Bitcoin has tapped the $16k-level twice and still, it is yet to sustain a breach or a capture of this level. What does this mean? Well, one can argue that this shows the market’s bulls are weak and ready to be farmed by the bears.

“Ready to be farmed?”

Yes, ready to be farmed. After all, the market’s bears haven’t had a feast since 1 September, a day when Bitcoin dropped by $900 in a matter of 16 hours. A similar drop transpired on 3 September, pulling Bitcoin’s value by $1,489 in 12 hours. Together, the aforementioned bears pulled Bitcoin down to $9,990 from $12,000 in less than a week.

Since it has been a fairly long time since we saw a long red candle, we might just see one very soon.

Reason 1

Source: CryptoQuant

Exchange Whale ratio: According to Crypto Quant, the exchange whale ratio has hit 85% now, a level common among dumps witnessed in the past. For instance, this was the case with the price drops back in March 2020 and November 2019.

Reason 2

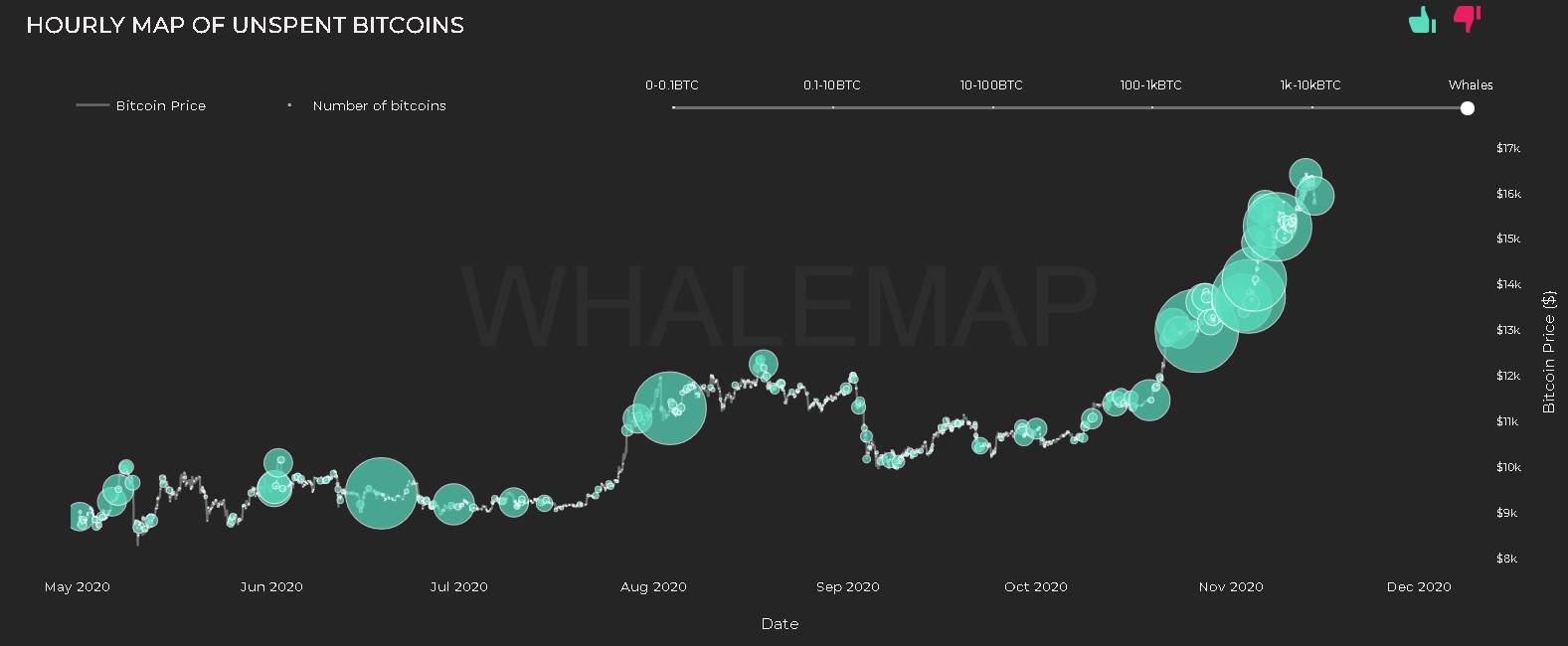

Source: WhaleMap

Another metric related to the market’s whales also shows that whales have been accumulating like crazy since early-November, accumulating an average of $12,000 to $15,000 since 1 November.

With the future being so uncertain, now would be a good time to start taking profits, especially since Bitcoin has failed to breach the $16,000 level not once, but twice already.

Reason 3

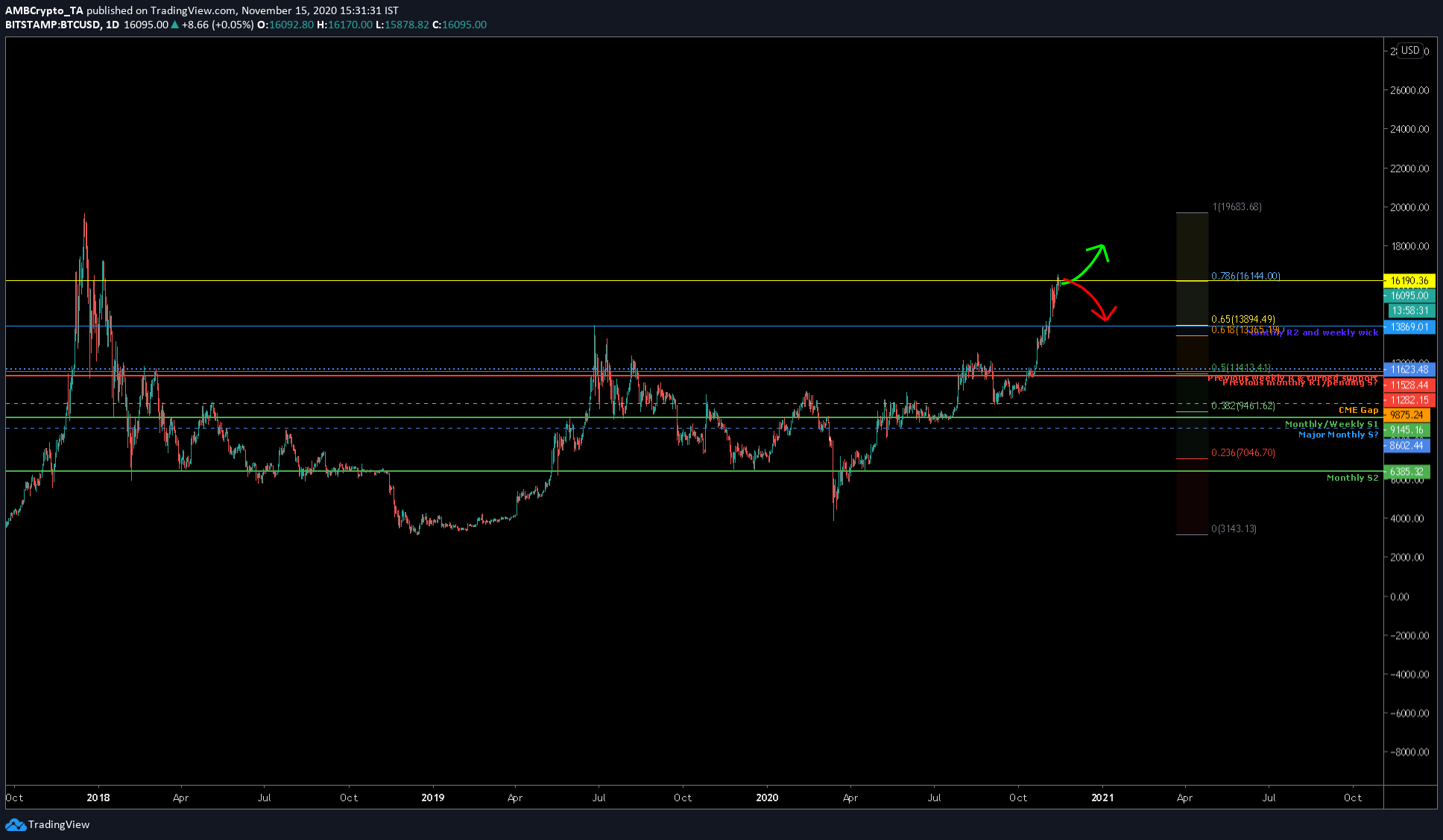

Source: BTCUSD on TradingView

The third reason makes it much more agreeable that a drop is around the corner. If we draw a Fibonacci extension starting from the top of 2017 to the bottom in December 2018, we can see that the price has hit the 78.6%-Fibonacci level.

We can see the resistance that a 50% level caused to Bitcoin. We can expect, not a similar, but equally strong resistance at the current level. All of these indicators and the macro outlook of Bitcoin’s price show that a drop is coming soon. Ergo, ignoring the on-chain metrics right now would be a blunder.

Hence, since a drop in the price charts is expected soon, one must be prepared for it. Minimizing downside risks and/or hedging would be prudent right now.

The post appeared first on AMBCrypto