, the difference in the inequality ratio would be little changed.

“Even when we take out the huge exchange-owned addresses in our analysis, the wealth concentration is still very high, far higher than global wealth. In this exclusive club of the crypto elite, the exchanges are only a minority stakeholder.”

What’s more, given the nature of cryptocurrency custody – where only the key-owner controls the funds – exchanges are hardly worthy of exclusion. Kalinowski pointed out that when coins leave your control, you no longer have any claim to them whatsoever.

“Unlike banks, which are insured against robbery and hacks, exchanges effectively control your assets as they own the private keys and there’s little real recourse if your cryptocurrency assets are lost… So really, I’d argue, it’s the individuals who own the exchanges (which are all privately held) who have ultimate control of any assets deposited there.”

Bitcoin: The game has changed, but the players remain the same

PARSIQ says crypto is a “zero-sum game” and that it’s beginning to mirror the legacy financial markets. | Source: Shutterstock

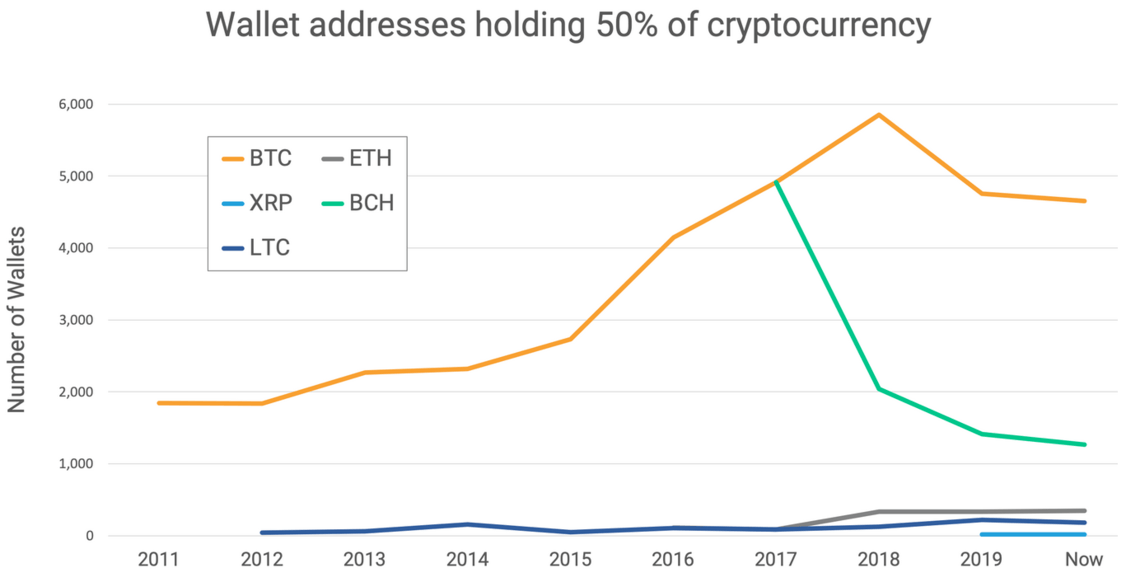

The graphic below shows that Bitcoin’s current inequality ratio isn’t a new phenomenon.

In the early days following Bitcoin’s creation, 50% of the wealth was concentrated in just 2,000 addresses. That distribution grew as time went on, but has gone into reverse in the past two years.

But as Bitcoin’s popularity grew, so too did the gap between its richest holders and its poorest holders.

The inequality has always existed, but wealth has begun concentrating in fewer hands again in the past two years | Source: PARSIQ

That said, the data takes Bitcoin addresses to mean any address with at least $1 worth of Bitcoin in it. That pushes the average down somewhat, but anyone who has watched the crypto market for longer than a few days won’t need to be convinced that the point still stands.

Kalinowski reminded us that despite the dramatic claims that Bitcoin really is a game-changer, the rules to that game have never really changed, and the players remain the same.

“Crypto is a zero sum game, if somebody wins then it means somebody else loses – although we shouldn’t be afraid of this because it’s the same in the financial markets too. We believe the real threat is the lack of transparency and accountability in the crypto market – that the so-called ‘whales’ can manipulate the market to their benefit without anyone knowing.”

Given the findings unearthed by PARSIQ, even if Bitcoin were to attain the status of global cryptocurrency, wouldn’t we just be swapping out one wealthy boss for another?

With additional reporting by Josiah Wilmoth

This article is protected by copyright laws and is owned by CCN Markets.

The post appeared first on CCN